Bad ‘Good News’ Batters Big-Tech, Bitcoin, Black-Gold, & Bonds

Hotter than expected German inflation and sliding European economic confidence combined with a double whammy of hot JOLTS data and better than expected consumer sentiment was just enough good news to be more bad news for bulls who continue to hope for a Jay Powell “just kidding” moment. Stocks also suffered from geopolitical risk premium pain too as Taiwan fired live ammo at a Chinese drone for the first time.

Instead, rate-hike expectations extended recent hawkish gains today, pushing up to their highest since the cycle began…

…suggesting US equities have plenty of downside before this ‘pain’ is over…

Source: Bloomberg

Overnight gains, triggered at the European market open, were erased ahead of the open as Taiwan-China news hit and then things escalated quickly on the back of the ‘good news’ from JOLTS and Conference Board which is just more bad news for the bulls as this offered no ‘outs’ for The Fed… Small Caps were the ugliest horse in the glue factory, closely followed by Nasdaq…

Bear in mind that liquidity is abysmal with the lowest volume days of the year…

US equities have given back more than half of their gains off the mid-June lows…

The Nasdaq is down 10% from the mid-August highs now…

And Nasdaq is down over 6% from the start of Powell’s speech…

All the US majors broke below critical technical support levels today (S&P, Dow, and Nasdaq all below their 50DMA, and Russell 2000 below its 100DMA)…

The credit markets are beginning to flash red again as ‘triple-hooks’ CCC debt spreads breach 1000bps once again

Source: Bloomberg

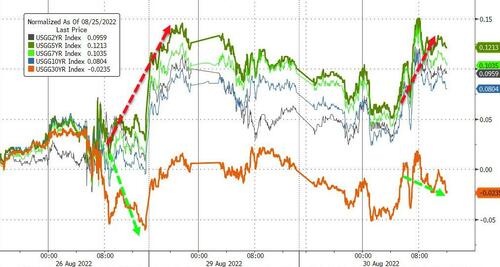

Treasuries were mixed today with most of the curve higher in yields but the long-end managing modest gains (2Y +4bps, 30Y -2bps). Since Powell’s speech, the long-bond yield is down over 2bps, while the belly is underporfoming (5Y +12bps)

Source: Bloomberg

US 2Y Yields jumped to their highest since Nov 2007…

Source: Bloomberg

The yield curve (2s30s) flattened notably, pushing back to its most inverted since early August…

Source: Bloomberg

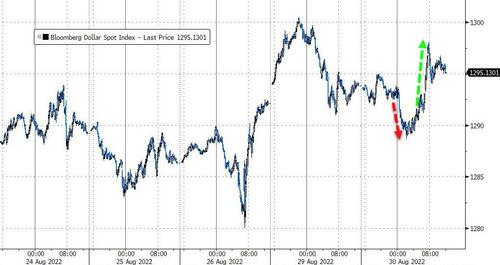

The Dollar managed to hold on to modest gains today after some weakness during Europe’s early hours…

Source: Bloomberg

Cryptos tanked with Bitcoin breaking bad, back below $20,000…

Source: Bloomberg

Overall, the Bloomberg Commodity Index had one of its worst days of the year…

Source: Bloomberg

Gold tumbled, erasing yesterday’s gains…

Crude prices crashed as Iraq confirmed no output impacts from its internal conflicts but chatter is that the futures market was very thing today, exaggerating the move dramatically…

Finally, the so-called “Rule of 20” – which combines CPI with the S&P’s P/E ratio – suggests the market has a lot further to fall (or CPI does) before any sense of normality resumes…

Source: Bloomberg

Pain is Coming!

Tyler Durden

Tue, 08/30/2022 – 16:00

via ZeroHedge News https://ift.tt/HhDmQJL Tyler Durden