Oil Tumbles On China PMI Weakness, Libya Output Hike; To Remain Muted On Low Liquidity

Oil started the new month on the back foot, driftng lower slowly at first and then accelerating the move to the downside, with Brent trading just south of $100, as disappointing Chinese PMI prints added to concerns that a global slowdown may sap demand while an increase in Libyan output eased supply concerns ahead of this week’s OPEC+ meeting.

WTI slid below $97/bbl after sinking almost 7% in July in the first back-to-back monthly loss since late 2020. Weekend data indicated a surprise contraction in Chinese factory activity, highlighting the cost of mobility curbs to tackle Covid outbreaks. Purchasing managers’ indexes also weakened in South Korea and the euro area’s four largest members.

Libya’s crude output has rebounded to its early April levels, the OPEC member’s oil minister said, in an increase that could help cool a jittery global oil market. Output climbed to 1.2 million barrels per day, Oil Minister Mohamed Oun said in a Bloomberg telephone interview. The increase comes after officials reached an agreement earlier this month with protesters and tribal leaders to reopen fields and export terminals largely shut for months.

Unfortunately for bulls, as Bloomberg’s Nour Al Ali correctly notes, open interest in Brent crude indicates that low liquidity is driving the market at the moment. This means that prices may remain range-bound as traders assess recessionary risks against tight market dynamics.

As Ali adds, even before OPEC+ meets later this week, the verdict might already be out: “Low open interest in Brent shows that traders are as invested as they can be in the oil market for the time being. When both prices and open interest fall, that could mean that long positions are being liquidated. This chart that Alex Longley showed me earlier today shows aggregate open interest adjusted for prices near historic highs.”

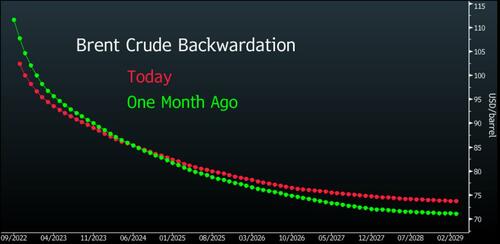

Of course, as we have been pounding the table for months, on the ground, market fundamentals still look extremely tight. The market is in backwardation, where near-term prices trade at a premium to long-term ones. In fact, it’s gotten tighter for Brent over the last month as the chart below shows!

The concern, however, is demand destruction. Some corners of the market remain bullish over oil after the rally of the last two years, but slower global growth as well as a stronger dollar mean big consumers such as China and India might start to cut back demand. In a dynamic like this, it’s hard to see how OPEC+ can heed to US demand for more oil. More barrels on the block could mean less revenue for producers.

But not today: as the next chart from Bloomberg shows, in a stark reversal from years of underperformance, US drillers are drowning in cash and are expected to post record 2Q profits in coming days, reversing nearly a decade of debt-fueled losses. The top 28 publicly traded US independent oil producers generated $25.5 billion in free cash flow in the three months to June 30, according to estimates compiled by Bloomberg. In that space of time they’ll have made enough cash to erase one-fourth of what they lost over the previous decade!

Meanwhile, speaking of this week’s OPEC+ meeting, Bloomberg notes that Biden took a political gamble with his visit to Saudi Arabia last month, courting a kingdom he once vowed to punish in a quest for more oil supplies, and this week will reveal whether it paid

off. The US president said he expected “further steps” from the Saudis to cool oil prices and safeguard the global economy at the close of his trip to Jeddah two weeks ago. OPEC+ will decide on Wednesday whether to oblige, though delegates warn that any supply boost would be modest — and may not materialize at all. The reason why? As Bloomberg’s Javier Blas notes, for only the 3rd time only in history, Saudi Arabia oil production is rising above 11m b/d from today (OPEC+ quota for Riyadh for August is exactly 11.004m b/d).

CHART OF THE DAY: For the 3rd time only in history, Saudi Arabia oil production is rising above 11m b/d from today (OPEC+ quota for Riyadh for August is exactly 11.004m b/d)

For more on Saudi oil output, take a look at his @opinion column from late June: https://t.co/NKj7H389NE pic.twitter.com/F5T6Kg81id

— Javier Blas (@JavierBlas) August 1, 2022

In other words, even if it wanted to, the best Saudi can do is ramp up output by a few barrels here and there…

Tyler Durden

Mon, 08/01/2022 – 09:22

via ZeroHedge News https://ift.tt/AHDdr4W Tyler Durden