Morgan Stanley Spots A New “Recession Canary” In The Credit Coal Mine

By Srikanth Sankaran, Head of European ABS Strategy at Morgan Stanley

As this summer of optimism draws to a close, the Fed path and recession fears are returning to the fore. On the corporate front, the message from 2Q earnings was not overwhelmingly negative, but evidence of weakening demand, shifts in consumer spending and inventory pressures for retailers were abundant. The full impact of rate hikes on growth and earnings will become more apparent in the coming quarters, we think.

In framing recession risks through the lens of corporate credit, the High Yield index has often served as a key fear gauge. As a rule of thumb, US HY spreads of 800-850bp are associated with elevated recession fears or a growth scare. Current cash spreads of 450bp are well inside levels that can be seen as stressed, suggesting that recession risks are still not adequately priced in. However, taking into account the favorable mix shift in the HY index, we believe that the fair spread level in a mild recession is ~700bp this time around.

What’s changed?

-

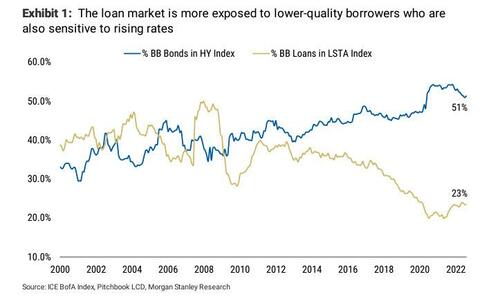

First, the HY market today is more exposed than ever to higher-quality issuers. BB rated bonds account for more than half of the benchmark HY index – 7 points higher than in the years immediately preceding Covid and more than 10 points above the post-GFC window from 2010-12.

-

Second, the concentration of secured bonds stands at a record high – 27% of the US HY market by par. They are safer than typical unsecured bonds, with better recovery rates (55% versus 40%) in the extreme event of a default.

-

Third, we see no clear “problem sector” – an axis of weakness along which credit could crack. While HY no doubt has its share of problem credits, the stresses this time around are more dispersed, and muted refinancing pressures should temper the escalation from idiosyncratic defaults to sectoral/systematic pressures.

-

Finally, cash prices of HY bonds were hit hard by the rates moves earlier this year, before growth concerns took center stage. For context, the current HY index cash price of 90 is nearly 10 points lower than the pre-Covid window (January-February 2020), even though spreads are comparable. Low prices reduce investors’ gross exposure in the event of a default, hence are associated with lower loss severity through a default cycle. This feature alone could account for half of the 100bp spread reduction in the recession threshold.

The canary in today’s credit coal mine could well be leveraged loans, a less “macro” but equally important part of the credit market. At US$1.4 trillion in outstanding volume, the loan market has nearly doubled in size since 2015, with a significant deterioration in quality. Due to the floating-rate nature of these instruments, underlying borrowers are particularly vulnerable to the double whammy of weaker earnings and rising interest rates.

A downgrade wave is imminent, extending through the next few quarters. Historically, the loan index has breached 750bp in spread and an 85 cash price only in the depths of the GFC and Covid. This time around, we expect these levels to be tested even in a mild recession, signaling significant downside from current levels (480bp in spread; 95 cash price). Our conclusion: HY credit spreads may be less sensitive to a growth slowdown than in the past, but the loan market is fundamentally more vulnerable. Both canaries are singing for now. But given current valuations, we maintain a cautious stance across corporate credit – staying up in quality and up in seniority.

These credit-centric considerations have broader implications.

-

First, limited excesses and measured near-term refinancing pressures indicate that corporate defaults may not exacerbate economic stresses during the growth slowdown phase. This argues for a potential recession to be of the milder variety…for now.

-

Second, investors looking to take advantage of under-priced recession fears in credit should account for the index quality improvement when sizing credit hedges and strikes. For context, a 700bp target on cash HY spreads would push the index price to Covid lows of 80. Loans, for their part, are not the most amenable to bearish expressions or hedging. While hedging through total return swaps is feasible, liquidity in these instruments is limited.

-

Third, a majority of loan borrowers are unlisted companies, so the transmission of stresses into public equity markets is likely to be indirect.

In sum, the credit market has a new canary, but monetizing it directly could pose a challenge.

Tyler Durden

Sun, 08/28/2022 – 11:30

via ZeroHedge News https://ift.tt/7bFxjD1 Tyler Durden