Foreign Central Banks Call The Top In Yields With Record Indirects In Stellar 30Y Auction

After a subpar 10Y auction which followed a mediocre sales of 3Y paper, moments ago the Treasury concluded the week’s debt issuance with the sale of $19 billion in 30Y paper in the form of a reopening of the 29Y 10Month TG3 cusip.

The auction was, in a word, spectacular, and not just because of solid top-line results but much more importantly, because the record Indirect demand suggests foreign central banks called the top in long-term yields (i.e., what comes next is deflation).

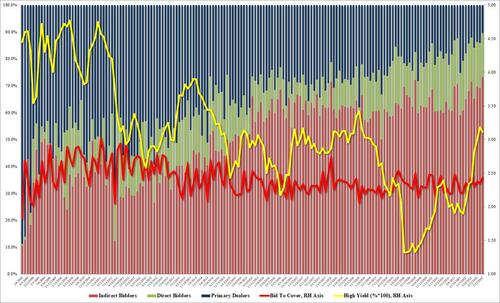

Starting at the top, the 30Y priced at a high yield of 3.115%, which was not only a drop from last month’s 3.185% but was a 1.8bps stop through the 3.133% When Issued.

In similar stellar fashion, the Bid to Cover jumped from 2.351 to 2.436, the highest since March and well above the recent average of 2.358.

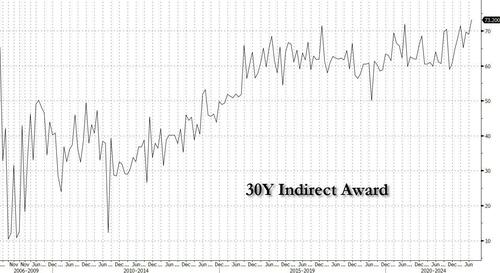

But it was the internals where the biggest surprise lay because that’s where we found that Indirects took down a record 73.20%, up from 69.02% last month and, well, the highest on record as foreign central banks and reserve managers clearly call the top in long-term yields and are saying that it’s all downhill from here (i.e., recession and or peak inflation).

And with Directs taking down 16.3%, or in line with recent auctions, Dealers were left holding just 10.5%, the lowest on record (which they were surely happy with since they can’t flip and sell it back to the Fed now that QE is taking a brief break).

Bottom line: a spectacular, stellar 30Y auction which telegraphed that foreign central banks are calling the peak for long-term yields, which makes sense now that the 2s30s is inverted by a whopping 1.6bps which screams recession…. and of course deflation and – eventually – much more monetary stimulus.

Tyler Durden

Wed, 07/13/2022 – 13:19

via ZeroHedge News https://ift.tt/Y6lOJjr Tyler Durden