Capitulation Is Coming

Submitted by QTR’s Fringe Finance

The ethos in stock market trading last week was all too familiar: it reminded me of every trading day over the last 10 years. The market had a legitimate reason to plunge to start the week – a continuation of Friday’s selloff which, in my opinion, was for a very good reason – but instead the market rallied on the open and pared its losses by the close. The market held steady for most of the week thereafter.

“Three things cannot be long hidden: the sun, the moon, and the truth.”

Of all the things that bulls have going for them, one of the most powerful is the perpetual tailwind of psychological buy-in to the narrative that stocks are always going to move higher. Not unlike the jet stream helping an airplane along a cross-country flight, this psychological buy-in has been an uninterrupted undercurrent in capital markets in this country for a century.

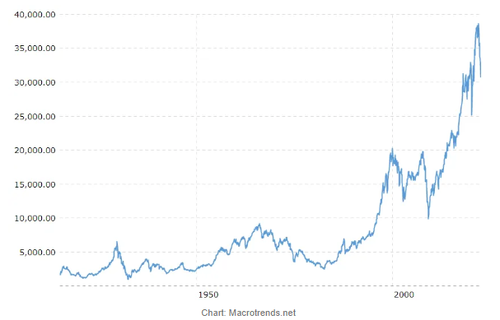

Ergo, as the above chart shows, there have been very few bumps in the road that have been able to shake this unwavering mentality. Even giant market disruptions, like the one we saw after people finally realized Covid was going to be a big deal, eventually find a way to smooth out and continue moving in one direction: up.

All this “smoothing out” of late has occurred regardless of valuation, common sense, geopolitical events or monetary. Yet I still believe last week’s speech by Jerome Powell at Jackson Hole all but guarantees another massive shockwave coming for markets. Hell, Powell said twice within the last two paragraphs of his speech that the Fed needed to stay at it until the job was done:

That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

These lessons are guiding us as we use our tools to bring inflation down. We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.

“You’re not goin’ anywhere ya think lump! Ya still until the job’s done!”

Since then, even the most dovish members of the FOMC, including one Neel Kashkari, have continued to posture up:

“I was actually happy to see how Chair Powell’s Jackson hole speech was received,” Kashkari said in an interview with Bloomberg’s Odd Lots podcast on Monday, reflecting on the steep drop after Powell spoke. “People now understand the seriousness of our commitment to getting inflation back down to 2%.”

“I certainly was not excited to see the stock market rallying after our last Federal Open Market Committee meeting,” he said. “Because I know how committed we all are to getting inflation down. And I somehow think the markets were misunderstanding that.”

“One of the biggest mistakes they made in the 1970s at the Fed is they thought that inflation was on its way down. The economy was weakening. And then they backed off and then inflation flared back up again before they had finally quashed it,” Kashkari said. “We can’t repeat that mistake.”

While the market mills around, I’ve become convinced that any decided move significantly higher, including breaching all time highs again, isn’t going to happen without a Fed pivot. Otherwise, the market will likely stay in ebb-and-flow mode for the time being. If inflation starts to come down, we could see a bit more of a risk on environment, but the fact is that if Jerome Powell means what he says and says what he means regarding his monetary policy stance going forward, I still think we’re going to see capitulation at some point.

As a reminder, many people saw the days leading up to last week’s speech as an opportunity to be optimistic – they thought Powell would finally start to indicate to the market that the Fed was easing. Instead, the opposite happened.

So the market is already likely in a dazed state of semi-surprise. And if the Fed follows though, there is no doubt in my mind we are still in for a market crash. As I’ve said in numerous past articles, the fact that we have hiked so much so quickly will eventually lead to a “surprise” shock to equity markets.

That surprise may very well pop up in September or October, when the Fed’s QT hits “full stride”:

The Federal Reserve’s balance-sheet unwind is set to ramp up this week, which means the central bank will finally begin unloading the Treasury bills it started amassing almost three years ago.

As part of its broader plan to reduce its $9 trillion portfolio, the Fed will boost its monthly caps for the amount of Treasuries and holdings of mortgage-backed securities that it will let mature to $60 billion and $35 billion, respectively, while using its $326 billion stash of T-bills as filler when coupons run below the monthly level. September will be the first month that bills will be redeemed since coupons will fall below the monetary authority’s new cap.

Further, long before rates were as high as they are now, I raised the point that the sell off so far has mostly been orderly. We haven’t seen the “extreme fear” capitulation-style moment yet. As was the case with 2020, the market rarely puts in lows without real fear or capitulation. Today’s market hasn’t had its “hell is coming” moment like the March 2020 market did – the Dow was off 9.26% that day.

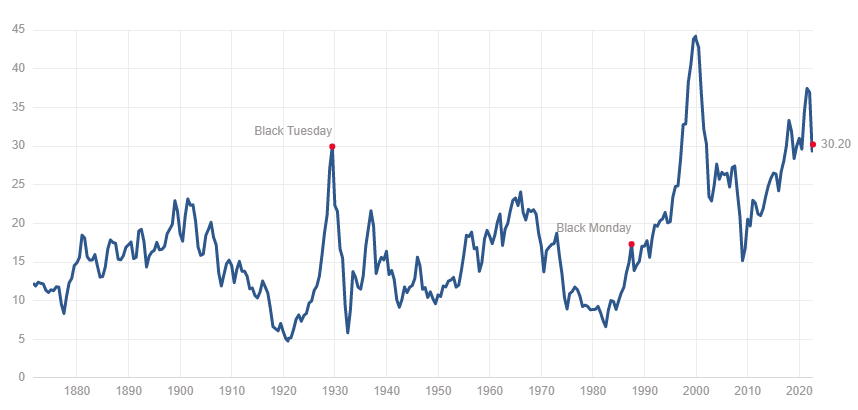

In addition, valuations using a Schiller PE or market cap/GDP metric still remain well above historic means. This makes a very easy case for stocks to move lower yet. With the Fed’s attitude as it stands, who wants to be buying equities at a Shiller PE of 30x?

Given these valuations, the fact that the economy is turning into recession, the Fed’s posturing and rate hikes that I still believe have not resonated through the economy yet, there is a case to make that this market is going to have to move 20%, 30% or even 40% lower before it hits a bottom. And in my opinion, it’s worth watching how the market makes this bottom instead of just how low it goes.

Capitulation and real fear will be the sign that I will look for to reassess valuations but, based on the reaction to last week’s speech by Jerome Powell, we are nowhere near that point just yet.

If you have the means to support my work and want to become a subscriber, you can use this link for 50% off.

Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Tue, 09/06/2022 – 06:30

via ZeroHedge News https://ift.tt/xVly1Uz Tyler Durden