Futures Flat In Muted End To Turbulent Week With All Eyes On Payrolls

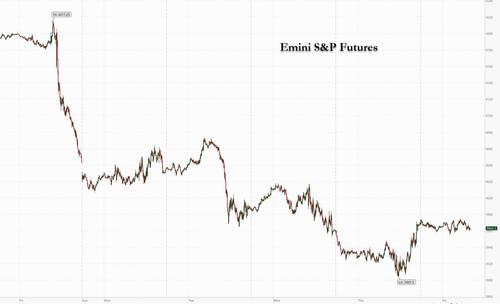

US futures dropped on Friday, ending a third straight week of declines, as investors eyed a key jobs report that will be pivotal for this month’s Fed rate hike decision. S&P futures fell 0.2% at 730 a.m. ET, with the underlying cash index down 2.2% this week. Nasdaq 100 futures fell 0.3%, with the tech-heavy index down 2.6% in the previous four days. The dollar index slipped from a record high and the euro strengthened. 10Y yield traded slightly lower, at 3.25%, following yesterday’s spike.

In pre-market trading, Lululemon jumped 10% after raising its full-year outlook. Meanwhile, Bed Bath & Beyond fell as much as 6%, putting the home-goods retailer on track for a weekly loss following its survival plan earlier in the week. Analysts raise PTs on the stock, though some flag higher inventory levels as a note of bearishness. Here are other notable movers:

- Procept BioRobotics (PRCT US) initiated at overweight by Wells Fargo, highlighting the potential of the company’s AquaBeam Robotic System, a therapy for prostate gland enlargement

- JPMorgan cuts its ratings on Dow and LyondellBasell (LYB US) to neutral from overweight, saying the petrochemicals companies are “probably not the best places to put new money to work.”

- Shares in Addentax (ATXG US), a Chinese garment-maker, drop as much as 40% in US premarket trading, set to extend yesterday’s 95% plunge into a second day.

- US semiconductor- related stocks could be active on Friday after Broadcom gave a robust sales forecast for the current quarter, calming worries that spending on infrastructure is slowing

The outlook for stocks has soured since mid-August after traders ramped up bets that the Fed will continue its aggressive monetary tightening, hurting the economy in the process. The S&P 500 has erased $2 trillion in market capitalization in the past five days, and has given up half of its gains made in the summer rally. Meanwhile, tech stocks have succumbed to rising rates, which are a headwind to the expensive growth sector.

“We don’t have a lot of reasons to be bullish in this type of environment for the next couple of weeks and months,” Meera Pandit, global market strategist at JPMorgan Asset Management, said on Bloomberg Television. “Yet when we think about the longer term perspective and the longer term investor, these are the types of level that can be fruitful in the long run.”

US stocks had outflows of $6.1 billion in the week to Aug. 31 – the biggest exodus in 10 weeks – according to a Bank of America’s Michael Hartnett, adding that investors expect “fast inflation shock, slow recession shock” as nominal growth continues to be boosted by surging consumer prices, fiscal stimulus, large household savings and the impact of the war in Ukraine.

Next up on investor minds is the August jobs report in under an hour, which is expected to show healthy payrolls growth following a stronger-than-expected US manufacturing report. This is how Goldman traders framed what to expect (full preview here): “we are still in a bad is good and vice versa set up for US stocks as Fed has made it clear that they want to see some froth exit the labor market in tandem with cooling inflation: i) Strong print here will clearly make 75bps much more likely on 9/21; ii) Inline print of 300k(ish) will keep pressure on this tape…anything close to last month’s shocking print of 528k would lead to real risk unwind into the wknd (I think at least a 200bp sell off). iii) Sweet spot for stocks tomorrow is a 0 – 100k headline reading…should get a 100+bp rally for S&P in this scenario after this recent drawdown. If we happen to get a negative number an even sharper rally”, and the pivot will be right back on the Q1 calendar.

“The risk of having another additional 75-basis-points hike is high and also to have a big rally on the real rates” depending on the outcome of the jobs report, said Claudia Panseri, a global equity strategist at UBS Global Wealth Management. “Volatility in the equity market will remain quite high until the picture on inflation becomes more clear than it is right now,” she told Bloomberg Television.

In Europe, the Euro 50 rose 0.9%, with Germany’s DAX outperforming peers, adding 1.5%, IBEX lags, rising 0.2%. Autos, financial services and energy are the strongest-performing sectors. Here are the biggest Europen movers:

- Nokia shares are up as much as 1.4% on Friday, adding to a weekly gain and outperforming the wider markets decline as the communications company will join the Euro Stoxx 50 benchmark

- Ashmore shares gain as much as 5.5%, reversing a small decline at the open, with Panmure Gordon upgrading the emerging markets fund manager to buy from hold following its FY results

- Smith & Nephew rises as much as 4.9%, extending a weekly gain. RBC says investors are viewing stock’s “historically low valuation” against orthopedic peers as a “buying opportunity.”

- Segro and Tritax Big Box gain 2.5% and 2.2%, respectively, after Shore Capital upgrades the REITs, saying downside risks for Segro are “fairly priced,” and the risk- reward balance for Tritax is more even

- UK homebuilders fall and are among the worst performers in the Stoxx 600 after HSBC cut its ratings on seven stocks, saying the UK is on the “cusp of a housing downturn”

- Sectra shares are down as much as 6.6% after the Swedish medical technology company presented its latest earnings, which included a drop in operating profit

- Alliance Pharma falls as much 11%, most since July, as the UK’s competition watchdog seeks to disqualify seven of the firm’s directors, including CEO Peter Butterfield

- Proximus falls to fresh record low, declining as much as 4.3% after Morgan Stanley resumes at underweight in note citing structural market headwinds and an unsupportive valuation

- Kofola CeskoSlovensko shares drop 2.5% after rising costs prompted the Czech producer of soft beverages to reduce its dividend proposal and rein in guidance

- Compleo Charging Solutions falls as much as 4% after Berenberg downgrades to hold and lowers its price target by 80%, citing resignation of the company’s co-founder Checrallah Kachouh

Earlier in the session, Asian stocks fell, on course for their worst week in more than two months, as the dollar hit a new high amid worries about the Federal Reserve’s aggressive rate-hike path and as lockdowns continued in China. The MSCI Asia Pacific Index declined as much as 0.7%, set for a weekly loss of nearly 4%. TSMC and other tech stocks contributed the most to the benchmark’s drop as Treasury yields climbed, sending the Bloomberg Dollar Spot Index to a record high. Equity gauges in Hong Kong led declines in the region, dragged by the banking and tech sectors. Meanwhile, shares in Japan fell as the yen slipped to a 24-year-low against the dollar. Fresh lockdowns in China are also weighing on sentiment, putting the Asian stock benchmark on track for its third-straight weekly decline. The sell-off reflects broad concerns of an economic slowdown amid weaker manufacturing data in the region’s major tech exporters.

“Dollar momentum sees no sign of breaking,” Saxo Capital Markets strategists including Redmond Wong wrote in a note. “Fresh Covid lockdowns in China, in particular, the full lockdown of Chengdu and extended restriction in Shenzhen, have caused some demand concerns.” Investors will keep a keen eye on the US August jobs report due later Friday to gauge the Fed’s next move in its September meeting. While weak sentiment has kept Asian shares hovering near their two-year lows, hedge-fund giant Man Group said Asian stocks are set to outshine peers next year. The investment firm is betting on defensive stocks in India and Southeast Asia, Andrew Swan, Man GLG’s head of Asia ex-Japan equities, said in an interview

Japanese stocks fell as investors awaited key US employment figures and assessed the yen’s decline to a 24-year low against the dollar. The Topix Index dropped 0.3% to 1,930.17 as of the market close in Tokyo, while the Nikkei 225 was virtually unchanged at 27,650.84. Sony Group contributed the most to the Topix’s decline, decreasing 1.1%. Out of 2,169 stocks in the index, 738 rose and 1,307 fell, while 124 were unchanged. “The US jobs report won’t be very positive no matter what’s out,” said Tatsushi Maeno, a senior strategist at Okasan Asset Management. “If it’s strong, the FOMC will lean toward a 0.75% rate hike and on the other hand, if it’s weak, there could be talk of a recession.”

India’s benchmark equities index closed slightly higher, after swinging between gains and losses several times throughout the session, as investors tried to gauge the impact of the US Federal Reserve’s hawkish stance in a week marked by volatility. The S&P BSE Sensex rose 0.1% to 58,803.33 in Mumbai, but ended lower for a second consecutive week. The NSE Nifty 50 Index was little change on Friday. Housing Development Finance Corp and HDFC Bank provided the biggest support to the Sensex, which saw 19 of its 30 member stocks ending lower. Thirteen of the 19 sector indexes compiled by BSE Ltd. declined, led by a measure of oil and gas companies. “The effect of Jackson Hole is still revolving across financial markets, with a soaring dollar and falling equities as the main themes,” Prashanth Tapse, an analyst at Mehta Securities, wrote in a note.

In FX, the greenback fell against all of its Group-of-10 peers except the yen. The euro rose a fourth day in five against the greenback, to edge above parity. The pound languished near the lowest since March 2020 versus the dollar. Investors awaited the results of a vote to choose the country’s next prime minister on Monday, with expected winner Liz Truss aiming to cut taxes and increase borrowing. The Norwegian krone outperformed, and rebounded from a six-week low versus the greenback, amid a recovery in oil prices before an OPEC+ meeting on supply at which Saudi Arabia could push for output cuts. The yen weakened past 140 per dollar after a slight rally in Asian trading faded.

In rates, treasuries were little changed while European bonds slipped. The 10-year Treasury yield held steady near 3.26%; while gilts 10-year yield is up 2.6bps around 2.90% and bunds 10-year yield is up 2bps to 1.58%.

In commodities, WTI crude futures rebound 3% to around $89, within Thursday’s range; oil pared gains after news that the Group of Seven most industrialized countries is poised to agree to introduce a price cap for global purchases of Russian oil, while Russia looks set to resume gas supplies through its key pipeline. Gold rose $6 to around $1,704. Meanwhile, zinc headed for its biggest weekly loss in over a decade on concern Chinese demand will be hamstrung by new virus restrictions.

Bitcoin has reclaimed the USD 20k mark but the upward move is yet to gain any real traction amid the broader contained price action.

Looking to the day ahead now, the main highlight will be the US jobs report for August. Otherwise on the data side, there’s US factory orders for July and Euro Area PPI for July.

Market Snapshot

- S&P 500 futures little changed at 3,969.25

- Gold spot up 0.4% to $1,704.52

- MXAP down 0.5% to 154.28

- MXAPJ down 0.5% to 506.44

- Nikkei little changed at 27,650.84

- Topix down 0.3% to 1,930.17

- Hang Seng Index down 0.7% to 19,452.09

- Shanghai Composite little changed at 3,186.48

- Sensex up 0.4% to 59,025.66

- Australia S&P/ASX 200 down 0.2% to 6,828.71

- Kospi down 0.3% to 2,409.41

- STOXX Europe 600 up 0.7% to 410.47

- German 10Y yield little changed at 1.58%

- Euro up 0.3% to $0.9980

- U.S. Dollar Index down 0.25% to 109.42

Top Overnight News from Bloomberg

- Under pressure from central bankers determined to quash inflation even at the cost of a recession, global bonds slumped into their first bear market in a generation. The Bloomberg Global Aggregate Total Return Index of government and investment-grade corporate bonds has fallen more than 20% from its 2021 peak, the biggest drawdown since its inception in 1990

- The ECB remains behind the curve on tackling record euro- zone inflation and will have to act more forcefully than previously envisaged to wrest control of prices, according to a survey of economists

- Consumers’ expectations for inflation in three years rose to 3% in July from 2.8% in June, European Central Bank says in statement summarizing the results of its monthly survey.

- Russia looks set to resume gas supplies through its key pipeline to Europe, a relief for markets even as fears persist about more halts this winter. Grid data indicate that flows will resume on Saturday at 20% of capacity as planned

- German exports and imports both fell in July as surging prices and the war in Ukraine threaten to send Europe’s largest economy into a recession. The trade surplus shrank to 5.4 billion euros ($5.4 billion) from 6.2 billion euros in June, as exports dropped by 2.1% and imports by 1.5%

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were indecisive with price action relatively rangebound after the mixed lead from the US and with the region lacking firm commitment as participants await the upcoming US NFP jobs data. ASX 200 was lacklustre as earnings releases quietened and with strength in financials offset by losses across the commodity-related sectors. Nikkei 225 traded subdued amid underperformance in large industrials although losses in the index were stemmed by retailers after several reported strong August sales. Hang Seng and Shanghai Comp were mixed as Hong Kong underperformed amid notable losses in developers and with the mainland choppy but ultimately kept afloat after the PBoC recently cut rates on its Standing Lending Facility by 10bps from August 15th and after several officials pledged measures.

Top Asian News

- PBoC official Ruan said monetary policy is to further improve cross-cyclical adjustments and maintain stable and moderate credit development, while they will keep liquidity reasonably ample. PBoC will also better coordinate structural and aggregate policy tools but will avoid flood-like stimulus and keep prices stable. Furthermore, the PBoC said China has not taken excessive monetary policy stimulus since the pandemic, leaving room for subsequent policy adjustments and that balanced consumer prices also create favourable conditions for monetary policy adjustments, according to Reuters.

- PBoC adviser Wang said banks need to increase financial support for infrastructure and that infrastructure is restricted by local government debt levels, while Wang added that they need to ensure property companies’ financing needs are met, according to Reuters.

- China’s securities regulator official said they will promote new legislation for overseas listings and will implement the China-US audit agreement, as well as continue strengthening communication with foreign institutional investors, according to Reuters.

- China’s banking regulator official said they will steadily resolve the risks faced by small and medium-sized financial institutions, while they will improve monitoring and disposal of debt risks of large companies, according to Reuters.

- Japanese Finance Minister Suzuki said it is important for currencies to move stably reflecting economic fundamentals, while he noted that recent FX moves are big and they will take appropriate action on FX if necessary. Suzuki also stated that they are watching FX with a sense of urgency and will brief the media after the G7 finance ministers meeting tonight.

European bourses are firmer across the board as hawkish yield action in the EZ has eased from yesterday’s recent peaks, Euro Stoxx 50 +0.8%. Stateside, futures are contained and flat with all focus on the NFP report. Alphabet’s Google (GOOG) is planning to accept the use of third-party payment services on its smartphone app in national such as Japan and India but not the US, according to the Nikkei

Top European News

- British Chambers of Commerce said the UK is already in the midst of a recession and it expects the UK economy to decline for two more periods following the contraction in Q2, while it also sees inflation to reach 14% later this year

- EU warned UK Foreign Secretary Truss against triggering Article 16 and said they will refuse to engage in serious talks on reforms to the post-Brexit deal unless she takes the “loaded gun” of unilateral legislation off the table

- German Economy Gets Another Growth Warning as Trade Volumes Drop

- Russian Gas Link Set to Restart as Traders Weigh Further Halts

- ECB Says Consumers Now See Inflation in Three Years at 3%

- A Hot Jobs Report Could Send Bitcoin to $15,000, Hedge Fund Says

- Citi Favors Bets on 75Bps Hikes at Each of Next Two ECB Meetings

FX

- DXY’s overnight pullback has picked up pace in early European hours.

- The EUR stands as the best performer alongside reports that Nord Stream 1 flows are expected to resume on Saturday.

- Non-US dollars are all modestly firmer to varying degrees, whilst JPY fails to benefit from the dollar weakness.

- Yuan shrugged off another notably firmer-than-expected CNY fixing overnight.

Fixed Income

- Comparably contained session overall thus far though Bunds are holding at the lower end of a 85 tick range in limited newsflow pre-NFP.

- Currently, the Bund low is circa. 10 ticks above 147.00, with yesterday’s 146.78 trough in focus and then 145.97/87 thereafter.

- Gilts and USTs are very similar thus far in that both benchmarks are essentially unchanged.

Commodities

- WTI Oct and Brent Nov futures are firmer on the day amid a softer Dollar and narrowing prospects of an imminent Iranian Nuclear deal.

- Spot gold edges higher as the Dollar remains weak, with the yellow metal back on a 1,700/oz+.

- Base metals are mixed LME copper softer around the USD 7,500/t.

US Event Calendar

- 08:30: Aug. Change in Nonfarm Payrolls, est. 298,000, prior 528,000

- Change in Private Payrolls, est. 300,000, prior 471,000

- Change in Manufact. Payrolls, est. 15,000, prior 30,000

- Unemployment Rate, est. 3.5%, prior 3.5%

- Labor Force Participation Rate, est. 62.2%, prior 62.1%

- Underemployment Rate, prior 6.7%

- Average Hourly Earnings YoY, est. 5.3%, prior 5.2%

- Average Hourly Earnings MoM, est. 0.4%, prior 0.5%

- Average Weekly Hours All Emplo, est. 34.6, prior 34.6

- 10:00: July Durable Goods Orders, est. 0%, prior 0%; July -Less Transportation, est. 0.3%, prior 0.3%

- 10:00: July Factory Orders, est. 0.2%, prior 2.0%

- 10:00: July Cap Goods Orders Nondef Ex Air, prior 0.4%

- 10:00: July Factory Orders Ex Trans, est. 0.4%, prior 1.4%

DB’s Jim Reid concludes the overnight wrap

If I’m not here on Monday it’s not impossible that I’ve been eaten by a snake or a small crocodile, or poisoned by a tarantula. For our twins’ 5th birthday party this weekend we’ve hired a professional reptile handler to come round and show 30-40 overexcitable kids some interesting animals. If I’m not eaten or bitten I’m a bit worried he won’t do the full register on the way out and I’ll be left with a huge lizard hiding in my bed. All I can say is that for my 5th birthday party we just had pin the tail on the donkey and a few stale sandwiches. Life was so much simpler then.

Markets are pretty complicated at the moment with investors not being quite able to decide whether the newsflow was bad or good yesterday for risk assets. We went to both extremes with the US rallying back into positive territory by the close (S&P 500 +0.30% having been -1.23% just after Europe logged off). As the US starts it’s day a bit later we’ll have a fresh payroll print to throw into the mix which could be the swing factor between 50 and 75bps at the September Fed meeting.

Last month’s strong print ratcheted up expectations that the Fed could hike by 75bps for a third meeting in a row, and markets are still pricing that as the more likely outcome than 50bps, with futures now pricing in +67.7bps worth of hikes. In terms of what to expect today, our US economists are looking for +300k growth in nonfarm payrolls, which should be enough to keep the unemployment rate at its current 3.5%.

Ahead of that, the US labour market data we got yesterday was pretty good, continuing the run of decent releases over recent days. Initial jobless claims for the week through August 27 unexpectedly fell back to 232k (vs. 248k expected), and the previous week was also revised down by -6k. That’s the third week in a row that the jobless claims have fallen, marking a change from the mostly upward trend we’ve seen since late March. On top of that, the ISM manufacturing release also surpassed expectations, remaining at 52.8 (vs. 51.9 expected), with the employment component at a 5-month high of 54.2 (vs. 49.5 expected).

Treasuries lost significant ground on the day, even before the data, with the 2yr yield rising +1bps to hit another post-2007 high of 3.50%, whilst the 10yr yield rose +6bps to 3.25%. The moves were driven by higher real yields across the curve, with the 5yr real yield hitting a 3-year high of 0.849%. It was a similar story in Europe too, where yields on 10yr bunds (+2.2bps), OATs (+2.5bps) and BTPs (+3.3bps) rose. Those European moves came as investors grew increasingly confident that the ECB would hike by 75bps at some point this year, which was aided by the latest data that showed Euro Area unemployment fell to a new low of 6.6% in July. That’s the lowest level since the single currency’s formation, and means that the latest data is showing that the Euro Area simultaneously has the highest inflation and the lowest unemployment of its existence.

As discussed at the top, US equities turned round late in the session with the Nasdaq nearly making it back into the green (-0.26%) as well as the S&P after being -2.28% at 6pm London time. This was too late to save the European session as the STOXX 600 (-1.80%) took a significant hit. Sentiment was pretty downbeat from the outset after the lockdown of the Chinese city of Chengdu (population 21m) risked further disruption to supply chains and global economic demand. That said, the energy situation continued to develop in a positive direction, with German power prices for next year coming down by a further -9.11% to €523.40 per megawatt-hour. In fact they have halved since their intraday peak on Monday when they hit €1050, which just shows how amazingly volatile this market is right now. The EU is considering various interventions to deal with the current turmoil, including price caps and windfall taxes, and Commission President Von der Leyen is set to outline the measures in her State of the Union address on September 14.

Staying on commodities, the decline in oil prices continued yesterday thanks to fears of further Chinese lockdowns and hawkish central banks. Brent crude was down -4.28% to $92.36/bbl, which is a substantial decline since its closing level on Monday of $105.09/bbl. As we go to print, crude oil prices are showing some recovery with Brent futures +1.91% higher at $94.12/bbl. There was a similar negative pattern among industrial metals, with copper (-2.96%) down for a 5th day running on the back of those same fears about demand. Meanwhile in the precious metal space, gold (-0.79%) slipped below $1700/oz, while hitting its lowest since July intraday as markets priced higher interest rates, thus raising the opportunity cost of holding a non-interest-bearing asset.

Over in the FX space, a number of new milestones were reached yesterday, most notably a rise in the dollar index (+0.91%) to levels not seen since 2002. The greenback was supported yesterday by the strong data that added to expectations the Fed would keep hiking into next year, although the reverse picture was that the Euro fell back beneath parity against the dollar, and the Japanese yen fell to 140 per dollar for the first time since 1998. In Asia’ morning trade, the Japanese yen further weakened, touching 140.26 per US dollar. Here in the UK, sterling also fell just beneath the $1.15 mark in trading for the first time since March 2020.

In Asia this morning, the Nikkei (-0.21%), the Hang Seng (-0.58%), and the CSI (-0.20%) are trading lower with the Shanghai Composite (+0.28%) bucking the trend. Elsewhere, the Kospi (+0.04%) is struggling to gain traction after South Korea’s headline inflation slowed after six months of accelerating (more below).

Moving ahead, US stock futures are fairly flat with contracts on the S&P 500 (-0.08%) and NASDAQ 100 (-0.04%) treading water.

Early morning data showed that Korea’s inflation eased to +5.7% y/y in August (v/s +6.1% expected) from +6.3% in July as energy prices eased. MoM prices dropped -0.1% in August (v/s +0.3% expected) after rising +0.5% in the prior month thus providing some comfort to the Bank of Korea (BoK) in its yearlong tightening cycle.

Rounding off yesterday’s data, there was plenty to digest from the global manufacturing PMIs, although they mostly confirmed the picture from the flash readings we’d already got. In the Euro Area, the reading came in at 49.6 (vs. flash 49.7), and the US had a 51.5 reading (vs. flash 51.3). The UK had a stronger revision up to 47.3 (vs. flash 46), but it was still in contractionary territory and the lowest since May 2020. Elsewhere, German retail sales grew by +1.9% (vs. -0.1% expected).

To the day ahead now, and the main highlight will be the US jobs report for August. Otherwise on the data side, there’s US factory orders for July and Euro Area PPI for July.

Tyler Durden

Fri, 09/02/2022 – 07:52

via ZeroHedge News https://ift.tt/qPAuYvt Tyler Durden