“Unsettling” July Rally Is Facing European Reality Check

By Michael Msika and Jan-Patrick Barnert, Bloomberg Markets Live commentators and reporters

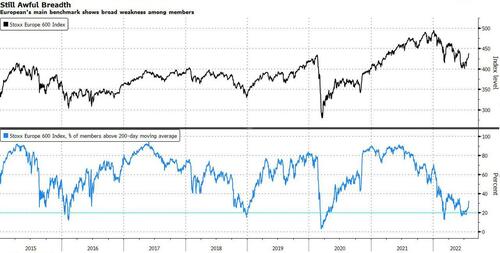

There’s little time to savor the brisk rally we’ve just seen in European stocks, as the market enters what is usually the worst time of the year. To add to the ominous history, there are significant technical hurdles lying ahead.

The Stoxx 600 soared 7.6% in July, the best month since November 2020. But as August and September usually deliver poor returns for stock bulls, with the worst returns over the past 25 years, some caution is warranted.

“Markets are rallying on the hope the Fed can prevent a hard landing, brushing off the risk that the slowdown accelerates and causes further headwinds to corporate fundamentals,” say Barclays strategists led by Emmanuel Cau. “This rally feels unsettling to us, we would fade it.”

The view is echoed by Goldman Sachs strategists led by Sharon Bell. The market is “too complacent” following the bounce, given downside risks related to Russian gas supply and Italian politics, while earnings estimates need to fall further, they say.

The move higher in equities has been supported by a reassuring earnings season to date, with 57% of Stoxx 600 companies beating estimates, EPS growth running at 3% year-on-year and surprising positively by 2%, according to JPMorgan strategists. Still, five out of the 11 sectors are serving up negative EPS growth: financials, real estate, discretionary, tech and communication services.

Charts signal that there are obstacles ahead, with a trend line in place that’s acting as a ceiling on gains in stocks. “We are in a rangy market, but the range is wide,” says DayByDay technical analyst Valerie Gastaldy. “This means that in the coming weeks, it may look like a bullish market, but it should not lead to new highs.”

Investors have started to price a peak in the hawkishness of the Federal Reserve’s commentary, while an economic slowdown seems to also be increasingly factored in, judging by the muted reaction to the US entering a technical recession last week.

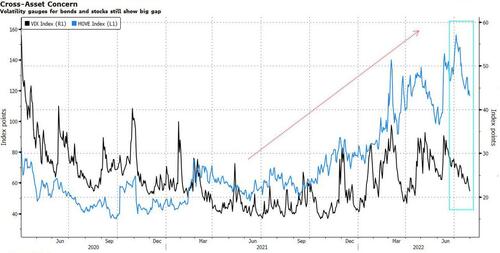

Volatility measures for both bonds and stocks are falling, but an unusually wide gap persists between the two. Stress in rates remains elevated and while the asset classes have regained a positive correlation, investors should be aware of the risk of a fresh episode of cross-asset turmoil, one way or the other.

To be sure, the market is allowing for plenty of negativity already, even with the latest rally. That’s why some argue that should the clouds troubling investors suddenly clear, upward pressure could arrive with momentum behind it.

“No one is positioned for any good news,” says Thomas Hayes, chairman at Great Hill Capital. He points to cash levels that are at the highest since 9/11, and recession fears at the most pronounced since April 2020 and March 2009.

“The stock market is a discounting mechanism, so while we may be in or will have a recession, the market will bottom far before it is declared,” Hayes says. “Managers will have to chase up and panic buy any further unexpected strength.”

Tyler Durden

Mon, 08/01/2022 – 12:05

via ZeroHedge News https://ift.tt/qNj8dwE Tyler Durden