Nomura Now Sees 100bps Rate Hike In Two Weeks, As Bostic Says “Everything Is In Play”

Earlier today, Fed trial balloon intermediary and Powell’s preferred leaker, WSJ reporter Nick Timiraos was seen as taking a 100bps rate hike off the table – despite today’s scorching, red hot CPI print – in an article titled “Inflation Report Likely to Seal Case for Fed’s 0.75-Point Rate Rise in July” in which he said that “another big increase in consumer prices last month keeps the Federal Reserve on track to raise its benchmark interest rate by 0.75 percentage point at its meeting later this month.”

However, that’s not enough for Nomura which in addition to being the first bank to call for a H2 2022 recession (followed duly by BofA this morning and all other banks soon), moments ago also announced that it now sees a 100bps rate hike as its base case. Impossible? Nope: Nomura was also the first bank to correctly call last month’s 75bps rate hike (which was initially seen as a ludicrous call, only to have Timiraos confirm the outcome during the Fed’s blackout period).

Below we excerpt from the full note (available to pro subscribers in the usual place):

We Expect a 100bp Hike in July

The Fed remains extremely data dependent, and the data suggest a larger rate increase is needed

June CPI data cement the need for an even more aggressive Fed and we now expect a 100bp hike in July

June CPI surprised to the upside across both headline and core components, with monthly core inflation accelerating further to 0.71% m-o-m from 0.63% in May and 0.57% in April. Fed participants have consistently communicated they are looking for stabilizing or moderating monthly inflation measures when determining whether 75bp or 50bp in July is more appropriate.

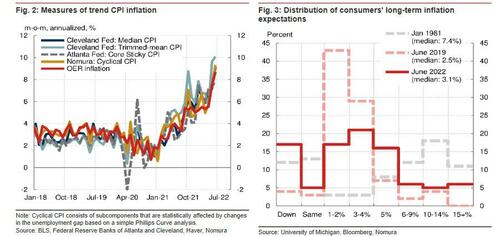

We believe the outright acceleration, for the second consecutive month, will likely encourage participants to now push for a 100bp hike. That may be particularly true considering one of the major drivers of the upside surprise in June was rent inflation, which remains a driver of overall trend inflation measures ( Fig. 2 ).

The Japanese bank continues:

The choice between 75bp and 100bp in July may still be close for participants, but we believe 100bp is the “right” call, both from a forecasting perspective and from the perspective of optimal monetary policy. When asked about 100bp at the June press conference, Chair Powell noted that “we’re going to react to the incoming data and appropriately.” Incoming data suggest the Fed’s inflation problem has worsened, and we expect policymakers to react by scaling up the pace of rate hikes to reinforce their credibility.

In addition, Nomura notes, “the revision between the June preliminary and final readings of the University of Michigan data suggests the Fed would likely hike by 100bp in July even if the upcoming July preliminary report surprises to the downside slightly.”

But won’t 100bps in an economy which is already in a technical recession unleash a, say, an even worse recession (or depression)? Well, yes, that’s the point! Cut Nomura again:

While concerns are rising over slowing economic activity, recent inflation forecast upside misses by the Fed have pushed the FOMC towards prioritizing current data over forward-looking projections when making policy decisions. Additionally, we continue to see considerable risk of unanchored inflation expectations, which may require even more aggressive tightening to bring inflation down to target

As a result, Nomura sees the Fed prioritizing high current inflation prints above all other factors at present, and do not expect data on slowing activity to dissuade policymakers from reacting strongly to today’s CPI release.

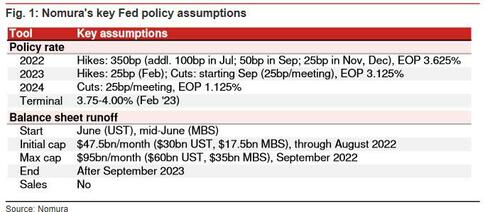

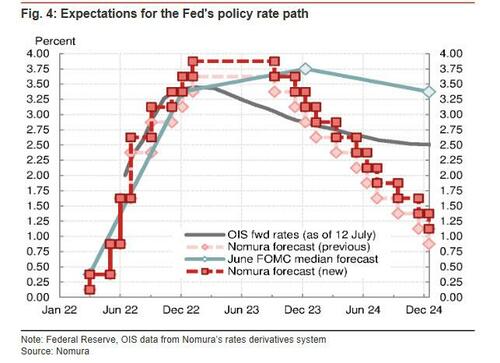

So what happens after the Fed hikes 100bps in the last week of July (assuming it does, of course)? Well, Nomura continues to expect a 50bp hike in September and three more 25bp hikes in November, December and February.

After incorporating the 25bp upward revision to its July call, Nomura’s terminal rate is now slightly higher at 3.75-4.00%, where the bank thinks it will remain until September 2023 when the Fed starts cutting rates by 25bp/meeting.

Here we disagree: the Fed will be cutting long before Q4 2023, and indeed, as of this moment the eurodollar market is pricing in almost one full rate cut in Q1 2023!

Finally, Nomura sees two risks to its Fed call:

- First, the Fed may continue to hike by larger-than-50bp increments for longer than it assumes. The choice in September is likely to be between 50bp and 75bp. Recent Fedspeak from Daly and Bostic indicates Fed participants have raised their short-term nominal neutral rate estimate to around 3%. A 50bp hike in September would reach that level, allowing the Fed to then downshift to 25bp in November (our current forecast). To be sure, the two inflation reports between the July and September FOMC meetings could surprise to the upside, resulting in continued 75bp or larger hikes.

- Second, further out on the forecast horizon Nomura expects the Fed to begin cutting rates by 25bp per meeting in late-2023 as inflation approaches target amid recessionary conditions. However, today’s data suggest there is a risk that the start of rate cuts will be delayed, but they will be larger once easing begins. Today’s high print and recent inflation expectations data suggest inflation is becoming more entrenched, which could prompt a more severe tightening in financial conditions and a deeper recession. Such an outcome could result in the Fed eventually cutting rates by larger increments to a lower level once inflation cools.

Again, #2 above is wrong as EDZ2-H3 shows over 25 bps in Q1 2023 rate cuts, i.e., almost more than one full rate cut in the first quarter! How soon until the market starts pricing in the next QE???

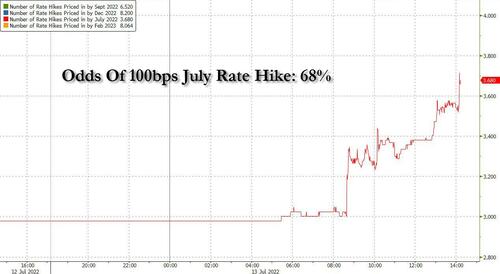

Finally, with Bostic saying “everything is in play” moments ago when asked if a 100bps rate hike is possible, the market is clearly convinced that Nomura is right and is assigning 68% odds of a 100bps rate hike in July.

There is more in the full Nomura note available to professional subs.

Tyler Durden

Wed, 07/13/2022 – 14:18

via ZeroHedge News https://ift.tt/e8vFrBK Tyler Durden