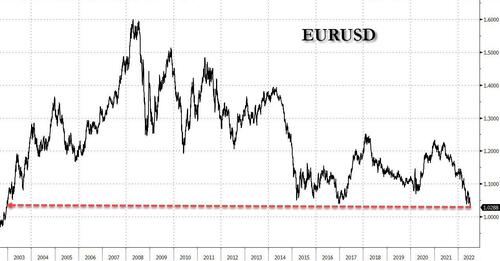

“Parity Is Just A Matter Of Time Now”: Euro Crashes To 20 Year Low As Recession Reality Trounces ECB Rate Hike Delusions

We have long mocked the ECB for making the typical European mistake codified over a decade ago by Jean-Claude Trichet, when it launches rate hikes right into a recession (and after that, debt crisis).

*ECB SLASHES GDP FORECASTS, NOW PREDICTS 2.8% IN 2022

hiking into a slowdown and then recession

— zerohedge (@zerohedge) June 9, 2022

Today, it finally appears that the market got the memo and sent the euro plunging crashing a 20-year low against the US dollar as traders bet that the European Central Bank will go slower on raising interest rates as the economy risks being tipped into a recession.

The artificially constructed common currency which was meant to keep German exports competitive, fell as much as 1.4% to $1.0281, its weakest level since December 2002. The losses came as money markets finally agree with us, and continued to trim bets the ECB will tighten as the growth outlook for the region darkens, with traders now eyeing the prospect of gas shortages as Russia cuts back on supplies.

Europe’s slide into recession was accelerated by the latest Italian and Spanish composite PMIs which both declined in June, led by a deceleration in the services sector, and which Goldman said was “consistent with our view of a deceleration in the growth momentum across the Euro area going into H2. Accordingly, we continue to forecast subdued growth in the second half of the year and see risks as skewed towards the downside if gas flows from Russia do not pick up following the end of the pipeline maintenance period in mid-July.”

Indeed, the fallout from war in Ukraine is hampering the ECB’s ability to raise rates as fast as the Fed, despite record inflation, widening the interest-rate differential.

According to Bloomberg’s options-pricing model, there is a 60% chance the currency hits parity versus the dollar by year-end, up from 46% on Monday.

“Parity is just a matter of time now,” said Neil Jones, head of FX sales to financial institutions at Mizuho.

Parity may be on deck for the EURUSD, but it already well in the rearview mirror for the swiss franc cross, with the EUR now trading at levels last seen when the SNB broke the peg against the euro: the euro fell as much as 0.9% against the Swiss franc to 0.99251, the lowest level since 2015, a tumble compounded by by poor liquidity.

Even as they price in a recession, traders also bet the ECB will kick off their first tightening cycle in a decade later this month with a 25 basis-point increase. The Fed in contrast has already raised rates by 150 basis points, with markets pricing in an 80% chance of a 75-basis-point hike at their July meeting; the US is also now widely expected to enter recession by late 2022 or early 2023 at the latest.

“It is hard to find much positive to say about the EUR,” said Dominic Bunning, the head of European FX Research at HSBC. “With ECB sticking to its line that we will only see a 25bp hike in July – at a time when others are hiking much faster – and waiting for September to deliver a faster tightening, there is also little support coming from higher yields.”

And while few are predicting the ECB will capitulate before it hikes even once, money-market traders are betting ECB will deliver around 140 basis points this year, down from more than 190 basis points almost three weeks ago. The repricing gathered pace after a string of weak economic data last week, with traders trimming bets again on Tuesday after French services PMI was revised lower.

Investors have also been more cautious on the euro due to the risk of so-called fragmentation, when economically weaker nations see unwarranted spikes in borrowing costs as financial conditions tighten. The ECB is expected to deliver further details of a new tool to backstop more vulnerable countries’ debt at their policy meeting later this month.

“The FX market is not back up to full liquidity given the US holiday,” said Mizuho’s Jones. “Any given size of trade is likely to have a greater impact on market movement.”

Tyler Durden

Tue, 07/05/2022 – 08:34

via ZeroHedge News https://ift.tt/O0CYlqQ Tyler Durden