Will The Inflation Reduction Act Of 2022 Do Anything At All?

Authored by Mike Shedlock via MIshTalk.com,

Assuming the Inflation Reduction Act passes reconciliation hurdles, what would it do?

Please consider Penn Wharton Preliminary Estimates of the Inflation Reduction Act.

-

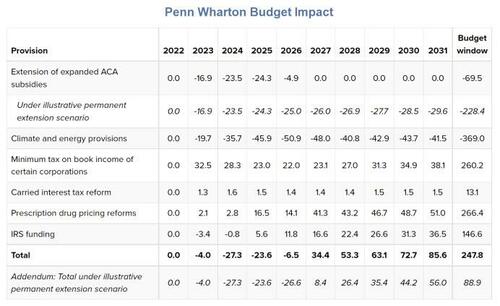

PWBM estimates that the Inflation Reduction Act would reduce non-interest cumulative deficits by $248 billion over the budget window with no impact on GDP in 2031.

-

The Act would very slightly increase inflation until 2024 and decrease inflation thereafter. These point estimates are statistically indistinguishable from zero, thereby indicating low confidence that the legislation will have any impact on inflation.

-

We project no impact on GDP by 2031 and an increase in GDP of 0.2 percent by 2050. These estimates include the impact of debt and carbon reduction as well as capital and labor supply distortions from rising tax rates.

-

As written, the Inflation Reduction Act contains a sunset for the Affordable Care Act (ACA) subsidies provision at the end of 2025. Under an illustrative scenario where that provision was extended indefinitely, the 10-year deficit reduction estimate falls to $89 billion. The impact on GDP remains zero through 2040.

Penn Wharton Budget Impact Inflation Reduction Act

What About Deficit Reduction?

“This effect is offset by the effects of higher personal and business taxes, which discourage saving and investment. The net result is that private capital increases by 0.3 percent in 2040 and 0.7 percent in 2050.”

Color me skeptical, especially 30-year projections

— Mike “Mish” Shedlock (@MishGEA) August 1, 2022

A decrease in spending on prescription drugs combined with increases in revenues from personal income taxes and business taxes lead to a decrease in government debt, which declines by 8.4 percent by 2050. This decrease in government debt crowds-in investment in productive private capital.

Nonetheless, this effect is offset by the effects of higher personal and business taxes, which discourage saving and investment. The net result is that private capital increases by 0.3 percent in 2040 and 0.7 percent in 2050. This increase in private capital makes each worker more productive, which is reflected in higher wages. Wages increase by 0.1 and 0.3 percent in 2040 and 2050 respectively.

Each of the spending provisions in the Inflation Reduction Act has different economic effects. For example, the additional ACA subsidy benefits are transfers or payments to households, which reduces the incentive to work. This effect contributes to the 0.1 percent decline in hours worked in 2031, 2040, and 2050. PWBM also accounts for the positive economic effects of programs like infrastructure investment and carbon abatement associated with certain clean energy provisions, as described in a previous brief. These provisions lead to a slight increase in productivity.

Overall, all the provisions taken together lead to an increase in GDP of 0.1 percent in 2040 and 0.2 percent in 2050.

Manchin Defends Plan

The Wall Street Journal reports Joe Manchin Defends Tax Increases in Democrats’ Climate Plan

“We should not increase taxes, and we did not increase taxes,” he said on NBC’s “Meet the Press,” characterizing a new 15% minimum tax on large, profitable corporations as “closing a loophole.” In a series of appearances on Sunday news shows, he also said he hoped Sen. Kyrsten Sinema (D., Ariz.) would support the bill despite a provision that would raise taxes on private-equity managers’ carried interest income that she has signaled she opposes.

A separate study by the Penn Wharton Budget Model estimated that the Democrats’ plan would cut the deficit but have little to no impact on inflation. Mr. Manchin said on CNN that he disagreed with that inflation finding.

Who Pays Taxes?

Corporations don’t pay taxes, consumers do.

If this bill actually would shrink the deficit, then it will not be the wealthy footing the bill. It will taxpayers, and not high end taxpayers either, but spread out.

What About Electric Vehicle Credits?

Please consider Greens vs. Electric Vehicle Tax Credits

The Schumer-Manchin tax bill’s rich electric-vehicle subsidies are a boon for auto makers, but they come with a hitch: It’s unlikely any electric vehicle on the market today would qualify for the $7,500 tax credit because of conditions in the bill on material manufacturing. This will be one policy where Democratic promises of permitting reform meet the road.

Most of the world’s critical minerals are also mined in countries such as Russia, China, Indonesia and the Democratic Republic of Congo with which the U.S. doesn’t have free-trade agreements. Mr. Manchin insisted on these content requirements to ensure the U.S. doesn’t become dependent on China for critical minerals and batteries as Europe has on Russia for natural gas.

But green activists say these requirements for the EV credit are too aggressive. “All it does is negate the tax credit,” a Center for Biological Diversity government liaison told E&E News, adding that the U.S. supply chain “just doesn’t exist right now.” It also won’t ever develop if regulators keep vetoing projects and greens use litigation to stop them.

The Biden Administration has blocked or delayed more than a half dozen mining projects. In January the Administration revoked federal leases for the Twin Metals mine in Minnesota that contains copper, nickel and cobalt. The U.S. Forest Service in June recommended a region-wide ban on mineral mining in the Superior National Forest.

Does Any Part of the Bill Make Sense?

I am not sure what Sinema objects to regarding carried interest, but I have no problem with that provision for private-equity managers’.

If it were up to me, I would levy taxes on executive stock options.

Manchin wants relaxation on permits. Curiously the Progressives want that too. Current EPA rules require environmental impact studies for wind and solar farms as well.

I suspect Manchin is getting railroaded. The Administration will find a way to restrict oil and gas projects but fast approve what Progressives want.

The tax credits seem to benefit no one. Since I am against tax credits and subsidies, that’s actually fine by me.

Instead of allowing Medicare to negotiate prices, why not allow drug imports from Mexico and Canada?

Does the Bill Do Anything?

In general, the best we can hope for is “nothing at all”.

This bill seems close.

However, the Senate will likely make many modifications. Then the House may do the same.

There’s also a very real possibility there’s some language tucked in this deal that only a couple of lobbyists understand.

Finally, as I have stated before, Congressional legislation has a way of acting opposite to the title and stated intent.

The name “Inflation Reduction Act” is ominous.

As Amazing as it Seems, One Key Person Will Actually Read the Manchin Bill Before It Passes

Yesterday, I commented “I always advocate passing bills then checking to see what’s in them. It’s the sure-fire way to let lobbyists run the country. And who wouldn’t want that?”

A couple of people chimed in.

“Sorry, I slipped in your dripping sarcasm!”

Sarcasm warranted and appreciated; Mish is correctly identifying an egregious feature of how legislation is done all too often.

Example: ACA, aka, Obamacare

Pelosi: “we have to pass the bill to find out what’s in it.”— Specguy (@speculato) July 28, 2022

And As Amazing as it Seems, One Key Person Will Actually Read the Manchin Bill Before It Passes

Senator Kyrsten Sinema is going to read the bill. She has not yet signaled approval.

The bill may indeed not do much of anything. But the best hope is that the Senate Parliamentarian kills the bill.

Sinema may do it as well. See the above link for more discussion.

* * *

Tyler Durden

Mon, 08/01/2022 – 08:10

via ZeroHedge News https://ift.tt/YbycWKN Tyler Durden