Earnings Decline… Likely More To Go Before We Are Done

Authored by Lance Roberts via RealInvestmentAdvice.com,

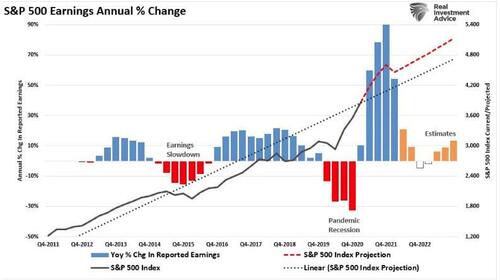

Last year, I wrote an article discussing that 2022 earnings estimates were too optimisticgiven the impending reversal of the economic “Sugar Rush” of massive liquidity injections. With the Fed hiking rates, high inflation, and slower economic growth pending, a continuation of that earnings decline remains highly probable.

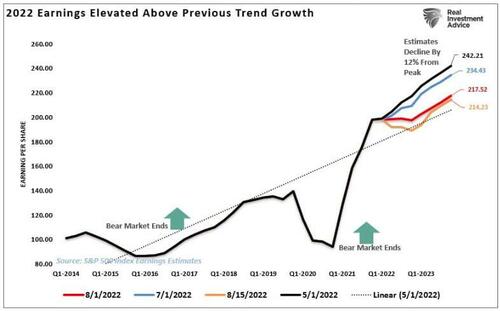

We previously noted that earnings estimates were overly optimistic and would need to come down to align with economic realities. That process has now begun. In the last couple of months, estimates for Q4-2023 have dropped by roughly 12%. Such would be considered normal for an economic slowdown. However, if the economy slips into a recession, a decline of 50% in estimates would be in line.

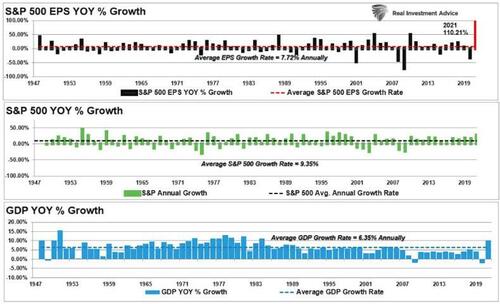

There should be no surprise, given that economic growth and earnings have a long-term historical correlation. Such would seem logical, given that economic activity generates revenues for companies. Therefore, while it is possible for earnings to grow faster than the economy at times, i.e., post-recession, they can not outgrow the economy indefinitely. The earnings surge in 2021 is something never witnessed previously and must eventually revert to norms.

Estimates Are Extremely Deviated

Despite weakening economic growth as inflation increases, the reduction of liquidity, and profit margins under pressure, analysts continue to keep estimates elevated. Currently, estimates for Q4-2023 are $214.23/share according to S&P. This is revised down from $242.21 in May, suggesting only an 8% increase in earnings over two years. Hardly something supportive of strongly rising asset prices.

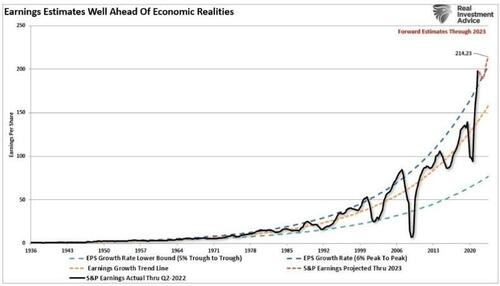

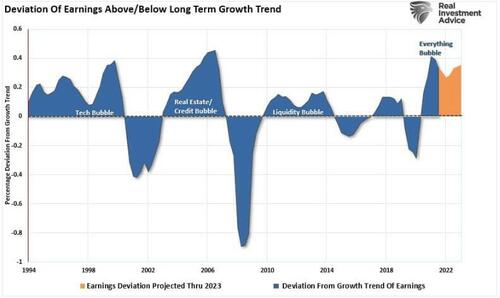

More importantly, despite the recent downward revisions, the current estimates still exceed the historical 6% exponential growth trend, which contained earnings growth since 1950, by one of the most significant deviations ever.

The only two previous periods with similar deviations are the “Financial Crisis” and the “Dot.com” bubble.

While many have become increasingly bullish on the market, suggesting the “bottom” for stocks gets made, I would caution otherwise.

The market risk remains fundamentals against a backdrop of the reversal of monetary accommodation. The most significant bottom-line earnings drivers remain accounting gimmicks, share repurchases, and lower tax rates. However, as we advance, there are numerous risks to earnings.

-

Changes to tax code or rates (aka the 15% minimum corporate income tax.)

-

Increased borrowing costs from higher rates.

-

Increased wage costs

-

Inflationary pressures

-

Decreased demand

-

Slower economic growth

-

A reversal of share buybacks either through choice or legislation (aka the 1% tax on share buybacks.)

However, regardless of those potential impacts, the annual rate of change in earnings will slow markedly as year-over-year comparisons become more challenging.

While the bulls remain optimistic, the deviation between prices and fundamental realities suggests risks that investors should not quickly dismiss.

The Biggest Risk Remains A Recession

At the beginning of this year,few Wall Street analysts expected substantially weaker economic growth in 2022. As I stated then,

“So, as we head into 2022, here is a short list of the things we are either currently hedging portfolios against or will potentially need to in the future.”

-

Economic growth slows as year-over-year comparisons become far more challenging.

-

Inflationary pressures remain more persistent than anticipated, which impedes consumption and compresses profit margins.

-

Rising wage and input costs reduce corporate earnings, disappointing earnings growth expectations.

-

Valuations begin to weigh on investor confidence.

-

Corporate profits weaken due to slower economic growth, reduced monetary interventions, and rising costs.

-

Consumer confidence continues to weaken as slowing economic growth and rising costs crimp consumption.

“While analysts on Wall Street are confident the bull market will continue uninterrupted into 2022, there are more than enough risks to derail that market outlook. Importantly, none of these independently suggest a significant correction is imminent. However, the risk is that they will undermine the bullish “psychology” of the market.”

My list had a few more items, like a housing correction which is now in progress, but you get the idea. The significant risk to overly optimistic estimates remains an economic recession.

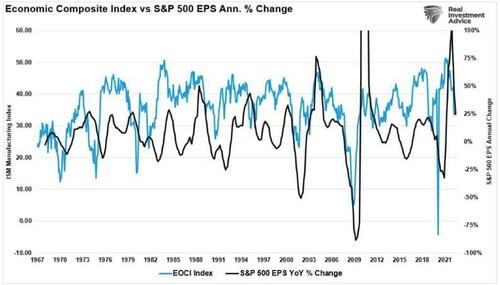

While Q1 and Q2 of this year registered negative economic growth, there was likely enough strength in the employment and consumption measures to avoid recession classification. However, as we head into 2023, the risk of a recession rises markedly as inflation and tighter monetary policy impact consumption.

Already, we are witnessing a broad contraction in manufacturing activity as demand slows. Not surprisingly, there is a high correction between the annual change in earnings, estimates, and the economy.

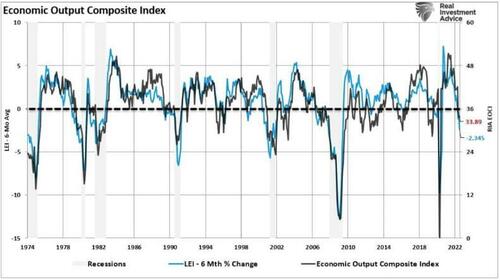

The chart below is our Economic Output Composite Index (EOCI), which combines several Fed regional surveys, CFNAI, Chicago PMI, Conference Board and OECD Leading Indices, NFIB Small Business, and the ISM composite index. This comprehensive index has a high correlation to the economy, as shown by the 6-month average of the Leading Economic Index.

Economic Weakness & Earnings

As shown, the economy peaked last quarter, and economic data points are softening on several fronts. Not surprisingly, earnings estimates are declining as economic growth rates slow.

With the Fed’s goal to reduce demand to quell inflation, the risk of triggering an economic recession through tighter monetary policy remains elevated.

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.” – Jerome Powell

As previously noted, the most considerable risk to the bullish thesis remains the Fed.

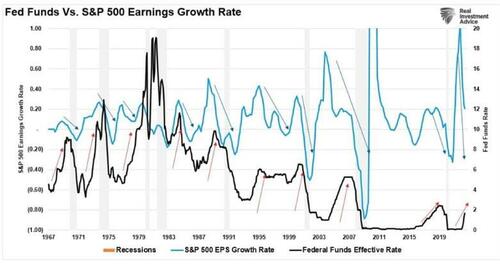

The Fed Problem

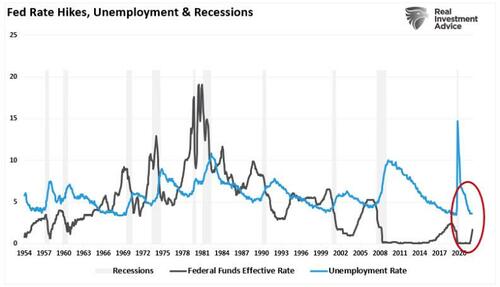

While many investors hope the Fed will “pivot” on their inflation fight sooner than later, Powell’s recent comments suggest otherwise. However, such should not be surprising given that the whole point of the Fed hiking rates is to slow economic growth, thereby reducing inflation. Unfortunately, with the economy slowing, additional tightening could exacerbate the risk of an economic contraction, given the dependence on low rates to support economic growth through increased debt.

Since earnings remain correlated to economic growth, earnings don’t survive rate hikes, especially in more aggressive campaigns.

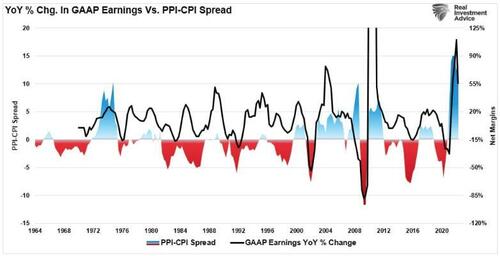

The Fed is in a difficult position. Producer prices, as shown below, have risen substantially faster than consumer prices. Such suggests that companies absorb input costs as they can’t pass all the price increases on to consumers. Eventually, the absorption of higher costs will impair profitability. As shown, there is a correlation between corporate earnings and inflation.

When the inflation spread rises enough to impair profitability, corporations take defensive measures to reduce costs (layoffs, cost cuts, automation.) Increased job losses contract consumer spending, slowing the economy toward recession. As Jerome Powell noted, we should expect softness in the labor market as higher Fed rates lead to job losses.

As the Fed continues to hike rates, that tightening almost assures a recession.

While no one currently expects an earnings decline, much less a recession, few tailwinds support economic growth. The most significant risk to investors comes from the lag effect of monetary policy changes. As the Fed focuses on lagging economic data to drive monetary policy decisions, the lag effect of those changes almost guarantees a policy mistake in the future.

In our opinion, the earnings decline has more to go before we are done.

Tyler Durden

Tue, 09/06/2022 – 08:06

via ZeroHedge News https://ift.tt/waA9RF1 Tyler Durden