Futures, Oil Jump As Record Dollar Rally Fizzles

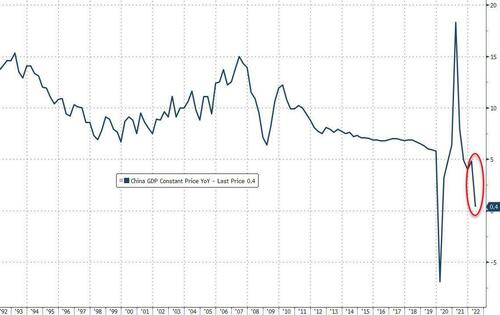

US futures and European stocks advanced, shaking off data that showed China’s economy expanded slowest pace since the initial 2020 Wuhan outbreak amid pervasive lockdowns…

… while the dollar’s record surge stalled at the end of a week in which markets have been whipsawed by shifting expectations for monetary tightening by the Federal Reserve and worries over global economic growth.

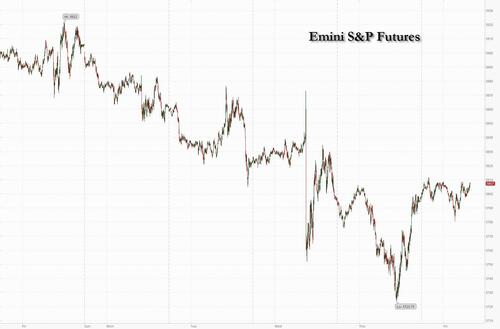

S&P futures traded at session highs, rising 0.38% or 14 points to 3807.50 signaling a higher open for US stocks after Wall Street closed with a small drop as investors dialed back expectations of how aggressively the Fed will hike interest rates to combat inflation. Europe’s Estoxx50 gained 1% in quiet trading while Asian stocks closed mixed after lower-than-forecast China GDP data. Oil reversed recent losses which briefly dragged it below the 200DMA, and was also near session highs, up 3% even as WTI is poised to end the week below $100 a barrel for the first time since April. Commodity metals remained under pressure, with copper touching below $7,000/t, its lowest level in 20 months, as growth data from China fueled concern around the demand outlook for commodities while gold tested support at $1,700/oz. Treasuries rose and the the yield curve between two-year and 10-year maturities remained inverted, something viewed as recession signal. The Bloomberg Dollar Spot Index dipped from a record high.

In premarket trading, Wells Fargo dropped after missing analysts’ second-quarter profit estimates, adding to worries about the outlook for corporate profits after disappointing results yesterday from JPMorgan Chase & Co. and Morgan Stanley. Here are some other notable premarket movers:

- Pinterest (PINS US) shares surge as much as 16% in premarket trading after the Wall Street Journal reported that activist investor Elliott Management has acquired a stake in the social- media company.

- Codexis (CDXS US) tumbles 21% in premarket trading after the enzyme engineering company cut its sales guidance for the year and reported preliminary quarterly revenue that trailed the average estimate.

- Vonage (VG US) rises 7% in premarket trading after Ericsson receives all the necessary approvals from regulators to buy the cloud-based communications provider.

- Solar stocks could be active on Friday after Senator Joe Manchin told Democratic leaders he wouldn’t support new spending on climate measures or tax increases. First Solar (FSLR US) falls 2% in premarket trading.

Investors are evaluating how hawkish the Fed must be to curb inflation and the likely toll on the economy. Bets on a one-percentage-point July rate hike have been scaled back after the latest commentary pointed toward 75 basis points; a retail sales miss in this morning’s data should take a 100bps rate hike off the table.

“It seems most market operators are buying the news after selling the rumor of more monetary tightening brought by a higher US CPI,” said Pierre Veyret, a technical analyst at ActivTrades. Investors now expect a 0.75-1% rate hike from the Fed at the end of the month, he said adding that the tightening cycle is projected to end with the benchmark rate at about 3.2% in 2023, with monetary policy then seen as easing to combat slower economic conditions.

The pace of monetary tightening along with ebbing liquidity still threatens to stir more market volatility after steep losses for stocks and bonds in 2022. In his latest comments, Fed Governor Christopher Waller backed raising rates by 75 basis points this month, nixing Nomura’s base case of a 100bps rate hike, though he said he could go bigger if warranted by the data. St. Louis Fed President James Bullard echoed some of those comments, saying he favored hiking by the same amount.

“We need liquidity to dry up in order to reduce inflation,” Erin Gibbs, chief investment officer at Main Street Asset Management, said on Bloomberg Radio. “It’s a challenge, it’s a difficult situation, transition. I don’t envy the Federal Reserve, but we’ve known there has been too much money out there and that’s why we’re here in this position.”

In Europe, the Stoxx 50 rallied 1.2%. DAX outperforms adding 1.7%. Autos, energy and retailers are the strongest-performing sectors, while luxury stocks got hit after data showed China’s economy grew at the slowest pace since the country was first hit by the coronavirus outbreak two years ago. LVMH led the declines in European luxury stocks while Richemont and Burberry slide as China’s Covid Zero policy weighs on results. Louis Vuitton owner LVMH down 2.2%, while Birkin handbag maker Hermes and watch maker Swatch fall 1.1% and 3.1%, respectively, as China is a key market for luxury houses. Italy’s benchmark index rallied after the country’s president rejected an offer from Mario Draghi to resign as prime minister. Here are the biggest European equity movers:

- European automakers and car-parts suppliers lead gains in Europe with the Stoxx 600 Autos sub-index up as much as 3.8%. BofA analysts say current sector concerns are overdone.

- Uniper gains as much as 12% on Friday as Goldman Sachs upgraded the stock and progress was said to be made on its rescue package. Fortum, which owns 75% of Uniper, up 3.4%.

- Fevertree shares fall as much as 33%, the most on record, after the high-end tonic maker cut its outlook for the year. RBC said the profit warning raises questions about the company’s pricing power and long-term earnings potential, while UBS pointed to concerns about the “visibility on 2022 and beyond.”

- Burberry shares drop as much as 7%, the most since March 4, after the British fashion brand surprised investors by reporting a weak 1Q in the Americas. The operating environment in China remains “extremely volatile,” according to Morgan Stanley.

- Richemont shares fall as much as 6%, the most since May 20, with the 1Q sales beat not enough to quell investor concern over the broader macro-economic backdrop, including what Citigroup calls an “uncertain recovery in China.”

- TomTom shares gained as much as 9.8%, most since Feb. 7, after company reported “satisfactory results given challenging circumstances,” writes ING.

- Hapag-Lloyd shares drop as much as 7.1% after Morgan Stanley cuts its recommendation to underweight from equal-weight on expectations that demand for containers will decline in 2023.

- Direct Line shares rise as much as 3.6% following a 12% drop for the motor insurer in the prior session. Berenberg upgrades its rating to buy, saying the decline has created an opportunity, while JPMorgan cuts its ratings on both Direct Line and peer Admiral.

- Rio Tinto shares fall as much as 2.9% in London after the miner’s 2Q production report, with the company noting headwinds from a global economic slowdown and China’s Covid outbreaks.

- Aston Martin shares jump as much as 28%, reversing an early decline, after the luxury car-maker announces a funding package. Friday’s gain is the biggest since May 2020.

Earlier in the session, Asian stocks declined as renewed fear of a crackdown on enterprises battered Chinese internet names while traders assessed the market impact from weaker-than-expected China growth data and corporate earnings. The MSCI Asia Pacific Index fell as much as 0.6%, on track for a weekly decline. Alibaba dragged down the Asian benchmark and the Hang Seng Tech Index following a report that said some company executives were summoned for talks by authorities in Shanghai in connection with the theft of a vast police database. All but two sectors slipped. Stocks in China declined after data showed that the world’s second-largest economy grew 0.4% in the second quarter, the slowest pace since the country was first hit by the coronavirus outbreak two years ago. While the lower-than-expected expansion extended hopes that Beijing would maintain its easing stance, the latest figure puts its GDP target out of reach. According to Jack Siu, Greater China chief investment officer at Credit Suisse, the government’s current fiscal stimulus on tax rebate and the front loading of special purpose bonds issuance should bring 2022 GDP to 4.8%. READ: Fresh Scrutiny of Alibaba Sends China Tech Stocks Into Tailspin “While disappointing growth data gave views that the current easing stance would be maintained, traders are waiting for the government’s further response as banks, property and other sectors are hit by regulations and growth concerns,” said Kim Kyung Hwan, a Chinese equity strategist at Hana Financial Investment.

Asian stocks are poised for their worst week in about a month amid worries about resurging virus cases in China and a possible global recession. Central banks in the region and elsewhere have been tightening their policy to curb high inflation, with decisions by Singapore and the Philippines surprising investors earlier in the week.

Japan’s Nikkei 225 rose as the yen held near a fresh 24-year low, remaining close to 140 per dollar. The Nikkei 225 advanced 0.5% to 26,788.47 at the 3 p.m. close in Tokyo, while the Topix index was virtually unchanged at 1,892.50. Out of 2,170 shares in the index, 745 rose and 1,334 fell, while 91 were unchanged. “The yen’s depreciation to 139 yen provided support, but there is a limit to that,” said Mamoru Shimode, chief strategist at Resona Asset Management.

In Australia, the S&P/ASX 200 index fell 0.7% to close at 6,605.60, dragged lower by miners and energy stocks as commodities from iron ore to copper declined. Pendal was the worst performer after reporting net outflows for the third quarter of A$4.2 billion. Iron ore miners dropped on weaker prices for the steelmaking ingredient. Goldman analysts also cut their rating on peer BHP, while Rio Tinto warned of headwinds emerging from a global economic slowdown and China’s Covid-19 outbreaks. In New Zealand, the S&P/NZX 50 index fell 0.6% to 11,122.61.

In FX, the Bloomberg Dollar Spot Index slumped with AUD and NZD the weakest performers in G-10 FX, while CHF and SEK outperform. The euro held above parity, rising to session highs as US traders walked in. Sterling hovered near a two-year low against the US dollar, which remains broadly supported by demand for the safe-haven greenback. Markets will be keeping an eye on a debate between UK Conservative party candidates later in the day for a steer on who could become the country’s next prime minister. The Aussie weakened for a second day after Westpac trimmed its forecast for RBA rate hikes, and iron-ore prices tumbled. The yen rose from a 24-year low as risk sentiment was subdued amid weak Chinese economic data and concerns over aggressive policy tightening in the US.

In rates, Treasuries rose, led by the belly, while gilts jumped at the open and bunds extended gains. Treasuries were slightly richer across the curve with front-end lagging, mildly flattening 2s10s and 2s5s spreads. Yields richer by 2bp to 3bp across the curve with 10-year around 2.93%, trading broadly inline with bunds and outperforming Italian bonds by 4bp. Peripheral spreads widen to Germany with 10y BTP/Bund adding 6.5bps to 213.4bps. Italian bonds yields rose at the front end of the curve as political uncertainty prevailed: indeed, the focus remains on Italian bonds after President Sergio Mattarella rejected Prime Minister Mario Draghi’s resignation late Thursday. US session includes a packed data slate and three Fed speakers before blackout ahead of July 27 policy meeting.

In commodities, crude futures rose. WTI trades within Thursday’s range, adding 0.3% to trade near $96.05. Brent rises 0.7% near $99.83. Metals remain under pressure, with copper touching below $7,000/t and gold testing support at $1,700/oz.

To the day ahead now, and data releases include US retail sales, industrial production and capacity utilisation for June, along with the Empire State manufacturing survey for July, and the University of Michigan’s preliminary consumer sentiment index for July. Central bank speakers include the ECB’s Rehn, and the Fed’s Bostic and Bullard. Earnings releases include UnitedHealth Group, Wells Fargo, BlackRock and Citigroup. Finally, G20 finance ministers and central bank governors will be meeting in Indonesia.

Market Snapshot

- S&P 500 futures little changed at 3,795.50

- STOXX Europe 600 up 0.9% to 410.06

- MXAP down 0.5% to 153.77

- MXAPJ down 0.8% to 505.79

- Nikkei up 0.5% to 26,788.47

- Topix little changed at 1,892.50

- Hang Seng Index down 2.2% to 20,297.72

- Shanghai Composite down 1.6% to 3,228.06

- Sensex up 0.1% to 53,490.31

- Australia S&P/ASX 200 down 0.7% to 6,605.57

- Kospi up 0.4% to 2,330.98

- German 10Y yield little changed at 1.11%

- Euro little changed at $1.0026

- Gold spot down 0.4% to $1,702.69

- US Dollar Index little changed at 108.58

Top Overnight News from Bloomberg

- China’s economy grew at the slowest pace since the country was first hit by the coronavirus outbreak two years ago, making Beijing’s growth target for the year increasingly unattainable as economists downgrade their forecasts further. The 0.4% expansion in GDP reported for the second quarter, when dozens of cities including Shanghai and Changchun imposed lockdowns, was the second weakest ever recorded

- With Italy on the brink of chaos, Mario Draghi has less than a week to forge some difficult compromises with the populists in his government that have reluctantly backed him for the past 18 months

- The ECB will unveil an unlimited bond-buying tool next week to help markets better adjust to steeper and faster interest-rate increases than previously thought, economists surveyed by Bloomberg say

- Copper is heading for its steepest weekly decline since the early months of the coronavirus pandemic, with fears mounting of a recession that could destroy global demand for industrial commodities

A more detailed looked at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed after the 100bps Fed rate hike bets unwound and with headwinds from China’s GDP miss. ASX 200 was dragged lower by the mining sector amid losses in Rio Tinto shares despite an increase in its quarterly output and shipments, as it also warned of headwinds to its business and higher costs. Nikkei 225 swung between gains and losses but was ultimately higher intraday amid recent currency weakness and with index heavyweight Fast Retailing boosted by strong 9-month results. Hang Seng and Shanghai Comp. were indecisive after disappointing Chinese growth data which showed weaker than expected GDP and Industrial Production, although Retail Sales surprisingly expanded and the Unemployment Rate declined.

Top Asian News

- PBoC injected CNY 100bln via 1-year MLF vs CNY 100bln maturing with the rate kept at 2.85%.

- China’s Foreign Minister Wang also commented that China-Australia relations currently face challenges and opportunities, while he added that China is willing to recalibrate relations in the spirit of mutual respect, according to Reuters.

- China NBS official said downward pressure on the domestic economy increased substantially during Q2 and that the foundation for a sustained economic recovery is not solid, while the economy is facing shrinking demand and supply shock, according to Reuters.

- China’s Huaiyuan county has announced a lockdown amid COVID, according to local TV; 151 prelim cases were reported on July 14th, according to CCTV.

- China Traders Pile Into Carry Trades While Easy Money Lasts

- Telkom Indonesia Jumps Most in Seven Months on 2Q Bet

- MTN in Talks to Buy Rival Telkom in Cash & Shares: M&A Snapshot

- SK Hynix Is Said to Weigh Slashing Spending by 25% in 2023

European bourses are firmer across the board, as initial jittery performance dissipated with participants looking to US data and Fed speak. US futures are in the green, but only modestly so, and have been relatively contained awaiting further guidance from upcoming Fed officials on the 75bp/100bp discussion. UnitedHealth Group Inc (UNH) Q2 2022 (USD): Adj. EPS 5.57 (exp. 5.20/4.98 GAAP), Revenue 80.30bln (exp. 79.68bln). BlackRock Inc (BLK) Q2 2022 (USD): EPS 7.06 (exp. 7.90) Revenue 4.53bln (exp. 4.65bln). AUM 8.49tln (exp. 8.86tln). Net inflows 89.57bln (exp. 116.78bln).

Top European News

- ECB’s Rehn says ECB likely to go 25bps in July and 50bps in September. Note, the ECB is in its quiet period at the moment.

- Burberry Upbeat on Outlook But Concerns About China Remain

- Aston Martin Stock Jumps as Carmaker’s Fundraising Calms Nerves

- Euro Extreme Bearish Bets Have Room to Grow on NatGas Shut Off

- UBS Wealth Sees 15% Downside for European Stocks in Recession

FX

- Dollar in need of consumption or production boost after two Fed hawks lean against 100bp hike expectations that were becoming embedded for forthcoming FOMC meeting, DXY retreats through 108.500 after setting new 2022 peak at 109.290 yesterday.

- Franc outpaces fellow majors as yields retreat and curves re-steepen, while retaining bid against Euro, USD/CHF sub-0.9800 vs high near 0.9900 on Thursday, EUR/CHF depressed largely under 0.9850.

- Aussie underperforms as Chinese GDP data disappoints and iron ore dumps in response; AUD/USD top heavy above 0.6750, AUD/NZD reverses around 1.1000 handle.

- Loonie pares declines from new y-t-d low vs Greenback as crude prices stabilise, USD/CAD close to 1.15bln option expiries at the 1.3100 strike compared to 1.3200+ high yesterday.

- Euro attempts to consolidate back on a par with Buck after fleeting if not false break below.

- Yuan nurses losses after further depreciation on growth concerns and latest Covid lockdowns -Usd/Cnh and Usd/Cny slip from overnight peaks circa 6.7840 and 6.7690 respectively.

Fixed Income

- Bonds back off following further retracement from lows on less hawkish Fed vibes that prompted bull re-steepening

- Bunds sub-153.00 vs new 153.80 WTD peak, Gilts under 116.00 from 116.39 and 10 year T-note midway between 118-29+/118-13 stalls

- BTPs stage impressive recovery to 124.30 from 121.96 trough on Thursday awaiting next chapter in Italian political drama

Commodities

- Crude benchmarks are firmer, tracking sentiment, but cognizant of the Saudi-Biden meeting though an immediate production increase is not anticipated; WTI +USD 0.20/bbl.

- The US is not expecting Saudi Arabia to immediately boost oil production, US eyes the next OPEC+ meeting, according to a US official cited by Reuters.

- UAE says it wants more stable oil markets, will abide by OPEC+ decision; idea of a confrontational approach re. Iran is not something they buy into, via Reuters.

- Spot gold remains pressured near, but yet to breach, the USD 1700/oz handle; despite a pull-back in the USD as sentiment turns incrementally more constructive.

US Event Calendar

- 08:30: June Import Price Index YoY, est. 11.4%, prior 11.7%; MoM, est. 0.7%, prior 0.6%

- June Export Price Index YoY, est. 19.9%, prior 18.9%; MoM, est. 1.2%, prior 2.8%

- 08:30: June Retail Sales Advance MoM, est. 0.9%, prior -0.3%

- June Retail Sales Ex Auto MoM, est. 0.7%, prior 0.5%

- June Retail Sales Ex Auto and Gas, est. 0.1%, prior 0.1%

- June Retail Sales Control Group, est. 0.3%, prior 0%

- 08:30: July Empire Manufacturing, est. -2.0, prior -1.2

- 09:15: June Industrial Production MoM, est. 0.1%, prior 0.2%, revised 0.1%

- June Capacity Utilization, est. 80.8%, prior 79.0%, revised 80.8%

- June Manufacturing (SIC) Production, est. -0.1%, prior -0.1%

- 10:00: May Business Inventories, est. 1.4%, prior 1.2%

- 10:00: July U. of Mich. Sentiment, est. 50.0, prior 50.0; Expectations, est. 47.0, prior 47.5; Current Conditions, est. 53.7, prior 53.8

- 1 Yr Inflation, est. 5.3%, prior 5.3%

- 5-10 Yr Inflation, est. 3.0%, prior 3.1%

DB’s Jim Reid concludes the overnight wrap

The last 24 hours have seen another major risk-off move in financial markets, with worries about a potential recession getting fresh support from a weak round of US bank earnings as we kick off the latest results season, followed by much weaker than expected Chinese GDP growth in Q2. To be honest, it was hard to find an asset class where recession signals weren’t flashing red, with yesterday seeing the S&P 500 (-0.30%) lose ground for a 5th consecutive session, peripheral bond spreads widen in Europe, and oil prices seeing their lowest intraday levels since Russia’s invasion of Ukraine began.

In terms of the specific moves, equities declined across the board yesterday with the S&P 500’s losses led by energy and the more cyclical sectors. Banks were a major contributor to that, and JPMorgan (-3.49%) suffered, hitting a 20-month low after their earnings missed expectations and they announced the suspension of share buybacks, whilst Morgan Stanley (-0.39%) saw investment banking revenue down -55% on the previous year. European equities also suffered significant losses, with the STOXX 600 coming down -1.53% on the day.

However, the final losses by the US close were far from where they had been at the open, with the S&P 500 recovering from intraday losses of -2.11% after the FOMC’s resident hawks walked back the prospects of a super-sized 100bps hike in July, and signalled that a 75bp increase remained preferable despite the CPI beat. Tech shares were a particular beneficiary, and the NASDAQ managed to eke out a +0.03% gain by the close as a result. In terms of the comments, Governor Waller said that “with the CPI data in hand, I support another 75-basis point increase”. However, he did say that if upcoming retail sales and housing data were “materially stronger than expected it would make me lean towards a larger hike”. And then St Louis Fed President Bullard was quoted in a Nikkei interview that he “would advocate 75 basis points again at the next meeting.” In response, futures dialled back their expectations for a 100bp move, with pricing moving down from a peak of +94bps not long before Waller’s remarks came out, to +82.5bps by the close of trade.

Those remarks helped trigger a recovery among US Treasuries, with the 2yr yield falling back from an intraday high of 3.27% to end the day at 3.13%, and this morning it’s fallen further to 3.12%. Yield curves also steepened on the back of the remarks, although the 2s10s curve (+4.9bps yesterday) still remains well in inversion territory at -18.1bps as we go to press. Yields on 10yr Treasuries were up +2.6bps yesterday to 2.96%, although this morning have also fallen back to 2.94%. Today we’ll get further comments from Atlanta Fed President Bostic, St Louis Fed President Bullard and San Francisco President Daly, which will be important as today is the last day before the FOMC’s blackout period begins ahead of their next meeting, so all eyes will be on their thoughts about a 100bps move.

Over in Europe, Italian assets lost significant ground yesterday amidst ongoing political turmoil in the country. Prime Minister Draghi tried to tender his resignation after the Five Star Movement boycotted a confidence vote in the Senate, saying that “The loyalty agreement that was the foundation of my government has gone missing”, but President Mattarella rejected it, and it’s uncertain what exactly will happen next. Draghi is set to address parliament next week, although early elections remain a possibility if an agreement is unable to be reached. In terms of the market reaction, Italy’s FTSE MIB underperformed all the other major European indices, with a -3.44% decline that leaves the index at its lowest level since November 2020 just before Pfizer announced their positive vaccine news. Meanwhile the spread of 10yr Italian yields over bunds widened +7.7bps to 206bps yesterday, which is their highest level in nearly a month. That theme of widening spreads was echoed on the credit side too, where iTraxx Crossover widened +22.2bps to 626bps, which is its highest level since April 2020. Yields on 10yr bunds themselves were up +3.3bps.

That negative tone has persisted in Asia overnight after China’s Q2 GDP data showed economic growth slowed to just +0.4% year-on-year in Q2 (vs. +1.2% expected). On a quarter-on-quarter basis, there was even a -2.6% contraction (vs. -2.0% expected), which marks the first quarterly contraction since Q1 2020 when the Covid-19 pandemic started. The data for June alone was better however, with retail sales up +3.1% year-on-year (vs. +0.3% expected), and industrial production up +3.9% year-on-year (vs. +4.0% expected). Separately, China have reported their highest number of daily Covid-19 cases in 7 weeks, with 432 infections yesterday, of which 165 were in Guangxi province. A number of equity indices have lost ground against that backdrop, including the CSI 300 (-0.05%), the Shanghai Comp (-0.24%) and the Hang Seng (-1.19%), although the Kospi (+0.22%) and the Nikkei (+0.58%) have advanced, whilst Brent crude oil prices are back above $100/bbl. US and European equity futures are also pointing to a positive start, with those on the S&P 500 (+0.32%), the NASDAQ 100 (+0.41%) and the DAX (+0.99%) all up.

Yesterday’s other data releases didn’t exactly help sentiment either, with US producer price inflation beating expectations as well at a monthly +1.1% (vs. +0.8% expected), although core inflation did fall to +0.4% (vs. +0.5% expected). That pushed the headline year-on-year PPI reading up to +11.3% (vs. +10.7% expected), and core fell to +8.2% as expected. Separately, the weekly initial jobless claims for the week through July 9 came in at 244k (vs. 235k expected), which is their highest level since November. Furthermore, the 4-week moving average of claims rose to 235.75k, which was its highest level since December. Instead, the main positive news came from the continuing claims data for the week through July 2, which fell to 1331k (vs. 1380k expected).

Here in the UK, the second ballot of Conservative MPs took place yesterday as they select their next leader and the country’s next Prime minister. Former Chancellor Sunak remained in the lead with 101 votes, but trade minister Penny Mordaunt maintained her momentum with an increase to 83 votes, whilst Foreign Secretary Truss won 64 votes. There are now just 5 candidates remaining with the next ballot scheduled for Monday, and there are also a couple of TV debates taking place before then, so there’s still the potential for things to change over the weekend.

To the day ahead now, and data releases include US retail sales, industrial production and capacity utilisation for June, along with the Empire State manufacturing survey for July, and the University of Michigan’s preliminary consumer sentiment index for July. Central bank speakers include the ECB’s Rehn, and the Fed’s Bostic and Bullard. Earnings releases include UnitedHealth Group, Wells Fargo, BlackRock and Citigroup. Finally, G20 finance ministers and central bank governors will be meeting in Indonesia.

Tyler Durden

Fri, 07/15/2022 – 07:57

via ZeroHedge News https://ift.tt/r8tPeKR Tyler Durden