Key Events This Week: ECB And Powell Doubleheader, EU Energy Ministers And More

With the US closed for business on Monday, we get the typical post-payrolls slowdown, with all eyes this morning on gas futures and the aftermath to the NS1 news, with prices predictably surging as much s 30%.

Looking at this week’s post-Labor Day newsflow, DB’s Jim Reid writes that this Friday EU energy ministers meet so that will be a key meeting, and expect to see more government action over the next few days and weeks. Indeed Germany yesterday announced a fresh $65bn package to help consumers. This is now the third such package.

Elsewhere Liz Truss was voted as the new UK PM. Her reaction to the energy/cost of living crisis will be very much in focus, especially as it pertains to fiscal policy. This might come out more over weeks than days (emergency budget speculated for September 21st) but could signal a meaningful shift in policy.

All this has slightly overshadowed a big week for central banks with all eyes on the ECB meeting on Thursday, as well as Fed Chair Powell’s speech the same day. On Wednesday, we will get the Fed’s Beige Book and a likely 75bps hike from the BoC. For the ECB our economists’ preview here lays out the case for a 75bps hike following last week’s higher than expected flash CPI print for the region and an array of hawkish ECB comments of late from ECB officials.

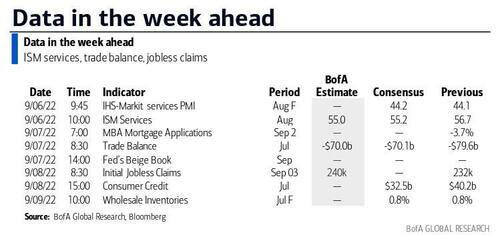

In terms of data the US services ISM (tomorrow) will be a highlight given that last month saw a surprisingly strong (to the market) 56.7 print. 55.2 is expected this month which would remain way above normal recessionary levels. In Europe Industrial production for Germany (Wednesday) and France (Friday) might be the highlights given recent energy travails. By contrast, Asia will have a busier week. China’s CPI and PPI (Friday) will be the key data release. Current median estimates on Bloomberg point to a slight YoY uptick in the CPI (2.8% vs 2.7% in July) and easing PPI pressures (3.2% vs 4.2%). This price data will be preceded by trade balance figures on Wednesday. We’ve already seen the Caixin services PMI this morning which came in at 55.0 for August (v/s 54.0 expected), recording the second highest level since May 2021 despite softening from July’s 55.5.

Courtesy of DB, here is a day-by-day breakdown of key events

Day-by-day calendar of events

Monday September 5

- Data: China Caixin PMI (services), UK August new car registrations, official reserves changes, Eurozone July retail sales, Italy services PMI

- Central banks: BoE’s Mann speaks

- Politics: UK Conservative Party leadership result announced

Tuesday September 6

- Data: US August ISM services index, Japan July household spending, labour cash earnings, Germany July factory orders, August construction PMI, UK August construction PMI

- Politics: New UK Prime Minister arrives in office

Wednesday September 7

- Data: US July trade balance, China August trade balance, foreign reserves, Japan July leading and coincident indices, Germany July industrial production, Italy July retail sales, Canada July international merchandise trade

- Central Banks: Fed’s Beige Book, Fed’s Barr and Brainard speak, BoC decision, BoE’s Governor Bailey and MPC testify to the Treasury Committee

Thursday September 8

- Data: US July consumer credit, initial jobless claims, UK August RICS house price balance, Japan August bank lending, Economy Watcher survey, July trade balance, France July trade balance

- Central Banks: ECB decision, Fed’s Powell speaks

Friday September 9

- Data: US July wholesale trade sales, Q2 household change in net worth, China August CPI, PPI, Japan August M2, M3, France July industrial and manufacturing production, Canada July labour market data, Q2 capacity utilisation rate

- Central banks: Fed’s Evans and Waller speak, BoE’s inflation attitudes survey

* * *

Finally, focusing on just the US, Goldman writes that the key economic data release this week is the ISM services report on Tuesday. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair Brainard, Governor Waller, and President Mester.

Monday, September 5

- There are no major economic data releases scheduled.

Tuesday, September 6

- 09:45 AM S&P Global US services PMI, August final (consensus 44.2, last 44.1)

- 10:00 AM ISM services index, August (GS 56.2, consensus 55.5, last 56.7): We estimate that the ISM services index declined by 0.5pt to 56.2 in August, reflecting convergence towards other business surveys and further normalization in supplier deliveries, partially offset by rebounding stock prices. Our non-manufacturing survey tracker edged up by 0.1pt to 51.8.

Wednesday, September 7

- 08:30 AM Trade Balance, July (GS -$66.1bn, consensus -$70.1bn, last -$79.6bn): We estimate that the trade deficit narrowed by $13.5bn to -$66.1bn in July on higher goods exports and lower goods imports.

- 10:00 AM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will participate in a livestream hosted by MNI. On August 31, Mester said, “My current view is that it will be necessary to move the fed funds rate up to somewhat above 4% by early next year and hold it there. I do not anticipate the Fed cutting the fed funds rate target next year.” She added, “The size of rate increases at any particular FOMC meeting and the peak fed funds rate will depend on the inflation outlook” and that “even if the economy were to go into a recession, we have to get inflation down.”

- 12:35 PM Fed Vice Chair Brainard speaks: Fed Vice Chair Lael Brainard will discuss the economic outlook and monetary policy at the Bank Policy Institute Annual Conference. On June 2, Brainard said, “Right now, it’s very hard to see the case for a pause” and “we’ve still got a lot of work to do to get inflation down to our 2% target.”

- 02:00 PM Beige Book: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the July Beige Book, most Fed districts’ contacts reported that consumer spending had moderated, as food and gas prices weighed on discretionary income. They noted that housing demand weakened noticeably, as affordability contributed to non-seasonal declines in sales, resulting in a slight increase in inventory and moderation in inflation. While we do not expect a recession, we expect low growth and inflation to remain elevated over the next few months. We therefore look for anecdotes of slowing growth and continued wage and price pressures in this month’s Beige Book.

- 02:00 PM Fed Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will discuss making the financial system fairer and safer at an event hosted by the Brookings Institution. Q&A with audience is expected.

Thursday, September 8

- 08:30 AM Initial jobless claims, week ended September 3 (GS 225k, consensus 239k, last 232k); Continuing jobless claims, week ended August 27 (consensus n.a., last 1,438k): We estimate initial jobless claims declined to 225k in the week ended September 3.

- 09:10 AM Fed Chair Powell speaks: Federal Reserve Chair Jerome Powell will participate in a moderated discussion at an event on monetary policy hosted by the Cato Institute. Text and Q&A are to be determined. At Jackson Hole on August 26, Chair Powell argued for restrictive policy. He reiterated that it will become appropriate to slow the pace of tightening “at some point,” as he laid out in his July press conference. However, Powell balanced that message by stressing that the FOMC remains committed to bringing inflation down, that the FOMC will likely need to maintain “a restrictive policy stance for some time,” and that progress on inflation “falls far short of what the Committee will need to see before we are confident that inflation is moving down.”

Friday, September 9

- 10:00 AM Wholesale inventories, July final (consensus +0.8%, last +0.8%)

- 10:00 AM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will speak on career opportunities at an event hosted by the Chicago Fed. There is not expected to be discussion on the economy or monetary policy outlook.

- 12:00 PM Fed Governor Waller speaks: Governor Christopher Waller will discuss the economic outlook at the Vienna Macroeconomics Workshop. On July 29, Governor Waller co-authored a note saying, “a soft landing is a plausible outcome for the labor market going forward.”

Source: DB, Goldman, BofA

Tyler Durden

Mon, 09/05/2022 – 11:25

via ZeroHedge News https://ift.tt/oCxUnBK Tyler Durden