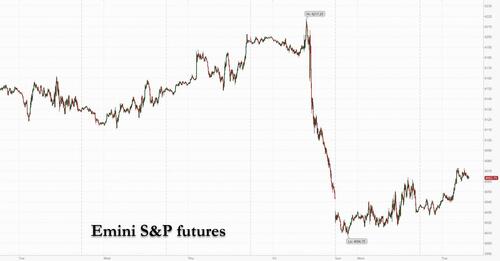

Futures Bounce, Kashkari Unhappy As Post-Jackson Hole Rout Fizzles

After revealing that he was so “happy” he danced a jig when stocks tumbled after Powell’s J-Hole speech sparked a market rout on Friday, we can only imagine that Neel Kashkari’s face looked like this when he saw the market update this morning…

When he turned on his bbg this morning pic.twitter.com/h6QqIcfgSV

— zerohedge (@zerohedge) August 30, 2022

… because after two days of selling, risk assets are sharply higher this morning, with S&P futures rising 0.8% and Nasdaq 100 futs rising 1.1%, as investor sentiment stabilized, while 10Y Treasury yields slid 5bps, the BBG dollar index lost 0.3%, and oil tumbled, 4% reversing most of Monday’s gains.

In premarket trading, cryptocurrency-tied stocks climbed as Bitcoin rose: Marathon Digital and Coinbase lead cryptocurrency-exposed stocks higher in premarket trading as Bitcoin trades in a narrow band around $20,000 for the fifth consecutive session: Marathon Digital +5.7%, Coinbase +3.7%, Riot Blockchain +4.9%; Twitter slipped after Elon Musk cited recent accusations from a whistle-blower as a new reason to terminate the $44 billion takeover. Here are some other notable premarket movers:

- Bed Bath & Beyond (BBBY US) shares jump as much as 16% in premarket trading, putting the home products retailer on track for a third session of straight gains after Monday’s 25% surge.

- Baidu (BIDU US) shares rise as much as 4.5% in premarket trading, leading China stocks higher, after the internet search company’s profit beat analyst estimates.

- Gran TierraEnergy (GTE US) shares jump as much as 8.7% in premarket trading, after the oil & gas company said it would buy back as many as 36m shares.

- Nikola stocks slumped after filing for At-the-Market stock offering

With markets once again very volatile, Credit Suisse recommended investors go underweight global equities (or at least short Credit Suisse bank itself) following the Jackson Hole symposium, while JPMorgan Chase strategists say that a reading on the US labor market that spells bad news for the economy is actually a bullish signal for stocks.

“The markets are spooked because they are afraid that the Fed could create a hard landing — that they’ll raise rates into a recession and that will be really painful for the economy and for corporate profits,” Terri Spath, chief investment officer at Zuma Wealth LLC, said on Bloomberg Television

Minneapolis Fed President Neel Kashkari said sharp stock-market losses show investors have got the message that the US central bank is determined to contain inflation. “People now understand the seriousness of our commitment to getting inflation back down to 2%,” he said; it wasn’t clear what he said this morning when he saw futures sharply higher.

In Europe, the Stoxx 50 rallied 1.3%. DAX outperforms, adding 1.5%, FTSE 100 lags, adding 0.4%. Retailers, banks and tech are the strongest-performing sectors while energy companies underperformed as prices plunged on signs that the region is stepping up efforts to curb a crisis. Here are some of the biggest European movers today:

- Banks and lenders lead a broader rebound in European stocks as yields rise in the UK, with banks in the country resuming trade following Monday’s holiday.

- Adevinta shares rise as much as 16%, with analysts noting a beat on earnings from the classified advertising firm, along with a strong performance in its Mobile arm and reassuring guidance.

- Aker Solutions shares rise as much as 17% after the Norwegian offshore firm said it would form a joint venture with Schlumberger and Subsea 7. Pareto notes “significant” cost synergies.

- Bango shares jump as much as 15% after Liberum increased their price target to a Street high. The broker said the acquisition of NTT DOCOMO’s payments business helps accelerate Bango’s growth strategy.

- Munters shares rise as much as 8.7% after the Swedish industrial cooling and climate solutions manufacturer said it had received its “largest order ever” for a data center in the US.

- Technoprobe shares gain as much as 2.5% in Milan as Mediobanca increased its PT on the stock to EU9.10 from EU8.6 ahead of what the broker expects to be “another robust release” on Sep. 27.

- Diurnal Group shares soar as much as 136%, the most since January 2019, after Neurocrine Biosciences agreed to buy the specialty pharmaceutical company for 27.5p in cash per share.

- Carrefour shares fall as much as 2.7%, after JPMorgan cut its recommendation on the French grocer to neutral, noting “lackluster” operating momentum and a “lack of short-term catalysts.”

- Bunzl shares fall as much as 8.1%, the most intraday since March 2020, after the supplies distributor reported 1H results that disappointed, according to Interactive Investor.

- European mining stocks underperforms all other European industry groups as the regional equity benchmark advances, after iron ore and base metals fell amid concerns over demand in China.

- Warsaw stocks are worst performers globally so far in August, down 8.2%, on the way to largest monthly drop since April as a domino effect from Europe’s gas crisis hits Polish companies.

Asian equities rebounded from a post-Jackson Hole slide, with investors focusing on earnings on the region’s busiest day this season. The MSCI Asia Pacific Index added as much as 1% following Monday’s 2.2% slump, lifted by technology and financial shares. Indian and Japanese shares were among the region’s best performers, while benchmarks in China and Hong Kong declined. Chinese search-engine operator Baidu Inc. and Industrial and Commercial Bank of China Ltd., the world’s biggest bank by assets, were among the 110 MSCI Asia Pacific Index members to report results Tuesday. Investors had been bracing for a poor earnings season in a quarter marred by China’s lockdowns, but an analysis by Bloomberg Intelligence shows the results have surprised to the upside so far. While Asian stocks are set for a 1.1% monthly slump in the wake of Federal Reserve Chair Jerome Powell’s hawkish comments last week, there’s a possibility that the region’s valuations could attract investors, said Christina Woon, an Asian equities investment director at Abrdn in Singapore. Asia has “more of a relative buffer in valuations” given investors are already quite cautious toward the region, Woon said in a Bloomberg TV interview. Many of Asia’s quality companies are “producing earnings that are holding up well,” which may support stock performances, she added. China tech stocks in Hong Kong slid amid lingering uncertainties over discussions to avoid the delisting of companies from New York stock exchanges. Asian emerging market ex-China equities saw a small net outflow last week after five weeks of inflows.

Japanese equities also rebounded after heavy selling on Monday, as investors digested the Federal Reserve’s continued stance to keep up its hawkish monetary policies and the yen stayed near 140 per dollar. The Topix rose 1.2% to 1,968.38 as of the market close in Tokyo, while the Nikkei 225 advanced 1.1% to 28,195.58. Keyence Corp. contributed the most to the Topix’s gain, increasing 2.1%. Out of 2,169 stocks in the index, 1,839 rose and 257 fell, while 73 were unchanged. “There may be a slight effect from the weak yen,” said Mamoru Shimode, chief strategist at Resona Asset Management.

The S&P/ASX 200 index rose 0.5% to close at 6,998.30, boosted by gains in banks and energy shares. All but one of the 11 sector gauge rallied, while mining shares edged lower as iron ore fell below $100 a ton for the first time in five weeks on signs a crisis in China’s steel industry is worsening. Uranium shares including Paladin surged after Tesla Chief Executive Elon Musk said countries shouldn’t shut down existing nuclear power plants as Europe grapples with an energy crisis.

In FX, the Bloomberg dollar spot index falls 0.3%, its first drop in three days as the greenback weakened against all of its Group-of-10 peers apart from the Swiss franc. The euro rose above parity against the dollar. European bonds advanced as month-on-month numbers for German state CPIs showed signs of slowing. A euro-area economic confidence gauge fell to 97.6 in August, its lowest level in 1 1/2 years, and down from 99 the previous month. Analysts surveyed by Bloomberg had expected a decline to 98. The pound traded near a 2 1/2-year low versus the US dollar amid speculation the UK is headed for recession with further interest-rate hikes potentially deepening an economic downturn. Aussie eased after a sharp drop in building approvals, only to rebound in European trading.

Meanwhile, China’s central bank set a stronger-than-expected yuan fixing for a fifth day, a sign it doesn’t want an excessively weak currency. The move highlights how greenback strength is a challenge for Asia as the region’s currencies slip.

In rates, treasuries are near session highs as US trading gets under way Tuesday, holding most of gains that were paced by euro-zone bonds during European morning after release of German regional CPIs, with national gauge due out at 8am New York time. US yields are lower by 2bp-5bp, 10-year TSY sliding by 5.8bp at 3.05%. Gilts curve bear-flattened with 2-year yield 12bps higher as money markets raise BOE tightening bets. Gilts slumped after yesterday’s English holiday as money markets cranked up BOE tightening bets. The UK 2-year yield briefly rose above 3% for the first time since October 2008. Peripheral spreads are mixed to Germany; Italy and Portugal widen, Spain tightens. Australian sovereign bonds extend an opening gain as iron ore slumped back under $100 for the first time this month. IG credit issuance lull expected to last through US Labor Day holiday Sept. 6.

In commodities, WTI drifts 2.8% lower to trade near $94.32. Most base metals are in the red; LME copper falls 2.9%, underperforming peers. LME lead outperforms, adding 0.7%. Spot gold falls roughly $2 to trade near $1,735/oz. China was reported to provide Europe with an energy lifeline through the resale of surplus LNG, according to FT. UK PM candidate Truss is set to approve a series of oil and gas drilling licences in the North Sea in one of her first acts as PM, should she be elected, according to The Times. Canada said it is invoking the 1977 pipeline treaty with the US for the second time over Enbridge’s (ENB) Line 5 (540k BPD) dispute.

On the US calendar today, we get the August Conference Board consumer confidence, July JOLTS job openings, June FHFA house price index, Q2 house price purchase index; Bank of Montreal and Best Buy are among the companies expected to report results today.

Market Snapshot

- S&P 500 futures up 0.9% to 4,066.25

- STOXX Europe 600 up 0.8% to 426.16

- MXAP up 0.9% to 158.61

- MXAPJ up 0.6% to 518.99

- Nikkei up 1.1% to 28,195.58

- Topix up 1.2% to 1,968.38

- Hang Seng Index down 0.4% to 19,949.03

- Shanghai Composite down 0.4% to 3,227.22

- Sensex up 2.1% to 59,168.51

- Australia S&P/ASX 200 up 0.5% to 6,998.33

- Kospi up 1.0% to 2,450.93

- Gold spot down 0.0% to $1,736.80

- U.S. Dollar Index down 0.36% to 108.45

- German 10Y yield little changed at 1.46%

- Euro up 0.3% to $1.0029

Top Overnight News from Bloomberg

- Bonds are sliding toward the first bear market in a generation, burning investors who erred in bets that central banks would pivot away from rapid interest-rate hikes. The Bloomberg Global Aggregate Index, which tracks total returns from investment- grade government and corporate bonds, is within a percentage point of falling 20% from its peak after another bout of selling following the Federal Reserve’s Jackson Hole symposium

- The number of container ships headed for the California ports of Los Angeles and Long Beach — a traffic jam that once symbolized American consumer vigor during the pandemic — declined to the lowest level since the bottleneck started to build two years ago

- European energy prices plunged on signs that the region is stepping up efforts to curb a crisis that threatens to tip the region into recession with winter approaching

- The European Union is set to meet its gas storage filling goal two months ahead of target as the bloc braces for a tough winter with Russia limiting supplies and energy contracts trading at elevated levels throughout the continent

- China has rolled out “more forceful” economic policies this year than it did in 2020, Premier Li Keqiang said, as he warned the country faces an arduous task in ensuring its recovery

- China took the most aggressive step in its latest battle to bolster the yuan, setting its reference rate for the currency with the second strongest bias on record. The People’s Bank of China fixed the yuan at 6.8802 per dollar on Tuesday, 249 pips stronger than the average estimate in a Bloomberg survey. The bias was the second largest on the strong side since the survey of analysts and traders began in 2018

- The slide in the yen back toward the key psychological 140 per-dollar level is reigniting chatter on the likelihood officials will intervene to support the Japanese currency

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were somewhat mixed as most of the regional bourses recouped some of the prior day’s losses but with gains capped amid a slew of earnings releases and as participants look towards month-end, as well as the upcoming risk events. ASX 200 was led higher by the energy sector after recent gains in oil prices which printed a fresh monthly high and with strong earnings from Woodside Energy. Nikkei 225 outperformed and reclaimed the psychologically key 28k level. Hang Seng and Shanghai Comp were negative with participants digesting earnings releases and amid further COVID-related disruptions as China’s Dalian region limited movements for five days and Shenzhen ordered to close the Huaqiangbei subdistrict which is a global electronics sourcing centre. ICBC (1398 HK) – H2 2022 (CNY): net profit 171.51bln vs. Exp. 186.4bln, NII 351.4bln vs. Exp. 360.5bln. Baidu Inc (BIDU) Q2 2022 (CNY): EPS 15.79 (exp. 10.46), Revenue 29.6bln (exp. 29.31bln). Global funds invested into Evergrande’s (3333 HK) bonds have determined their own debt restructuring plan, via FT sources; demands the chair repay liabilities with own funds.

Top Asian News

- Chinese Finance Ministry said it will make good use of local government special bonds and strictly curb new local government hidden debt in H2, while it will strive to stabilise employment and prices.

- US President Biden’s administration plans to ask Congress to approve an estimated USD 1.1bln arms sale to Taiwan, according to Politico.

- PBoC has issued draft rules to regulate related transactions of financial holding firms.

- All industrial and business power usage has resumed in Sichuan as of August 30th, according to CCTV.

- Pakistan to Import Onions, Tomatoes To Meet Shortage After Flood

- Asia Push for Winter LNG Sends Price to New Five-Month High

European bourses are supported in tandem with pressure in European gas prices, Euro Stoxx 50 +1.7%, while the FTSE 100 lags somewhat after its Bank Holiday. Stateside, futures are firmer across the board, ES +0.9%, with the NQ +1.2% outperforming modestly as yields ease. Tesla (TSLA) CEO Musk has filed an SEC filing on Twitter (TWTR); on Aug 29th, sent a letter to Twitter notifying he is terminating merger agreement for additional bases separate from bases set forth in July 8th, according to a letter.

Top European News

- Spain is to propose the EU mimics its gas price system, via El Pais.

- Germany said to be open to discussing an EU gas price cap at the September 9th summit, via Reuters citing an official.

- Britons Ditch Staycations for Cheaper All-Inclusive Trips Abroad

- Spanish Inflation Slows But Any Retreat Is Likely to be Gradual

- UK July Mortgage Approvals Rise to 63.8k vs. Est. 62k

- Austria Is Probing Trades Behind Wien Energie Margin Call

- Revolution Beauty Shares to Be Suspended One Year After Listing

FX

- DXY dips under 108.50 after seeing a mild bid overnight to a high of 108.90.

- Antipodeans lead the gains whilst EUR feels a boost from receding European gas prices.

- Haven FX are mixed vs the USD with JPY firmer and the CHF in the red.

Fixed Income

- EGBs are bid as the benchmarks recoup from yesterday’s pressure, fresh fundamentals limited though European gas pricing easing has likely assisted.

- Gilts remain subdued by over a full point, though off worst, as it catches up to the weekend’s hawkish rhetoric.

- USTs are in-fitting with EZ peers and awaiting commentary from Fed’s Williams; yields slightly flatter.

Commodities

- WTI and Brent futures have pared back around half of the prior day’s gains; relatively pronounced pressure once more in European gas benchmarks.

- Spot gold is modestly softer intraday and remains under its 21, 50, and 10 DMAs.

- LME copper has fallen back under USD 8,000/t as the exchange plays catch-up following the UK bank holiday.

- China was reported to provide Europe with an energy lifeline through the resale of surplus LNG, according to FT.

- UK PM candidate Truss is set to approve a series of oil and gas drilling licences in the North Sea in one of her first acts as PM, should she be elected, according to The Times

- Canada said it is invoking the 1977 pipeline treaty with the US for the second time over Enbridge’s (ENB) Line 5 (540k BPD) dispute.

- Sadrist protesters in Iraq reportedly closed the oil production distribution company in Basra and there were explosions in Baghdad’s Green Zone from mortars targeting the former PM’s residential area, according to Iraqi Day.

US Event Calendar

- 09:00: June S&P Case Shiller Composite-20 YoY, est. 19.20%, prior 20.50%

- 09:00: June S&P/Case-Shiller US HPI YoY, prior 19.75%

- 09:00: 2Q House Price Purchase Index QoQ, prior 4.6%

- 09:00: June S&P/CS 20 City MoM SA, est. 0.90%, prior 1.32%

- 09:00: June FHFA House Price Index MoM, est. 0.8%, prior 1.4%

- 10:00: Aug. Conf. Board Consumer Confidence, est. 98.0, prior 95.7

- Present Situation, prior 141.3

- Expectations, prior 65.3

- 10:00: July JOLTs Job Openings, est. 10.4m, prior 10.7m

DB’s Henry Allen concludes the overnight wrap

For those also arriving back after the holiday weekend, markets have been playing a familiar tune for 2022, with risk assets losing ground as central banks underlined their determination to keep bearing down on inflation. Fed Chair Powell kicked off the latest selloff in his speech at Jackson Hole on Friday, where he said that getting back to price stability would “likely require maintaining a restrictive policy stance for some time.” He also went on to reiterate that hawkish message at multiple points, saying that “the employment costs of bringing down inflation are likely to increase with delay”, which favoured “acting with resolve now” to avoid a more costly outcome later.

With Powell explicitly warning against repeating the mistakes of the 1970s, investors moved to price in a more hawkish response from the Fed over the next year. In fact over Friday and yesterday, the rate that Fed funds futures are pricing in for the December 2022 meeting went up a further +7.1bps to 3.70%. And with a more hawkish Fed being priced in, that’s having an impact on Treasury yields, with the 2yr yield reaching its highest intraday level since 2007 in trading yesterday, at 3.48%, although it’s since fallen back to 3.41% this morning. US equities have also taken a significant hit, with the S&P 500 seeing its worst daily performance in over two months on Friday, with a -3.37% decline, followed by a more modest -0.67% fall yesterday. Strikingly, Minneapolis Fed President Kashkari said that he was “happy to see how Chair Powell’s Jackson Hole speech was received” in markets, saying it reflected an understanding of their commitment to return inflation to 2%.

That theme of investors adapting to more hawkish central banks has been seen on this side of the Atlantic as well, since a number of individuals at the ECB are now openly floating the idea of hiking by 75bps at a single meeting like the Fed. On Friday, Austria’s Holzmann said that a 75bps move “should be part of the debate”, and that a 50bps move was “the minimum for me”. Then in an interview on Sunday, Latvia’s Kazaks said that “at least 50 basis points would be appropriate” in September and said “at the current moment, I would say 50 or 75 basis points”. Those may be two of the most hawkish officials on the Governing Council, but the fact that a 75bps move is being openly discussed ahead of next week’s decision just shows how the direction of travel has shifted, and overnight index swaps are now pricing in a 75bps move as more likely than a 50bps one. Nevertheless, there was some pushback yesterday from Chief Economist Lane, who said that a “steady pace” was important when reaching the terminal rate.

In light of these developments, our European economists have updated their ECB call (link here), where they bring forward their timing for the terminal rate to mid-2023 from mid-2024, and now see the terminal deposit rate reaching 2.5% (up from 2% previously). In terms of the specific moves to get there, they now expect 50bp hikes at the remaining 3 meetings this year, bringing the deposit rate up to 1.5% in December, before the ECB slows to a 25bp pace at the 4 meetings in H1 2023 that takes the deposit rate up to 2.5%. They are maintaining their call for a 50bp hike at the September meeting for now, but note there are still some key data and risks around energy that could change the September profile.

With markets waking up to the prospect of more aggressive ECB hikes, sovereign bonds sold off significantly yesterday. Yields on 10yr bunds (+11.4bps), OATs (+10.6bps) and BTPs (+10.3bps) all moved sharply higher thanks to rises in real yields, whilst gilts were closed given the public holiday. European equities similarly lost ground as they caught up with the late US selloff from Friday, and the STOXX 600 (-0.81%) posted a decent decline, even as nearly a quarter of the index’s weighting didn’t trade given the London holiday. In the US, tech stocks bore the brunt of the decline given the higher yields, and the FANG+ index followed up its -4.26% loss on Friday with another -1.03% move lower yesterday.

Overnight in Asia, equity markets have put in a mixed performance, with the Nikkei (+1.02%) and the Kospi (+0.54%) clawing back some of their heavy losses yesterday, whereas the Hang Seng (-1.32%), the Shanghai Composite (-0.68%) and the CSI 300 (-0.61%) are all trading in negative territory. That underperformance in Chinese equities follows the moves from the People’s Bank of China to push back against yuan weakness, with a fix at 6.8802 per US Dollar this morning, which is noticeably stronger than Bloomberg’s survey estimate of 6.9051. Indeed, it was the strongest fix relative to estimates since August 2019. Elsewhere overnight, there are also signs that the recent market selloff could take a breather today, with futures contracts on the S&P 500 (+0.27%) and NASDAQ 100 (+0.3%) both pointing higher.

Looking forward now, this week should illuminate plenty on the near-term policy trajectory as a number of important data releases come out. For the Euro Area, the main one will be tomorrow’s flash CPI reading for August, where our economists see year-on-year CPI ticking down from the record +8.9% in July to +8.8% in August. However, we haven’t reached the peak yet in their opinion, as they see CPI rebounding again in September up to +9.3%, so the ECB would still have a long way to go to get back to their target. On the question of core inflation, they see that moving up to +4.3% in August year-on-year, which would be the highest since the formation of the single currency. So an important release for the ECB just over a week before their decision.

The other big release this week will be the US jobs report for August on Friday, which could go a long way to determining whether the Fed move by 50bps or 75bps. Our US economists expect that there’ll be another +300k increase in nonfarm payrolls, which would leave the unemployment rate unchanged at 3.5%. Markets are pricing in +69.1bps worth of hikes for September right now, so much closer to 75 than 50 still. But last month we saw how a strong jobs report jolted market expectations towards 75bps, so a surprise in either direction could well see that shift once again. In the meantime, keep an eye out for the July JOLTS data later today as well, which includes measures on job openings and hires. That’ll offer some further signals on whether labour demand is moving back in line with supply.

Otherwise this week, a major theme will be the ongoing turmoil in European energy markets, where yesterday saw prices come down from their record highs of last Friday. For instance, natural gas futures were down -19.63% to €273 per megawatt-hour, whist German power prices for next year fell -22.84% to €760 per megawatt-hour, having traded above €1000 for the first time earlier in the day. European Commission President Von der Leyen said yesterday that the EU was “working on an emergency intervention and a structural reform of the electricity market.” Let’s see what happens there, but one piece of better news from Germany came over the weekend after Economy Minister Habeck said in a Sunday statement that the target to see gas storage 85% full by October should be reached by early September. In the meantime oil prices have got the week off to a strong start, with Brent crude advancing +4.06% yesterday to their highest finish so far this month at $105.09/bbl. They’ve maintained the bulk of those gains overnight too, with Brent crude only down -0.69% at $104.36/bbl.

Tyler Durden

Tue, 08/30/2022 – 08:09

via ZeroHedge News https://ift.tt/pnmqC6h Tyler Durden