Ugly, Tailing 2Y Auction Spooks Bonds Ahead Of Jackson Hawkano

While the recently concluded TSY refunding auction week passed with flying colors, the same could not be said for today’s sale of $44BN in 2Y paper (to be followed by 5Y and 7Y auctions later this week) on a day when 10Y yields have been pushed and pulled by the 3.0% level on the 10Y.

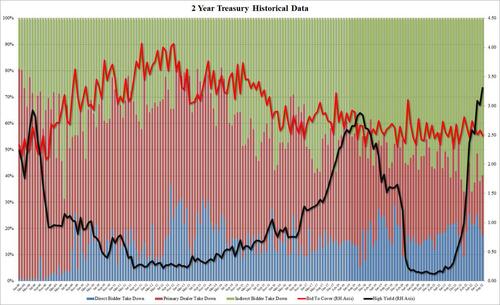

The auction was ugly, stopping at a high yield of 3.307%, the highest since at least 2007, and well above last month’s 3.015%; it also tailed the 3.293% When Issued by 1.4bps, the biggest tail since Feb 2020 (when it hit 1.6bps) just as the bond market locked up ahead of the covid crash.

The bid to cover of 2.488 dropped from last month’s 2.583 and was the lowest since March.

The internals were algo ugly, with Indirecst sliding from 62.0% to 59.7%, the lowest since June and below the six auction average of 60.4%. And with Directs buyers awarded 17.3%, or the lowest since January, meant that Dealers were left holding 22.9%, the second highest since Jan 2022.

Overall, an ugly, tailing 2Y auction and understandably so: why lock in money for 2 years at 3.30% when one can just buy 6 month bills for just a little bit less, or 3.15% at last check. Furthermore, if the Fed is indeed hoping to crush inflation even if it means a depression, we may well see 2Y yields soar to 5% or more in the coming months…

Tyler Durden

Tue, 08/23/2022 – 13:16

via ZeroHedge News https://ift.tt/d8hYcTk Tyler Durden