Norwegian Strikes Could Sever NatGas Supplies To UK

The European energy crunch is set to worsen this week after Norwegian offshore oil and gas workers went on strike, threatening to sever the Scandinavian country’s energy supplies to the UK and Europe, according to Reuters.

As much as 1,117,000 barrels of oil equivalent, or 56% of daily natural gas exports, while 341,000 barrels of oil would be lost by Saturday if strikes continue closing down fields, the Norwegian Oil and Gas (NOG) employer’s lobby warned.

“The strike has begun,” Audun Ingvartsen, the leader of Norway’s oil workers’ union, Lederne, said in an interview. He added the strike would escalate as workers pressure oil/gas companies to increase wages and benefits amid the worse inflation in Europe in decades.

Norway is Europe’s second-largest energy supplier after Russia. The timing of strikes comes as European countries rush to inject NatGas supplies into storage ahead of the winter, and Russian energy giant Gazprom significantly reduced Nord Stream flows to Europe. Gazprom plans to halt Nord Stream flows for routine maintenance from July 11 for ten days.

Norway’s Gassco, a state-owned pipeline operator, explained to Financial Times, “in a worst-case scenario, deliveries to the UK could stop totally.”

“The UK has also become a key conduit for moving supplies on to Europe over the summer, with its export pipelines to Belgium and the Netherlands running at speed to send excess imports of liquefied natural gas and Norwegian supplies into continental storage ahead of the winter,” FT said.

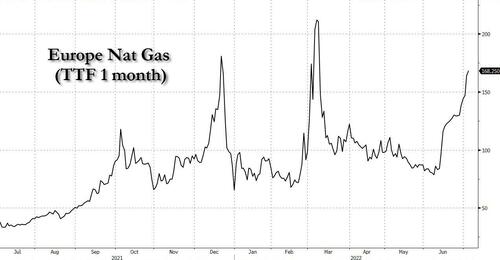

News of the strikes sent British wholesale NatGas price for day-ahead delivery up 16%.

Strikes began on Monday and knocked offline 89,000 barrels of oil equivalent a day of production at three fields on Norway’s continental shelf. Three more fields could be closed by Wednesday, affecting even more production. If the labor union and energy companies don’t come to a resolution on wages, a total of 14 sites could be offline by Saturday, representing a 56% reduction in NatGas exports.

Considering Norway is the UK’s largest source of NatGas in 2021, NatGas and power prices are soaring on supply woes. Prices in Europe are rising as well.

Tom Marzec-Manser, an analyst at consultancy ICIS, said the UK will receive four LNG cargos between July 10 and July 19 and might be able to weather the acute loss of NatGas supplies from Norway.

“But for Europe as a whole this couldn’t really be happening at a worse time, outside the depths of winter, as we desperately need to fill storage ahead of the colder months,” Marzec-Manser added.

Besides Norwegian supplies, Europe has been betting on LNG cargoes from the US. However, the closure of the Freeport LNG Terminal in Texas last month due to an explosion will affect roughly 16% of the total US LNG export capacity through late year.

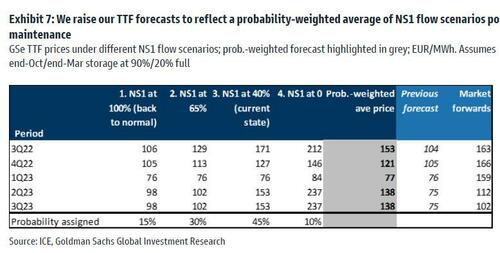

As the supply crunch worsens across Europe, Goldman Sachs’ Samantha Dart increased her European NatGas price forecast as she “no longer sees” a full resumption of Nord Stream flows.

“Instead, the lack of resolution around required turbine repairs, and the absence of any Gazprom-driven re-routing of the reduced NS1 flows via an alternative pipeline to mitigate the impact to supply suggest a prolonged reduced flow rate at NS1 is more likely going forward,” Dart wrote in a note to clients on Monday. She bumped her TTF price forecasts to €153 per MWh in the third quarter, up from €104.

Strike developments from Norway, affecting supplies to the UK and Europe, couldn’t have come at the worst time.

Tyler Durden

Tue, 07/05/2022 – 14:45

via ZeroHedge News https://ift.tt/CIA2Uto Tyler Durden