Oil Is Crashing As Recession Risk Roars, Dollar Soars

Oil prices are puking this morning, after some modest gains overnight, as recession risks roar higher around the world and the dollar’s strength hits the energy complex with a double whammy.

“In the very near term the Dow & S&P will have a major factor on crude direction as recession fears remain,” said Dennis Kissler, senior vice president of trading at BOK Financial.

Fundamentally, there are concerns that fuel demand could “drop significantly now that the 4th of July holiday is behind us.”

WTI has broken below June lows and is testing mid May lows now on its way to $100/bbl…

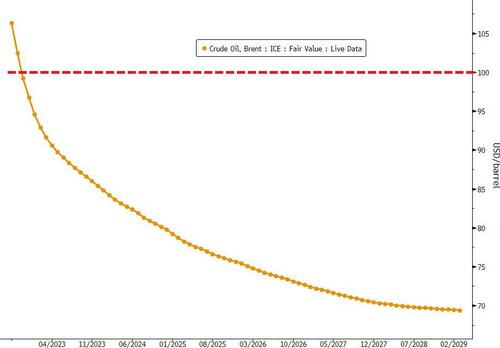

Brent Crude is trading below $100/bbl from November 2022 out…

The dollar’s explosive surge higher (on the back of a weak euro) is also not helping as it reaches its highest since March 2020…

Interestingly, Citi said that crude could fall to $65 this year in the event of a recession, dramatically different from JPMorgan’s most bullish $380 a barrel scenario.

Most notably, US retail gasoline prices have fallen for 21 straight days according to AAA.

Is President Biden hoping for a recession?

Tyler Durden

Tue, 07/05/2022 – 11:12

via ZeroHedge News https://ift.tt/k4UpJ92 Tyler Durden