Wall Street’s Biggest Bear Expects Stocks To Do Something They’ve Never Done Before As They Tumble To New Lows

After several weeks of unease, as stocks rampaged higher despite his bearish prognostications, on Monday Morgan Stanley’s permabear strategist, Michael Wilson, returned to his prime, forecasting doom and gloom and predicting that the current market swoon was just the start of the next leg lower.

To be fair, it is hardly a surprise that one of Wall Street’s biggest bears would forecast that the June to August ramp was nothing but a bear market rally; the question is where (and how) does Wilson see the current slump ending.

To answer that question, Wilson spoke to “Bloomberg Markets” on Wednesday warning investors to brace for more pain as “US stock indexes haven’t yet hit bottom for the year.”

“The index usually is the last thing to fall,” Wilson, who correctly predicted this year’s equity selloff even as almost all of his peers expected the S&P to easily rise and hold above 5,000. “June probably was the low for the average stock, but the index, we think, still has to take out of those June lows.”

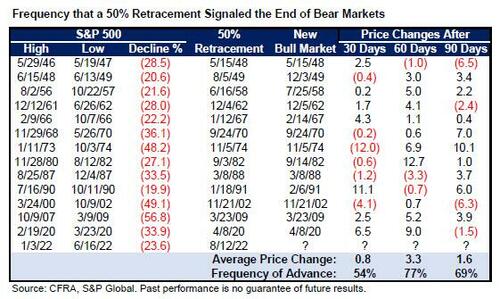

That is very notable, because as we explained several weeks ago, when the S&P retraced more than 50% of the drop from the Jan record high to the Jun bear-market lows, there has never been a “bear market rally” that bounce back above the 50% fib and then went on to make lower lows (although as Michael Burry noted last month, he clearly disagreed that this is anything more than a bear market rally. He was right). Indeed, as the table below from CFRA’s Sam Stovall shows, the S&P has never set a lower low in any of the 13 post-World War II bear markets after recovering 50% of its peak-to-trough decline.

In other words, by predicting fresh lows this year, Wilson expects the S&P to do something it has never done before.

“We view 3,400 for the growth recession or soft landing” scenario, Wilson noted, which ironically is even more bullish than Goldman, whose chief equity strategist David Kostin recently predicted the S&P would drop as low as 3,150 in case of a recession. And while Goldman has yet to make a recession its base case for the US economy, it is only a matter of time before the vampire squid is “forced” into admitting that its 5,100 year end target as recently as February was really just one big joke and “because markets”, said target is really 2000 points lower.

Going back to Wilson, the MS strategist echoes what he said earlier this week, namely that trends in operating margins were worse than forecast, while expecting this negative direction to continue.

“P/E multiple is wrong not because the Fed is going to be hawkish, but because the equity market is being too optimistic about the earnings outlook,” Wilson, said adding that “multiples will start to come down as earnings get cut and then somewhere in the middle of that earnings cut process the market will bottom and we think that’s probably between September and December.”

At the low in June, the S&P 500 was trading at 18 times earnings, a multiple that exceeded trough valuations seen in all previous 11 bear cycles since the 1950s. The current P/E for the index sits above 19.

Meanwhile, as the Fed remains laser-focused on economic data, Wilson thinks the central bank is “always going to be late by design” since it relies on two of the most backward looking data points: labor market data and inflation.

“By the time the labor market falls apart, it’s too late,” he said, since by then it will be evident that the US economy is in a recession. “The Fed is relevant but I think we priced most of the Fed pain after the first of the year,” he added.

Finally, while Wilson is rather doom and gloomish on most stock – he, like Zerohedge – has a soft spot for energy, and is why Wilson, whose firm is neutral on the sector, suggested looking at the S&P 500 excluding that industry.

“When energy is doing well it’s usually bad for everything else,” he said, adding the divergence will continue. “Energy is really the antithesis for everything else.”

Are we going to see XOM 200 before it’s all said and done?

Tyler Durden

Thu, 09/01/2022 – 13:40

via ZeroHedge News https://ift.tt/3WEBacu Tyler Durden