Is A Great Reset Of Monetary Policy Coming After Massive Money Supply Expansion?

Authored by Andrew Moran via The Epoch Times (emphasis ours),

In response to the coronavirus pandemic, the Federal Reserve took extraordinary and unprecedented action to cushion the economic blows resulting from the global health crisis.

Over the last two years, the central bank expanded the money supply by more than $6 trillion. The pandemic-era round of quantitative easing led to the creation of nearly 50 percent of all new U.S. dollars ever created in the nation’s history.

When Congress approved trillions of dollars in new government spending, whether it was the $2.1 trillion CARES Act or the $1.9 trillion American Rescue Plan (ARP), the Treasury Department issued fresh debt to cover the enormous shortfall. This prompted the central bank to issue new units of currency to purchase the debt.

The Fed did not stop with just buying Treasury debt. The institution also acquired mortgage-backed securities and corporate bonds. This increased its balance sheet to a record $8.9 trillion.

In a March 2020 interview with “60 Minutes,” Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, noted that the Fed has “unlimited cash,” assuring the public that the financial system possesses enough money.

Uncle Sam’s Wallet

Critics charge that the Fed has enabled officials to embark upon enormous deficit-financed spending efforts by monetizing the debt. This could exacerbate America’s finances, resulting in fiscal consequences for the federal government and the American people.

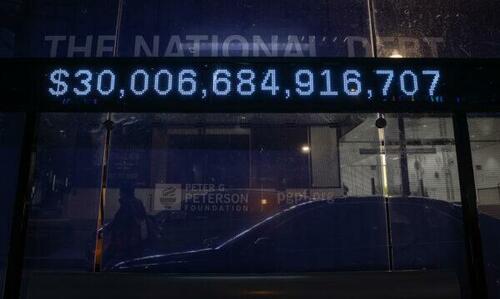

The national debt has topped $30 trillion, the federal deficit is projected to remain above $1 trillion for the next decade, and the government is contending with $200 trillion in unfunded liabilities and expenditures. But financial experts warn that debt-servicing payments could skyrocket in the coming years, especially if the Fed keeps raising interest rates to combat inflation. Last year, for example, the U.S. government spent more than $500 billion on interest for debt held by the public. With the benchmark fed funds rate projected to reach 3.4 percent by the end of 2022, officials will be paying more to service the national debt. By 2031, Washington’s net interest costs are predicted to increase to nearly $1 trillion per year (based on a 2.8 percent interest rate on the 10-year Treasury by the current administration).

In addition, debt can become a massive burden on the country when it swallows the nation’s production. Economists warn that a country’s red ink reaches a tipping point when the debt-to-GDP ratio surpasses 77 percent. Today, the debt-to-GDP ratio is about 125 percent.

If there is a hint of concern surrounding the national debt, Treasury investors will demand higher compensation for the heightened risk. Moreover, this can threaten the greenback because the dollar’s value diminishes if there is lower demand for U.S. bonds.

Market analysts purport that the Fed is performing a juggling act: fighting inflation while maintaining economic growth. But there might be another feat the central bank needs to accomplish: combatting higher prices without severely hemorrhaging the federal government’s finances.

Suffice it to say, the more the national debt grows—it is forecast to hit approximately $40 trillion over the next decade—the greater the challenge for the Fed to raise rates exceeding inflation levels.

Is the Debt Sustainable?

Experts have been ringing alarm bells about unsustainable debt levels.

“National debt may be sustainable in the short run, but at some point, rates will rise and deficits and debt will have to be tackled through spending cuts or tax increases,” wrote Meera Pandit, the global market strategist at JPMorgan Chase, in a January 2021 note.

Before the COVID-19 public health crisis, Fed Chair Jerome Powell told Congress that the national debt was on an “unsustainable” path.

“The U.S. federal government is on an unsustainable fiscal path,” Powell told the Senate Banking Committee in November 2019. “Debt as a percentage of GDP is growing, and now growing sharply … And that is unsustainable by definition. We need to stabilize debt to GDP. The timing the doing that, the ways of doing it—through revenue, through spending—all of those things are not for the Fed to decide.”

During a webinar sponsored by the Economic Club of Washington, D.C., in April 2021, Powell explained that the economy could handle the elevated debt load. However, he warned that the long-term trajectory of the U.S. budget is unsustainable.

Powell also told Sen. John Kennedy (R-La.) earlier this year that debt cannot grow faster than the national economy indefinitely.

But the central bank chair noted the U.S. government should only grapple with massive debt levels once the economy has stabilized.

According to the Congressional Budget Office (CBO), the federal debt is projected to top 150 percent of the gross domestic product (GDP) within 30 years. The budget watchdog warned that if policymakers refuse to act, the soaring debt will weigh on long-term economic growth, prevent crucial investments, accelerate a fiscal crisis, and stop officials from responding to unforeseen events.

“The benefits of reducing the deficit sooner include a smaller accumulated debt, smaller policy changes required to achieve long-term outcomes, and less uncertainty about the policies lawmakers would adopt,” the CBO wrote in its 2022 Long-Term Budget Outlook.

What About the Broader Economy?

Since the Fed’s tightening cycle began this past spring, money supply growth has been flat. But has the damage already been done to the U.S. economy?

The 8.5 percent annual inflation rate is the highest it has been in 40 years. The Producer Price Index (PPI) is still hovering near levels unseen since the 2008–09 financial crisis. The growing cost of living has consumers transforming their buying habits, from consuming less to altering their demand patterns.

Many economists note that the labor market has been fractured: real wage growth is still in negative territory, productivity is tumbling, the number of people quitting remains elevated, job openings continue to be above 10 million, and 7.5 million Americans work two jobs.

Asset bubbles have been the next notable consequence of the Fed’s historic monetary expansion. From stocks to cryptocurrencies, these assets reached record highs before crashing into a bear market. It is uncertain if the latest gains are part of a bear market rally or if the bottom has been touched and a bullish cycle has started. But the equities arena is hanging onto every word from the Federal Reserve, be it Chairman Powell or St. Louis Fed Bank President James Bullard.

The consensus on Wall Street is that the U.S. economy will slip into either a sharp or mild economic downturn, if it has not already. The country slipped into a technical recession after two consecutive quarters of negative GDP growth. If economic conditions worsen, there is an expectation that the Fed will reverse its hawkish tightening campaign and begin to cut interest rates.

Fed officials have stated that this is not happening. Instead, they aver: the institution will likely lift rates and leave them there, until there is concrete evidence that inflation is substantially coming down.

What’s Next for the Fed?

Will the present monetary system remain intact, or will it experience an overhaul?

Many developments are unfolding that could result in long-term consequences for households, policymakers, and geopolitical pursuits.

Countries are partaking in a de-dollarization initiative. The Fed is assessing a central bank digital currency. Higher inflation and rising borrowing costs are weighing on consumers. Trust in the Federal Reserve has eroded considerably over the last couple of years.

Whether or not the central bankers hit the reset button on the monetary system remains to be seen. But the pandemic might have ushered in a new era for the economy and fiscal and monetary policy, one that Powell’s successor might facilitate and install into the fabric of the Federal Reserve’s infrastructure.

Tyler Durden

Tue, 08/23/2022 – 07:20

via ZeroHedge News https://ift.tt/5QmncO6 Tyler Durden