Buffett’s BYD Sales Add To Chinese Stock “Pain Trades”

By George Lei and Ye Xie, Bloomberg Markets live commentators and reporters

Three things we learned last week:

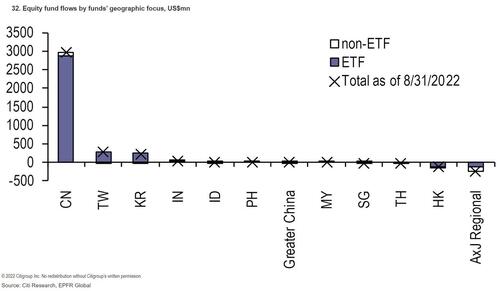

1. There have been strong inflows into China’s stock market, despite the nation’s economic challenges. Chinese equity funds, led by ETFs, received $3 billion in the week through Aug. 31, in contrast to an outflow of $9 billion from global equity funds, according to EPFR Global and Citigroup. Foreign investors appear to be unfazed by the weak market performance, as renewed Covid outbreaks sent Chinese stocks to a three-month low.

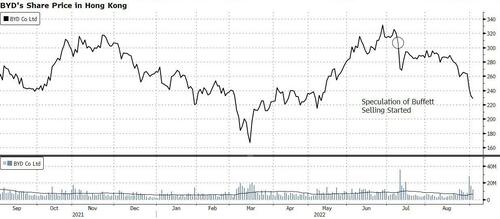

In August, long-only managers added bets on consumer-service names as part of the “reopening trade” as well as electric- vehicle makers, such as BYD Co., to gain exposure to the growth factor, according to Morgan Stanley. But their timing wasn’t particularly good. Warren Buffett’s Berkshire Hathaway started trimming its massive stake in BYD, putting the shares under pressure.

Meanwhile, restaurant and traveling names such as Yum China, H World and Trip.com aren’t performing well amid the spreading Covid cases. “The recent lockdown in some China major cities and investors’ transactions on BYD imply a prolonged wait for these trades to add values,” Morgan Stanley’s analysts led by Gilbert Wong wrote in a note.

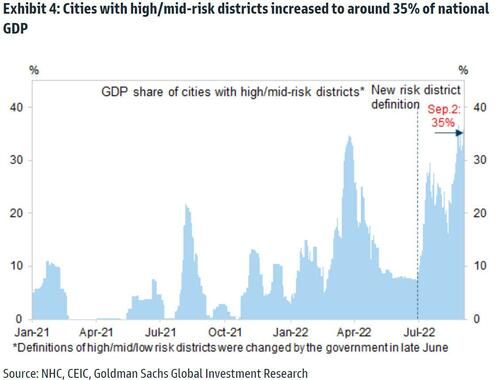

2. The number of Chinese cities grappling with virus outbreaks is now almost as high as it was at the peak of the Omicron wave earlier this year. The southwestern metropolis of Chengdu locked down its 21 million residents, and Shenzhen’s 17.5 million inhabitants now fear a second city-wide shutdown this year.

Since May, China has adopted a mass-testing strategy, setting up tens of thousands of testing booths across major cities. Authorities hoped frequent testing would help them avoid lockdowns and enable most business activities to carry on. The highly- transmissible BA.5 variant, however, has left the strategy increasingly ineffective and economic pains are mounting.

3. Policy divergence is putting the yuan under pressure, but the People’s Bank of China has resisted the currency’s depreciation. Friday’s US jobs report is unlikely to prompt the Federal Reserve to change its hawkish message. It’s a coin toss between a 75-bp or a 50-bp rate hike at the Fed meeting later this month. This week, the European Central Bank is likely to raise rates by 75 bps. Facing depreciation pressure, the PBOC has set the yuan fixing stronger than expected. It has slowed the yuan’s decline, at least for now.

Tyler Durden

Sun, 09/04/2022 – 20:12

via ZeroHedge News https://ift.tt/2xfLSVt Tyler Durden