Stagflation Scares Slam Stocks & Commodities As Fed Faces Yield-Curve Collapse

Hotter than expected inflation prints (but UMich expectations tumbled) combined with weak ‘real’ retail sales and industrial production unexpectedly contracting all support the stagflationary narrative and judging by this week’s chaotic swings, traders are confused at what to do.

Commodities are down (recessionary) and confirmed by the long-end of the yield curve (and stocks sinking) as initial claims data suggests the labor market is tightening (recessionary).

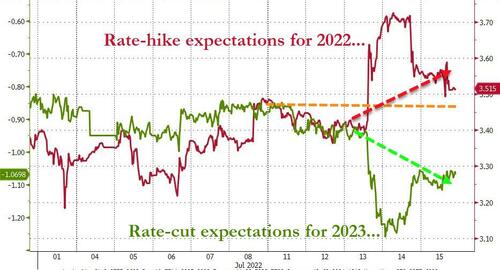

Rate-hike expectations are soaring (anti-inflationary) and the yield curve is inverting everywhere (Policy error) as rate-cut expectations are also soaring for next year after The Fed deepens the recession…

Source: Bloomberg

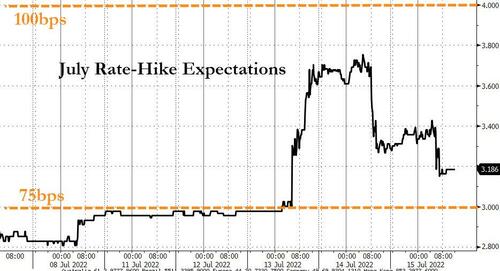

The odds of a 100bps hike in July is higher on the week but well off the highs post-CPI…

Source: Bloomberg

Despite a big rebound today (and yesterday afternoon), all the US Majors are lower on the week with The Dow the least ugly horse in the glue factory as Nasdaq underperformed…

None of the sectors closed green on the week with Energy the biggest loser. Financials ripped back higher today, putting a little lipstick on that pig. Staples and Utes were best at unch…

Source: Bloomberg

Defensives outperformed Cyclicals but both were weaker on the week…

Source: Bloomberg

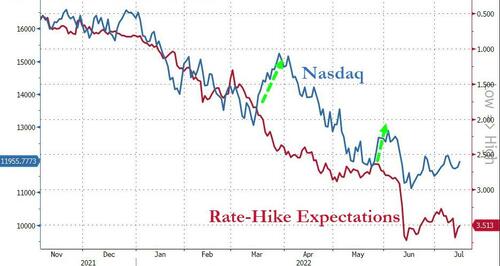

And no, stocks are not pricing in the same trajectory as STIRs…

Source: Bloomberg

Bonds were mixed this week with the short-end higher in yields and the rest of the curve pricing in recession and Fed reaction (2Y +3bps, 30Y -15bps)…

Source: Bloomberg

10Y yields ended the week back below 3.00%…

Source: Bloomberg

And that massive flattening pushed the yield curve (2s10s) to its most inverted since 2000…

Source: Bloomberg

The dollar rallied for the 6th week in the last 7, closing at its highest since 2002…

Source: Bloomberg

Cryptos were mixed this week with a late-week rebound lifting Ethereum into the green for the week (2nd up-week in a row), but Bitcoin had another down week…

Source: Bloomberg

Bitcoin rose back above $21k today and Ethereum rose back above $1250…

Source: Bloomberg

Commodities were down for the 5th straight week, tumbling back – based on the Bloomberg Commodity Index – to pre-Putin-invasion levels…

Source: Bloomberg

Gold tumbled for the 5th straight week, testing back below $1700 – its lowest since Aug 2021 (spike low)…

But gold outperformed silver on the week with the latter at its cheapest to the former since July 2019’s peak…

Source: Bloomberg

NatGas bucked the trend and surged back above $7 this week…

Oil prices fell for the 4th week of the last 5, with WTI closing back below $100

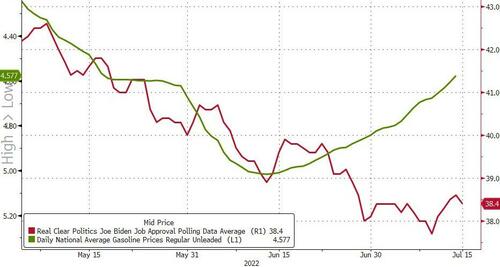

Finally, great news America!! Gas prices are down 31 days straight…

Source: Bloomberg

…it’s just not helping ‘the big guy’ out!

Perhaps it’s because Americans misery is at its highest since Carter was president…

Tyler Durden

Fri, 07/15/2022 – 16:01

via ZeroHedge News https://ift.tt/W9pseyE Tyler Durden