“I Don’t Care, I Love It!”

By Peter Tchir of Academy Securities

I Don’t Care, I Love It!

This market took everything that was thrown at it and just ran with it! “Bad” news helped markets rally and “good” news helped even more. Whatever was thrown at the market after Tuesday was absorbed and turned into a reason to celebrate. Trading with “Icona Pop” playing in the background set the right tone for this market!

The Fed

There still seems to be a lot of contention about what the Fed said (or more accurately, meant to say). That is important as the Fed will try and fine tune their message in the coming days and this highlights what we discussed in Did He, Or Didn’t He?

- Did we reach the Neutral Rate? I have seen some long diatribes about why we haven’t reached the neutral rate, at least not in this inflation environment, but we are closer to a long-run neutral rate than not. Parts of the economy have the risk of rolling over, so I suspect that we are done (or almost done) with tightening. I was a bit surprised that the Fed seemed to indicate that too, but it fits with my view on the path of rates so I’m not going to fight against what the “correct” neutral rate is and “around here” seems plausible.

- Balancing Inflation versus Recession risks. I keep coming back to this “disconnect.” What was actually said seemed to tilt slightly to the inflation fighting side. He said multiple things, including (specifically) that we might need unemployment to rise and the economy to slow to achieve reduced inflation. I cannot see any way to read the transcript and not come up with Powell leaning to the inflation fighting side at the expense of the economy. But it was more believable (or even natural) when he sounded dovish. There was a je ne sais quoi about how he delivered dovish versus hawkish messages. Maybe I’m imagining it, but the “inflation fighting” comments sounded more forced than the “data dependent” and “balanced” comments. Additionally, and rightfully so, the market seems to be expecting worse future data than the Fed. So, for the Fed, data dependency means they will examine the data and react to it, but the market decided it means that we will get weaker than expected data, so the Fed reaction function will be to take their foot off the brake.

- Fed Speak. A few members of the Fed have already commented, and overall, their message struck me as trying to put the hawkish message front and center (market reaction was – I Don’t Care – I Love It!)

The market has likely interpreted the Fed as too dovish relative to what they are trying to achieve, but that is difficult to fight given that the central bank has been a friend of the markets far more often than not for the past 25 years or so!

Inflation expectations. One thing to watch is inflation expectations. The St. Louis Fed 5-year, 5-year forward finished the week back at 2.33% (up from 2.1% where it was during July and higher than where it was for most of 2021). University of Michigan 5–10-year inflation expectations missed estimates and stopped their recent decline. That measure was taken before the Fed spoke, so there could be upward pressure on that.

Both market and survey measures of inflation have been moving in the right direction for the Fed, but if those metrics reverse, the Fed may have to adjust their message. This isn’t a “tomorrow” risk, but something to watch closely for in the coming weeks.

Losing Money with Inside Information

If I knew the Q2 GDP number in advance, I would have lost money. I thought that for a small negative, we could rally. I would have bet that a larger negative number, coupled with further downward revisions to Q1, would have caused some selling pressure. That may have even been briefly correct as markets initially embraced the weakness. However, the markets once again latched on to the “lower yields are great for stocks” concept, which I don’t think will work out as well this time as it did in 2020 (Celsius 233).

The Yield Curve

As previously mentioned, we have gone back to the trade where high beta/future potential growth gets rewarded with every tick lower in bond yields.

Heck, the 2s versus 10s finished the most negative it has been, but “I don’t care, I love it” seems to apply here as well. I struggle to embrace the bad news is good news trade and am skeptical that a recession will be moderate enough that dovish Fed policy will outweigh economic or earnings risks, but here we are.

The Return of TINA

I did hear a lot of chatter that There Is No Alternative (TINA) is back in play. It seems likely that investors, collectively, but especially total return/alpha generators are too underweight risk. There were certainly enough examples of companies popping on earnings to support that.

On the flip side, aggressive funds have continued to get inflows all the way down and I saw as many or more indicators pointing to overbought rather than oversold (especially by the end of last week).

On the earnings front, the messaging has been better than I feared, so that is good, but to the extent problems really accelerated this quarter (it was only Tuesday when some warnings linked to the consumer pushed markets down), the entire story isn’t over.

I Crashed my Car into the Bridge. I Don’t Care, I Love It!

Some of the most shorted stocks and assets performed the best last week.

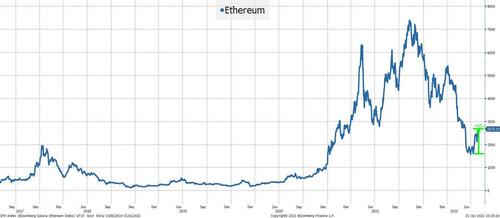

I just want to highlight Ethereum. Yes, there is a “merge” that some think will help a lot, but it jumped 66% in the last two weeks of July. Yes, 66% doesn’t look like a lot on the chart since Ethereum has been pummeled, but in the real world, 66% in a couple of weeks is a lot.

Charts like this scare me because it seems to indicate the “get rich quick” mentality is getting traction again. I don’t like that mentality, but if it has momentum, you don’t want to fight it!

I think what I like so much about this song is how the lyrics seem bad, but the music and singing are so upbeat, it is impossible not to get enthusiastic.

“I crashed my car into the bridge. I watched, I let it burn…I don’t care, I love it!”

Watching so many altcoins do so well for example, after having seemingly been left for dead, is either an opportunity, an indication that animal spirits are fully back in control, or is something to be watched very nervously (while not stepping in the way).

“I Threw your Stuff into a Bag and Pushed it Down the Stairs”

There is so much I could say about this line, but even the T-Report has some self-preservation mechanisms.

Sustainability is Inflationary Near-Term

Senators Schumer and Manchin announced a reconciliation deal that will raise taxes (mostly for corporations if their calculations are correct) and will fuel spending on energy production. There is no guarantee that the bill passes, but if it does, I don’t see how the spending on energy isn’t inflationary at this moment in time. Any new production will take time to come on-line. Sustainable energy eventually can be deflationary, but for now there will be a rush to buy concrete, steel, lithium, etc.

I keep reading headlines that the bill would address inflation, but I haven’t come across an argument about why it helps inflation in the next year? Maybe I’m reading the wrong sources, but I think this bill could spur another round of commodity inflation.

Some “Nagging” Credit Concerns

We’ve seen the housing data continue to deteriorate. Yes, I sound like a broken record, but markets didn’t care about that this week. I’m also hearing that “real-time” data, which I have limited access to, is indicating an uptick in delinquencies on credit cards and auto loans. When I look at the data I have available, I see a slight upturn, but not enough to set off the alarm bells. Just something to watch.

Similarly, it has been difficult to watch what has been happening in European credit markets and not experience a modicum of concern.

The pressure on Italian debt relative to German debt eased a bit. Europe outperformed the U.S. recently on credit spreads as both markets rallied.

That is comforting, but bears scrutiny.

It looks like Germany in particular will be hit by energy restrictions this year. That will affect their economy and their industry. Some of that slack could be picked up globally (including in the U.S.) which may explain why this is trading a bit like a zero-sum game (what Europe loses, someone else gains), but there is a risk that Europe gets bad enough that it drags down the global economy and global markets.

Bottom Line

There has been just enough good news on earnings that I have to respect that companies may be very resilient and if the Fed is easing off the brake, then we could avert the spiral about which I am concerned. Certainly, the wealth effect is back to moving in the right direction, though I’m dubious in the underpinnings of that rally.

I really don’t like the days where “bad news” turns out to be good, but it is difficult to step in front of that freight train which has worked quite well for much of the past few years (like many other things, it seems to work well most of the time, with a few abrupt and severe reversals).

I like buying one-month puts and calls on equities. I think we are at an inflection point.

- I can paint a story about why stocks will give up last week’s gains and head towards new lows (layoffs just starting, earning warnings yet to come, tapped out consumer, excess inventories, resurgence in commodity prices coupled with Fed hawkish leanings, etc.). That scenario feels more “real” to me.

- But, the “everything is good” scenario could play out. First comes TINA then comes FOMO. The Fed lets the economy run hot. We get some stimulus. China sorts itself out. Housing reaches a level where buying resumes across the board. More people get forced into the market. The market bounce lets companies spend again. The virtuous cycle starts again. I find this one less believable, but am reluctant to fight it.

So, with VIX back to 21, trying to capture a big move in either direction is compelling to me.

Overweight commodities again! If the stimulus is going to go through, I want to own the commodity complex. Emerging Markets (particularly Latin America) should also benefit.

Companies of the “past” will be the companies of the “future.” With EV incentives a part of any stimulus plan, we could see a surge in purchases there (though a chunk of that will be pulling forward demand rather than creating new demand, but that is a story for another day). With the ever-increasing number of EV offerings, there is room for growth both at the “new” EV centric companies, but also for the traditional autos. I own some of them and will be adding more. The same theory fits across energy and other areas, but they are already picked up in my “commodity resurgence” theme.

I still like yield products, though with the 10-year Treasury back to 2.65%, I’d lean towards credit and structured products. Credit has room to tighten and will benefit from stable yields. If yields rise a little, which seems likely given where they are, credit spreads could offset that.

Markets and even the economy continue to be volatile, illiquid, and reactionary. I wish things would get easier sooner than later, but I expect the next few weeks to be more of the same.

Tyler Durden

Sun, 07/31/2022 – 22:30

via ZeroHedge News https://www.zerohedge.com/markets/i-dont-care-i-love-it Tyler Durden