Semiconductor Inventories In South Korea Surge Most In 6 Years As Reverse Bullwhip Effect Takes Hold

The reverse bullwhip effect that we have been talking about non-stop for months looks as though it could be making its way into – out of all sectors – the semiconductor industry.

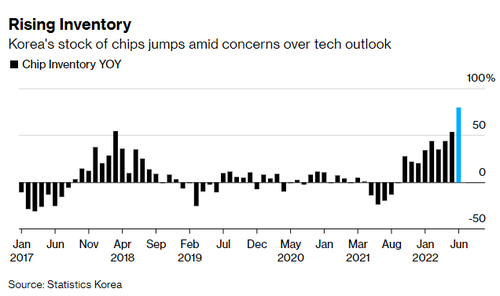

Stockpiles in South Korea have expanded at “the fastest pace in more than six years”, Bloomberg wrote this weekend, noting that the inventory rise could be a harbinger of bad things to come for the country’s export-driven economy.

In other words, the nation’s most profitable industry could be slowing down. Even more alarming, as the report notes, is that the slowdown could be coming at a time when Central Banks are in the midst of tightening.

Chip sales also help support South Korea’s currency, the won.

Nationwide inventory of chips in South Korea was up 79.8% in June from the year prior, the report says. This marks an acceleration from May’s number, which saw chips rise 53.8% in the month of May.

The rise is the largest since the country suffered a 2 year export slump and saw inventories climb 104.1% in April 2016. Other chipmakers like Samsung and SY Hynix have already warned that future sales could slow.

Investors are expecting chip companies to slow down on capex spending to offset a slump in sales.

Meanwhile, in South Korea, the economic slowdown could be broad across the country. Production was up 1.4% in the country in June, missing economist estimates of 2.1%.

In the last two months we have talked about the reverse bullwhip effect many times:

-

Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff

-

Deflationary Tsunami On Deck: A “Tidal Wave” Of Discounts And Crashing Prices

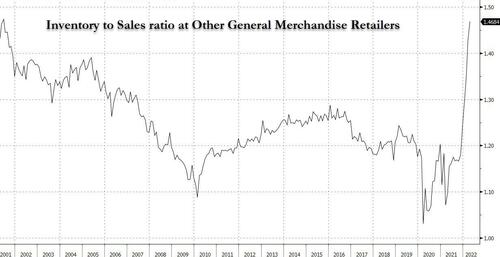

In these pieces we talked about the coming “bullwhip” effect and when formerly a scarcity of inventory becomes a glut, with inventory to sales ratios exploding higher (and in some cases reaching two-decade highs)…

… assuring inventory liquidations across the retail sector, resulting in a “deflationary tsunami” and “prices falling off a cliff“, forcing the Fed to eventually pivot on its hiking plans and even restart easing.

Tyler Durden

Mon, 08/01/2022 – 18:00

via ZeroHedge News https://ift.tt/YpGwtvu Tyler Durden