The Chillingly Realistic Path To Rate Cuts This Year

Authored by Jeffrey Snider via The Epoch Times,

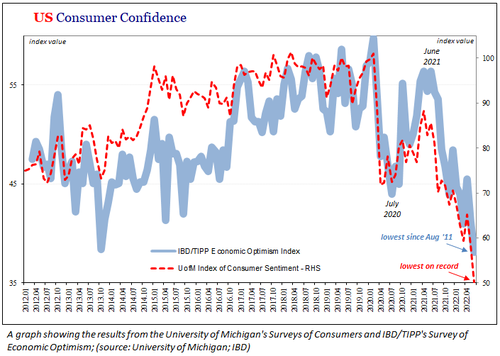

Consumer confidence has plummeted already. With gasoline and food prices weighing on far more than American sentiment, it’s no wonder much of the public may have come around to the idea of recession. Politicians and economists are another matter. Nothing in life—let alone the economy—is inevitable, but the entire global system may have passed that point of no return some time ago before anyone (outside of markets) had realized it.

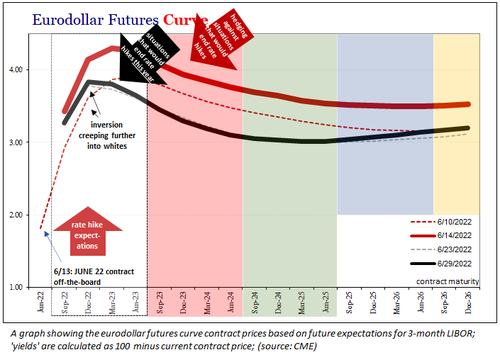

Treasury yields and eurodollar curves have been forecasting contraction not inflation for well over a year already. Starting out as small relative probabilities, as longer-term yields buckled and the eurodollar curve distorted, this was just the markets’ way of signaling a higher degree of confidence in this pessimism.

It all broke wide open, so to speak, once already shameful gasoline prices took a step too far around the beginning of March. In all likelihood, that was the point of no return.

Since then, these same markets after having moved on from “if” to “when” are now thinking especially hard about “how bad.” And this is where recent data fits in.

Unfortunately, various major and minor economic statistics around the world have rather unsurprisingly confirmed these market suspicions. First, a slowdown rather than acceleration in the middle of last year when the public’s attention was exclusively fixed on what “everyone” said was big inflation.

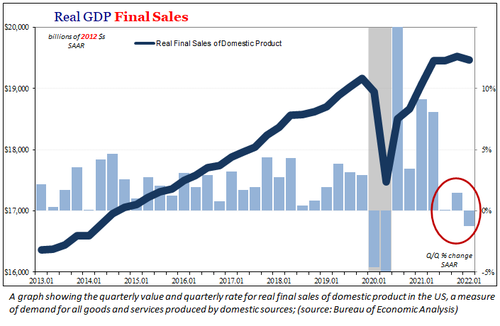

That slowing was a warning it had only ever been “inflation” (supply shock, not excess money) which meant it all came with an expiration date (yes, transitory). This unappreciated 2021 downturn was picked up in all the data, too, including U.S. (and overseas) real GDP.

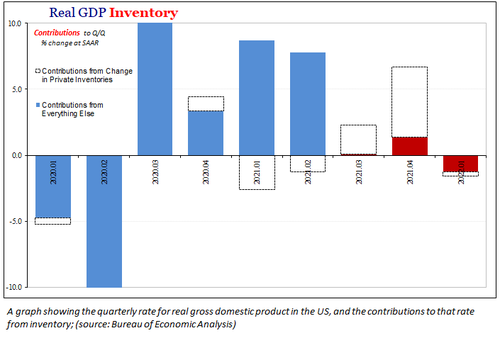

Then, like curves, GDP changed for the worse during 2022’s first quarter. In America, the Bureau of Economic Accounts (BEA) said output adjusted for prices (real) fell rather alarmingly in those three months. The final revisions to Q1 were released just now and were even weaker than previously thought (below).

To begin with, sales of goods were revised downward, while at the same time inventory accumulation was revised upward; basically, the BEA now thinks fewer goods were sold leaving more stuck in the hands of retailers who other data (Census Bureau) conclusively shows are already drowning in stuff, and are increasingly desperate to get out from under it all.

The inevitable result should be a near-term future of discounting and liquidations (falling prices, at least outside of energy for now) of that inventory pile to go along with canceled, cut, and desisted new orders for producers all around the world, domestic and foreign. We’ve seen this take shape already (PMIs have uniformly shown rapid declines in manufacturing order activity).

Here’s the truly concerning part.

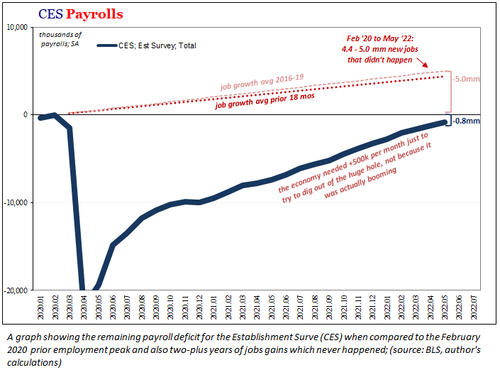

All of these things, bad enough already, have developed and transpired under a relatively benign backdrop. What I mean is, the labor market— therefore jobs— hasn’t thus far been seriously stressed. By most measures, it might appear to be doing rather well.

Confidence has crashed and spending in real terms is decelerating to modestly falling, and yet there are only tangential indications of employment difficulties (the BLS’s CPS, or Household Survey, turned negative in April and didn’t bounce back in May, otherwise most labor data might outwardly appear practically terrific).

What happens if—or when—the aggregate labor situation actually does become meaningfully worse?

We’re already in rough, possibly recessionary shape. Should employers begin to actively cut workers with any sort of serious determination, this could turn a mild recession into, well, what market curves are shaping as some real downside risk just ahead.

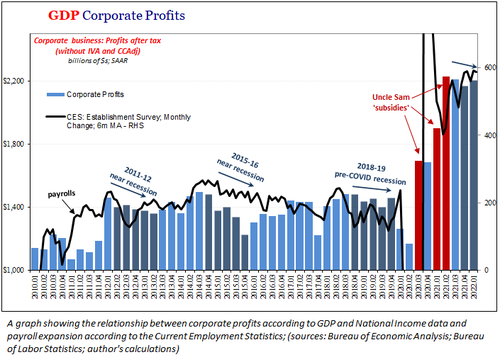

All it would take is the very thing that turns the labor market from uncertain and concerning into outright awful: falling corporate profits.

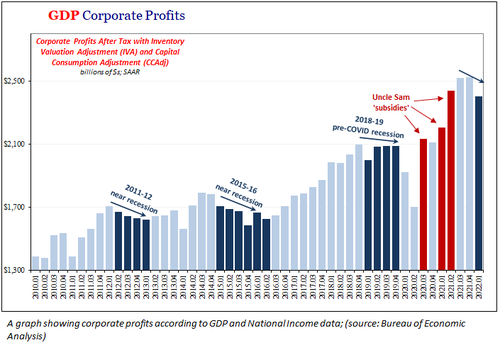

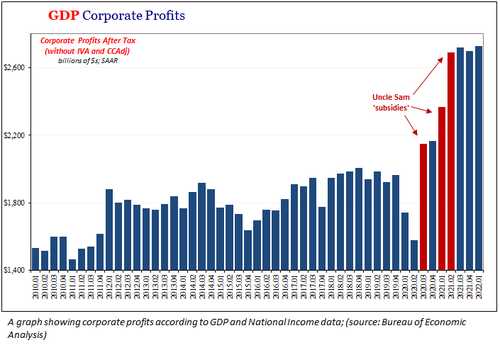

That very situation was included within the update to the bad GDP news for Q1 2022. Along with revised estimates for spending and investment across the U.S. economy, the BEA also produced profit estimates that fell by nearly 5 percent from the fourth quarter (first chart below). Like overall GDP and output, company bottom lines had previously been pressured throughout the second half of 2021 before this.

Much, maybe most, of the prior 2020-21 profit “growth” had been due to Uncle Sam’s various “rescue” schemes including all those PPP “loans” which immediately (corruption at America’s finest) became “grants.” It was an enormous transfer from the Treasury market via the federal government to corporations that were supposed to maintain and then add back their workforces.

The latter didn’t happen, not as much.

As a reminder, there are fewer jobs (CES) today than there had been in February 2020, well more than two years ago. Obviously, the grant-making scheme didn’t play all the way out as it was meant to (and there are honest arguments about whether the economy would’ve been much worse had it not been done).

In short, Uncle Sam massively boosted corporate earnings and these companies responded rationally to what was a temporary, one-time gift. They were cautious about rehiring (which is why jobs overall still lag so far behind, not some ridiculous Great Resignation excuse) because the “transitory” supply shock phenomenon isn’t the same thing as real and actual recovery.

It’s sure not overheating.

There is, as you’d expect, a pretty tight correlation between the rate of hiring economy-wide and bottom lines (specifically, between BEA’s corporate profit series and BLS’s Establishment Survey). With companies already more likely to have pocketed last year’s windfall than to have acted on it, and with profitability like the overall economy starting to go down already, what might this propose about this quarter right now before, then, the second half of this year?

It is shaping up to be a perfect storm of negative factors, only some of which have been thus far fully unleashed: strained consumers at their limits; overfilled retailers and wholesalers demanding mercy from producers by fast-canceling orders; global manufacturers and industry now dealing with fewer orders while struggling from input costs such as commodities; a pernicious lack of overall economic strength for about a year, despite so much talk about red-hot macro and inflation.

On top of all that existing woe, then comes the more-than-hypothetical hammer blow—very real prospects for widespread layoffs. In point of fact, it may not take that many to push it all over the edge, just further lack of a jobs rebound.

If consumers are already in the dumps when jobs aren’t disappearing, think ahead to what happens to all the above if they do start going away.

That’s what has happened on these curves.

All the preconditions for nasty have been set, met, and made plain by the flow of recent data. Therefore, taking curves more literally, exactly the way in which the inflation-fighting certitude and aggression from the FOMC becomes the meek, embarrassing U-turn (or “pivot,” as the Fed’s apologists prefer) into rate cuts.

This year.

Tyler Durden

Tue, 07/05/2022 – 07:20

via ZeroHedge News https://ift.tt/HU5upEz Tyler Durden