August Payrolls Preview: “Sweet Spot Is 0-100K… Negative Print And Stocks Will Soar”

While there is a wide range of forecasts for tomorrow’s payrolls print (see below), the median Street consensus expects the rate of payrolls growth to resume cooling in August, following a blowout month in July. The jobless rate is expected to hold steady, and there will be focus on the rate of participation after a decline last month. Average hourly earnings metrics will be a key focus to help gauge how surging consumer prices are translating into second-round effects and the wage-price spiral; some gauges suggest that the rate of pay rises is now exceeding the Fed’s preferred measures or inflation.

As Newsquawk notes, the Fed is yet to show signs that it is relenting in its fight against inflation, and is expected to keep tightening policy to put a lid on prices, even if that means stunting economic growth, although a big jobs drop will promptly force Powell to reverse once the Karen Liz Warrens of Congress start calling him every 5 minutes. Markets currently expect a 75bps rate hike at the September 21st FOMC, but officials have been suggesting that the CPI data due on September 13th could provide a more influential steer.

Here are the key median forecasts summarized:

- +298K headline print (Goldman at +350k) vs +528k prior, even though the Household Survey has shown far weaker numbers and there is a non trivial chance we may get a 100k or lower print if the Establishment Survey catches down (as we explained here)

- Unemployment rate of 3.5% (GIR 3.4%, prior 3.5%),

- Average Hourly Earnings 0.4% vs 0.5% prior and 5.3% Y/Y.

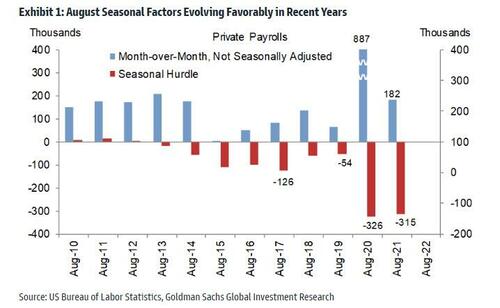

- Goldman writes, that August seasonal factors have evolved favorably in recent years, and the bank’s forecast assumes positive residual seasonality worth roughly +150k (mom sa).

In terms of market reaction, as Goldman trader John Flood writes, “we are still in a bad is good and vice versa set up for US stocks as Fed has made it clear that they want to see some froth exit the labor market in tandem with cooling inflation: i) Strong print here will clearly make 75bps much more likely on 9/21; ii) Inline print of 300k(ish) will keep pressure on this tape…anything close to last month’s shocking print of 528k would lead to real risk unwind into the wknd (I think at least a 200bp sell off). iii) Sweet spot for stocks tomorrow is a 0 – 100k headline reading…should get a 100+bp rally for S&P in this scenario after this recent drawdown. If we happen to get a negative number an even sharper rally”, and the pivot will be right back on the Q1 calendar.

What do others think? Here is a snapshot of tomorrow’s payrolls forecast by bank (higher to lower):

- Pantheon 400k

- BNPP 375k

- Wells 375k

- TD 370k

- GS 350k

- MS 350k

- BofA 325k

- Citi 305k

- Credit Suisse 300k

- DB 300k

- HSBC 300k

- JPM 300k

- SocGen 300k

- UBS 300k

- Nomura 290k

- StanChart 275k

- Jefferies 270k

- Evercore 250k

- ING 250k

- Mizuho 250k

- Natwest 200k

- Pictet 160k

Some more observations on what to expect tomorrow, courtesy of Newsquawk:

Headline to resume cooling: After a blowout jobs report in July, where almost all measures surprised to the upside, analysts are expecting the cooling in payroll growth to resume in August, with the consensus view looking for 300k nonfarm payrolls to be added; this would be lower than the prior 528k, the 3-month average of 437k, the 6-month average of 465k, and the 12-month average of 512k. This week, the White House said it was expecting the rate of payroll additions to “cool off a bit” into a “more stable and steady” growth rate as the economy “transitions”. Fed officials have also been talking about how some cooling of the labor market would be welcomed, as alluded to in its recent meeting minutes. The ADP’s new gauge of its National Employment also alludes to this theme, and reported that 132k private payrolls were added to the economy in August, against expectations for 288k (July’s reading was stated as 270k), although analysts have still expressed some scepticism around the data series.

Unemployment Rate Seen Steady: The jobless rate is expected to remain at the post-pandemic low of 3.5% (which was also the level of unemployment seen in February 2020, before the impact of the pandemic began hitting the labour market). The decline in the participation rate in July may have contributed to the fall in unemployment (this was perhaps the only ‘blip’ in last months’ data), but other gauges of the labour market (the July JOLTs figures, for instance) continue to allude to extremely tight conditions. NOTE: the Fed’s June forecasts (which will be updated at the September 21st FOMC) projected that the jobless rate will tick up to 3.7% by the end of this year, rising to 3.9% in 2023, before again rising to 4.1% in 2024, above the Fed’s longer-run estimate of 4.0%.

Policy Implications: Money markets are currently suggesting that there is a greater chance that the FOMC will raise interest rates by 75bps at the September 21st meeting rather than a smaller 50bps increment. The Fed has said that its policy on rate changes is data-dependent. This will be the final jobs report before the September confab, but there is still the US CPI report, due September 13th, that could influence officials’ view; indeed, Fed’s Mester, who votes on policy this year, said she’d be basing her decision on the inflation data, not the jobs report. That could mean that any market reaction to the data would be subject to revision based on the incoming CPI metrics. That said, the average hourly earnings measures will still provide some insight on how inflation dynamics are feeding through into second-round effects.

Wage Inflation: The wages metrics will be looked at by traders to gauge how surging (and broadening) consumer prices are translating into second-round effects; the consensus looks for average hourly earnings of +0.4% M/M in August, easing from the +0.5% pace in July, but the annual rate is still expected to climb by one-tenth of a percentage point to 5.3% Y/Y, while average workweek hours are seen unchanged at 34.6hrs. The ADP’s revamped National Employment Report said that the median change in annual pay was running at a rate of +7.6% Y/Y for job-stayers, and +16.1% Y/Y for those who had switched jobs – those rates are higher than the current level of average hourly earnings in July, as well as both the rate of headline and core PCE prices, the Fed’s preferred gauges of inflation (which were respectively 6.3% Y/Y and 4.6% Y/Y in the latest data for July). Fed officials have been emphasizing that the fight against inflation is not complete, refusing to overread into some nascent signs that the surge in consumer prices is peaking; many believe that the central bank will be comfortable in firing another large rate rise, particularly if other growth dynamics continue to hold up in Q3.

Arguing for a better-than-expected report (from Goldman):

- Seasonal Factors: According to Goldman, the August seasonal factors have evolved favorably in recent years, with an August month-over-month hurdle for private payrolls of -315k in 2021 and -326k in 2020 compared to -54k in 2019 and -126k in 2017 (which unlike 2019 was also a 4-week August payroll). The BLS seasonal factors appear to be overfitting to the reopening-related job surges in June and July of both 2020 and 2021. Goldman’s forecast assumes positive residual seasonality worth roughly +150k (mom sa). This compares to a seasonality headwind of around 100k in the previous report.

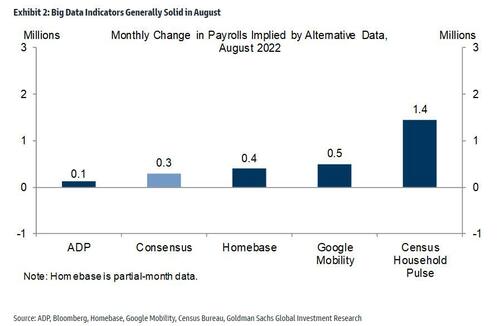

- Big Data. High-frequency data on the labor market were generally strong in August, with increases across all four measures tracked.

- Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—remained elevated, edging down by 0.2pt to +36.6. JOLTS job openings surprised to the upside, increasing by 199k in July to 11.2mn to a very elevated level.

Arguing for a worse-than-expected report:

- August slowdown effect. Payrolls have exhibited a tendency toward weak August first prints, which may reflect a recurring seasonal bias in the first vintages of the data. August job growth has decelerated in 8 of the last 10 years relative to the first-print July reading, with an average slowdown of 167k (and by 40k during the pre-pandemic decade, 2010-2019). Softness in the first vintage also tends to manifest in many of the same industries—including manufacturing, professional services, retail, and information. However, consensus may already reflect this tendency with its 230k forecasted deceleration.

- ADP. Private sector employment in the ADP report increased by 132k in August, below expectations for 325k. The ADP data adopted a new methodology in August, and while the updated series shows a strong correlation with BLS private payrolls over the full sample (+0.90 since 2010, mom sa), the relationship has broken down over the last year (correlation = -0.04), as shown in Exhibit 3. The ADP measure has also understated private payroll growth by 97k on average over the last year, including by 203k in July (+268k vs. +471k in the official measure).

- Employer surveys. The employment components of business surveys generally decreased in August. Our services survey employment tracker decreased by 0.3pt to 53.2 and our manufacturing survey employment tracker decreased by 0.6pt to 54.6.

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas rebounded 8.1% month-over-month in August, after decreasing 15.1% in July (SA by GS).

Last but certainly not least, after touting for months the strong employment numbers as a way to deflect criticism of soaring inflation, the White House on Tuesday warned that the numbers released later this week by the Labor Department will likely show a job markets that is “cooling off.” White House press secretary Karine Jean-Pierre said the slower hiring pace is a sign that the economy is “in transition.”

“It is going through a transition from the historic economic growth that we saw last year to a more stable and steady growth and that is kind of important to note,” she told reporters aboard Air Force One.

“We are expecting job numbers to cool off a bit as we are going into transition. We are expecting job numbers to not be at the high growth rate,” she Pierre continued. But will they be low enough to turn negative and send futures limit up…

Tyler Durden

Thu, 09/01/2022 – 22:21

via ZeroHedge News https://ift.tt/qNrd2bh Tyler Durden