SoftBank’s Vision Fund Plans To Reduce Headcount By 20% After Record Losses

The latest quarterly report shows that SoftBank Group Corp. is getting crushed on its tech investments via its Vision Fund investment unit, as profitless tech stocks plunge into the abyss amid global central banks committed to rapid interest rate increases to quell the highest inflation in decades.

A new report via Bloomberg said sources familiar with the matter indicate the loss-churning Vision Fund operation could soon reduce headcount by at least 20%.

The people said the Tokyo-based company could slash upwards of 100 positions as early as this month. Headcount reduction would be in the UK, US, and China offices. In total, there are about 500 employees in the investment unit.

Billionaire founder of the group Masayoshi Son acknowledged widespread cost-cutting measures were in the works in early August after his conglomerate reported a net loss of 3.16 trillion yen ($23.4 billion) in the April to June quarter. Remember, this is the second straight quarter of record losses.

One person said headcount reduction could be as high as 50%.

“As Masa said at our most recent earnings, we are reviewing the organization size and structure. However, nothing has been decided yet,” a company representative told Bloomberg via email.

The people said senior and junior employees in front and back office positions could be cut. Currently, there are about 200 employees in the US, including a Latam team. The UK has 150 people while China has 50.

“The loss is the biggest in our corporate history and we take it very seriously,” Son said last month, adding, “We have resort to big cost-cutting efforts at Vision Fund. The cost-cutting efforts will have to include a reduction in headcount – something I’ve made up my mind to do.”

Days ago, Bloomberg reported Rajeev Misra, who helped Son set up the $100 billion tech fund in 2017, will be stepping down from his corporate officer and executive vice president roles.

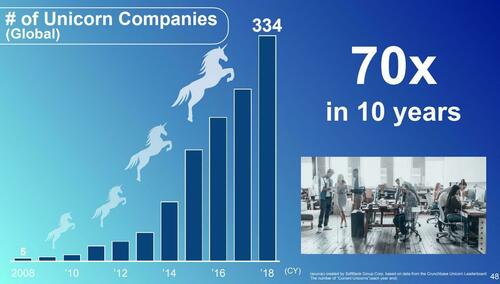

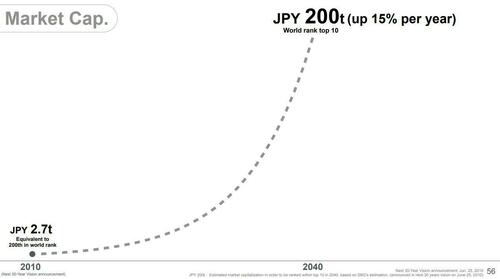

Back in 2019, around the time Son was creating ridiculous charts — we laughed.

…. and this…

We even questioned if SoftBank was the Bubble era’s “short of the century.”

Son can only hope for a Federal Reserve pivot on monetary policy to reinflate valuations of profitless tech investments in the fund.

Tyler Durden

Fri, 09/02/2022 – 10:35

via ZeroHedge News https://ift.tt/qH1avSu Tyler Durden