Futures, Global Markets Rise As Europe Unleashes Energy Hyperinflation Bailout Bazooka

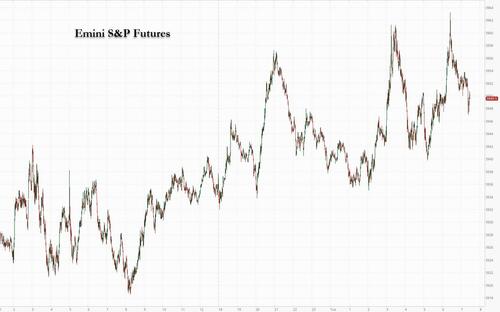

Following a flat Monday futures session when the US was closed for Labor Day and European stocks slumped as Russia confirmed it would halt NS1 pipeline flows indefinitely, on Tuesday European stocks and US equity futures rose as governments attempted to blunt the growing energy crisis, injecting tens of billions in fiscal stimulus to offset soaring energy prices and undoing central bank attempts to crush demand with tighter financial conditions. S&P futures rose 0.6% as Wall Street was set to resume trading after the long weekend, while Nasdaq futures rose 0.7%, ignoring – for now – news of more Chinese lockdowns. Meanwhile, as traders eyes the flood of fiscal “energy support”, Treasuries fell across the board, taking the two-year yield to 3.46%, while oil edged down reversing yesterday’s OPEC+ production cut gains on demand risks from fresh Chinese Covid lockdowns. The pound rebounded as traders assessed the agenda of incoming PM Liz Truss. European natgas prices eased with politicians scrambling to find solutions after Moscow switched off its main pipeline to the continent.

In premarket trading, Bed Bath & Beyond shares tumbled as much as 25% after Chief Financial Officer Gustavo Arnal fell to his death Friday from a Manhattan skyscraper. Other meme stocks were also drifting lower, including GameStop, which declined 5%. US-listed Chinese stocks also slumped premarket, with the drop led by Alibaba which tracked moves in Hong Kong-listed shares in the past two sessions, as lockdowns hit more cities amid an increase in Covid cases. Alibaba (BABA US) falls 2%, Pinduoduo (PDD US) -1.3%, JD.com (JD US) -1.8%, Baidu (BIDU US) -0.6%Here are some other notable premarket movers:

- FedEx (FDX US) shares decline 1.7% in US premarket trading as Citi downgraded the stock to neutral, noting that it’s concerned about the pace of freight activity heading into year-end.

- Ciena (CIEN US) shares drop as much as 1.4% in US premarket trading after JPMorgan downgrades the communications equipment company to neutral from overweight on “limited upside” for the stock.

- Digital World Acquisition (DWAC US) shares slump as much as 33% in US premarket trading, after the blank-check firm that is set to merge with former President Donald Trump’s social media group reportedly failed to get enough shareholder support to extend the deadline to complete the deal.

- Transocean (RIG US) gains 1.4% in premarket trading as the stock was upgraded to buy from neutral by BTIG, which said in a note that improving day rates in the floater market would help the company recharter rigs at higher levels.

- CVS Health (CVS US) stock could be in focus as the company agreed to buy Signify Health for $30.50 per share in cash in a transaction valued at ~$8 billion.

- Watch tanker shares as Jefferies says it remains positive on the outlook for the sector in a note raising PTs across its coverage and upgrading four stocks to buy. Euronav, Frontline (FRO US), Nordic American (NAT US) and Tsakos Energy (TNP US) upgraded to buy from hold, with PTs raised on all.

- Keep an eye on Rollins (ROL US) stock as it was raised to outperform from sector perform at RBC, with the broker saying the pest-control firm offers a “recession- resilient” model against a tough current backdrop.

Soaring energy costs have added to the complexities for monetary policymakers attempting to manage surging price pressures and the risk of recession. The focus turns next to the ECB, with economists at some of Wall Street’s top banks expecting it to announce a hike of 75 basis points on Thursday.

“The global economy, and in particular the European economy is really faced with a number of very difficult challenges, of which energy is sitting at the heart of everything,” Seema Shah, chief global strategist at Principal Global Investors, said on Bloomberg Television. “It does unfortunately mean that Europe despite all the help that governments are trying to provide for families and businesses, it’s simply not going to be enough to stave off a pretty significant downturn.”

And speaking of Europe, the Stoxx 50 rose 0.4%; Germany’s DAX outperformed peers, adding 0.7%, FTSE MIB lags, dropping 0.1% despite a massive a massive energy bailout plan announced by the new PM, Liz Truss, which amount to over €170 billion, and is meant to freeze houshold energy bills as well as rescue small businesses. Retailers, travel and autos are the strongest-performing sectors. Here are some of the biggest European movers today:

- Delivery Hero shares rally as much as 10% after Morgan Stanley raises the stock to overweight, saying the firm is set for the biggest margin improvement in the food delivery sector into 2023 and the most resilient top-line growth.

- Consumer stocks Greggs rises as much as +7.6%, Asos +8.5%, J D Wetherspoon +6.8%

- Volkswagen shares rise as much as 3.2% in Frankfurt after the German company decided to push ahead with its plan to list a minority stake in the Porsche sports-car maker this year.

- Commerzbank shares rise as much as 5% on Warburg upgrade, with the broker seeing good earnings and revenue growth prospects for the German lender.

- The Stoxx 600 Energy index falls, lagging the broader benchmark, as weaker gas prices and a stalled rally for crude weigh.

- Gas-exposed names Equinor drop as much as -6.1% and OMV -3.5%, among the biggest decliners

- Shell decline as much as -2.6% , BP -2.8%, TotalEnergies -2.2% and Eni -4.1% as Brent slipped following the OPEC+ meeting on Monday, with traders weighing the output cut alongside the impact of new lockdowns in China

- Remy Cointreau shares drop as much as 3.4% after Kepler Cheuvreux analyst Richard Withagen cut the recommendation to reduce from hold, citing slowing global spirits-market growth.

- BT shares fall as much as 2.8% to the lowest level since November 2021 after Berenberg downgraded the UK carrier to hold from buy, saying 1Q results raised “a multitude of questions” about the investment case.

Earlier in the session, Asian stocks turned lower as concerns over global monetary tightening and the impact of Europe’s energy crisis kept risk appetite in check. The MSCI Asia Pacific Index slid 0.4%, reversing an earlier gain of as much as 0.5%. Energy shares were the biggest advancers after oil rallied overnight, while most other sectors fell. Stocks in China rebounded after days of losses, while key measures of Hong Kong equities were the biggest laggards in the region. Australian stocks declined after the central bank raised its key rate by 50 basis points. Indonesia’s benchmark narrowly missed a fresh record high. The threat of a global economic slowdown continues to weigh on market sentiment, along with worry over inflation amid climbing commodities prices. The most recent earnings season has done little to quell concerns around the region, with MSCI’s main Asia gauge on track for its fifth-straight quarterly loss and volatility surging.

“Monetary tightening and accelerating inflation have weighed on investor sentiment and market returns,” Germaine Share, director of manager research of Morningstar wrote in a report. “We have also seen fund managers turn overweight China in the recent months to buy structural growth opportunities at attractive valuations.”

Japanese stocks closed mixed as uncertainty over the global economy countered optimism over the benefits of the weaker yen for exporters. The Topix fell 0.1% to close at 1,926.58, while the Nikkei was little changed at 27,626.51. Oriental Land Co. contributed the most to the Topix decline, decreasing 6.3% as the stock failed to be added to the blue-chip Nikkei 225. Out of 2,169 stocks in the index, 1,002 rose and 1,014 fell, while 153 were unchanged. “The markets are assuming that the US and European economies are going to be facing difficult situations,” said Hideyuki Suzuki, a general manager at SBI Securities. “Japanese stocks are in a relatively more favorable situation as the country has been late in restarting its economy, so there is still much room for growth.”

Indian stocks ended marginally lower, after swinging between gains and losses for most of Tuesday’s session, as the US Fed’s tightening bias and concerns about a worsening energy crisis in Europe remained an overarching themes in Asia. The S&P BSE Sensex fell 0.1% to 59,196.99 in Mumbai, erasing gains of as much as 0.5%. The NSE Nifty 50 Index dropped by a similar magnitude. Of the 30 members on the Sensex, 10 rose, while 20 fell. Twelve of 19 sector indexes compiled by BSE Ltd. advanced, led by a measure of power companies. “Markets are still in a range and rotational buying across sectors is helping the index to hold strong amid mixed global cues,” Ajit Mishra, vice president for research at Religare Broking Ltd. wrote in a note. “Since all sectors, barring IT, are contributing to the move, the focus should be more on stock selection.”

In FX, the Bloomberg Dollar Spot Index erased a decline as the greenback traded mixed versus its Group-of-10 peers. GBP and SEK are the strongest performers in G-10 FX, JPY and AUD underperform. Yen trades above 142 as Japan’s failed MMT experiment slowly comes to a close. The euro inched up to trade around 0.9950. Leveraged investors were heavily positioned for a lower euro versus the dollar, but they see scope to partially unwind some of that exposure and bet on further pound weakness. Sterling climbed as much as 0.8% to $1.1609 after sliding to the lowest since March 2020 on Monday. The rebound was fueled by a report that incoming UK Prime Minister Liz Truss has drafted plans to fix annual electricity and gas bills for a typical UK household at or below the current level of £1,971 ($2,300). The gilt curve bear steepened. Australia’s sovereign bonds gave back an advance after the central bank raised interest rates by a half- percentage point for a fourth consecutive meeting and signaled further hikes ahead in its drive to rein in inflation. The Reserve Bank took the cash rate to 2.35%, the highest level since 2015, in a widely expected announcement on Tuesday. The Australian dollar slumped. The yen fell to a new 24-year low against the dollar as rising Treasury yields highlighted the policy divergence between the Federal Reserve and Bank of Japan. Bonds were little changed.

In rates, TSY 10-year yield rose 6bps to 3.25%, while front-end-led losses flatten 2s10s, 5s30s by 1bp and ~3bp on the day; in 10-year sector bunds outperform by nearly 10bp with 10-year German yields richer by ~3bp on the day. The yield on 10-year bunds is up about 1.4bps to 1.54% while German 2-year yields remain 10bp lower on the day following dovish comments from ECB’s Centeno, Kazaks and Stournaras. UK short-end bonds gain, benefiting from new PM’s plan to freeze energy bills, while long-end gilts declined amid concerns about how the proposal will be funded. Treasury cash market was closed Monday for US Labor Day holiday, and few events are slated for Tuesday. Wednesday has several Fed officials slated to speak.

In commodities, brent fell 3% to near $93, paring its post-OPEC+ meeting gains, effective assuring that more production cuts are coming. Spot gold is little changed at $1,712/oz.

Bitcoin has been oscillating under the USD 20,000 mark throughout the European session.

Looking to the day ahead now, and in the political sphere the main event will be that Liz Truss succeeds Boris Johnson as UK Prime Minister. Otherwise on the data side, we’ll get German factory orders for July, the German and UK construction PMI for August, and from the US there’s the final services and composite PMIs for August, and the ISM services index too.

Market Snapshot

- S&P 500 futures up 0.5% to 3,944.00

- STOXX Europe 600 up 0.2% to 414.17

- MXAP down 0.3% to 153.07

- MXAPJ little changed at 503.42

- Nikkei little changed at 27,626.51

- Topix down 0.1% to 1,926.58

- Hang Seng Index down 0.1% to 19,202.73

- Shanghai Composite up 1.4% to 3,243.45

- Sensex up 0.1% to 59,320.84

- Australia S&P/ASX 200 down 0.4% to 6,826.54

- Kospi up 0.3% to 2,410.02

- Gold spot up 0.2% to $1,714.18

- U.S. Dollar Index up 0.13% to 109.68

- German 10Y yield little changed at 1.57%

- Euro up 0.3% to $0.9956

Top Overnight News from Bloomberg

- German factory orders fell for a sixth month in July. Demand slipped 1.1% from June, driven by a slump in consumer goods, particularly pharmaceutical products. That’s worse than the 0.7% drop economists had predicted

- European households will benefit from at least 376 billion euros ($375 billion) in government aid to stem whopping energy bills this winter, yet there’s a risk the smorgasbord of spending won’t bring enough relief

- Switzerland and Finland joined Germany in offering credit facilities to energy companies as the worsening supply crunch and surging prices threaten to create financial havoc in Europe

- China set a stronger-than-expected exchange-rate fixing for a 10th straight day and said it will allow banks to hold less foreign currencies in reserve, its most substantial moves yet to stabilize a weakening yuan

- China sealed off parts of Guiyang, capital of the mountainous southern Guizhou province, as an increase in virus cases triggered a stringent response

- Egypt’s government now favors a more flexible currency to support an economy that’s come under pressure from Russia’s invasion of Ukraine, a top official said

A more detailed look at global markets courtesy of Newsquawk

Asaia-Pac stocks traded somewhat mixed following the holiday lull stateside and as participants braced for this week’s central bank decisions beginning with an expected 50bps rate increase by the RBA. ASX 200 lacked firm direction with strength in the energy and tech sectors offset by mixed data releases and an unsurprising 50bps rate increase by the RBA. Nikkei 225 was contained following disappointing household spending and softer wage growth data. Hang Seng and Shanghai Comp were mixed with Hong Kong pressured as losses in tech overshadowed the strength in property names, while the mainland was underpinned after further support pledges by Chinese authorities and with the PBoC cutting its FX RRR which is seen as a measure to stem the recent currency depreciation.

Top Asian News

- PBoC set USD/CNY mid-point at 6.9096 vs exp. 6.9304 (prev. 6.8998)

- China’s Shanghai reportedly added one high-risk area and two middle-risk areas Tuesday after report of one local asymptomatic COVID case outside of quarantine.

- Japanese Finance Minister Suzuki confirmed fund requests from ministries for FY23 reached JPY 110tln and said they will decide on a fuel subsidy extension based on prices and other factors.

- Japan is poised to shorted its COVID isolation time to seven days, Nikkei reported.

- Japan Arrests Kadokawa Executives in Olympic Bribery Probe

- MUFG to Sell $600 Million of Marelli Debt to Deutsche Bank

- PBOC Seen Easing Monetary Policy Despite Yuan Slump

- Evergrande to Exit Shengjing Bank in $1.1 Billion Forced Sale

- Nomura India’s Head of Debt Shantanu Sahai Is Said to Leave

European bourses kicked off Tuesday’s trade in the green following a mixed APAC session, which saw no lead from Wall Street amid the US Labor Day holiday. Sentiment this morning was somewhat choppy and bourses trade off highs. Sectors in Europe are mostly firmer and now portraying a mildly anti-defensive/pro-cyclical tilt, with Healthcare, Utilities, Telecoms, and Food & Beverages towards the bottom of the bunch. Stateside, US equity futures remain firmer across the board with the NQ narrowly outpacing the ES, YM, and RTY.

Top European News

- Europe’s Lehman Warning on Energy Prompts Flurry of Cash Help

- Retail Rally on Truss Could Be Short-Lived as ‘Storm Is Brewing’

- UK Utilities Up on Truss Plans to Cap Electricity, Gas Bills

- Handelsbanken Recruits From Citi, Penser, Dagens Industri

- European Gas Drops as Governments Move to Fix Energy Crisis

FX

- The Dollar and index lost upward momentum in low-key US holiday trade on Monday, but found underlying bids to keep the latter propped around 109.50

- EUR sees some respite and consolidation on either side of 0.9950 against the USD, whilst several ECB headlines were released in the blackout period, albeit from a monthly publication.

- JPY declined further on yield differentials, with USD/JPY rising above 141.00 and closer to 142.00.

- Yuan came under renewed pressure irrespective of a firmer than forecast onshore midpoint fix, with China’s COVID situation continuing to be a headwind.

- Russia’s Sberbank said they are beginning to lend the Chinese Yuan, seeing large demand for the currency, according to Reuters.

Fixed Income

- Bunds are off recovery highs, but remain firm within 145.75-144.74 parameters for the Dec contract

- Gilts have pulled back below parity after rebounding in sympathy to 106.79.

- 10yr T-note remains depressed towards the bottom of a 116-00/27+ range awaiting the return of US cash markets from the long Labor Day weekend

Commodities

- WTI and Brent futures have declined below the levels seen at the reopening of electronic trade, but divergence is seen in terms of intraday changes between the contracts as the former saw no settlement on account of the US Labor Day holiday.

- Spot gold hovers around recent levels just above USD 1,700/oz – gold sees key support at 1699.1 and 1678.4, whilst resistance levels include 1,729 and 1,745.

- Base metals are mostly firmer with 3M LME copper posting mild gains above USD 7,500/oz but off best levels.

- France’s Aluminium Dunkerque is to cut production by one-fifth amid power costs, according to sources cited by Reuters

Central Banks

- ECB’s Centeno said monetary policy must be patient, ECB may achieve inflation goal with slow normalisation via Eurofi Magazine.

- ECB’s Kazaks said broad of protracted recession could slow rate hikes’ ECB will have above the neutral rate if needed via Eurofi Magazine

- ECB’s Scicluna said determining when to use Transmission Protection Instrument (TPI) is a major challenge, via Eurofi Magazine.

- ECB’s Stournaras sees energy costs moderating and bottle easing; EZ inflation is close to its peak, inflation will start steady deceleration via Eurofi Magazine.

- BoE’s Mann said a fast and forceful approach to tightening, potentially followed by a hold or reversal is better than a gradualist approach, while she added that a 75bps rate hike by the BoE is an important question and that they must ensure inflation expectations do not drift further from the target.

- RBA hiked rates by 50bps to 2.35%, as expected. RBA reiterated that the board is committed to doing what is necessary to ensure inflation returns to the target and it expects to increase rates further in the months ahead but is not on a preset path. Furthermore, it stated that the size and timing of future interest rate increases will be guided by the incoming data and the Board’s assessment of the outlook for inflation and the labour market, while it noted that the Australian economy is continuing to grow solidly and national income is being boosted by a record level of the terms of trade.

US Event Calendar

- 09:45: Aug. S&P Global US Services PMI, est. 44.2, prior 44.1

- 09:45: Aug. S&P Global US Composite PMI, est. 45.0, prior 45.0

- 10:00: Aug. ISM Services Index, est. 55.4, prior 56.7

DB’s Jim Reid concludes the overnight wrap

US markets might have been closed for the Labor Day holiday, but there was plenty of action in Europe as markets finally reacted to the closure of the Nord Stream gas pipeline on Friday evening. Unsurprisingly it wasn’t a happy one and European assets slumped across the board, with the Euro itself falling beneath $0.99 for the first time since 2002 as we went to press yesterday, whilst the STOXX 600 managed to claw back its initial losses to “only” close -0.62% lower. Those countries most exposed to Russia’s gas were particularly affected, with the DAX falling -2.22% on the day. In the meantime, the prospect that the latest shock would force the ECB into even more aggressive rate hikes saw sovereign bonds yields move higher across the continent.

Of course, the one asset class these losses didn’t apply to were energy itself, and European natural gas futures surged by +14.56% on the day, albeit down from +35% up just after 9am London time. That still leaves them at €246 per megawatt-hour, which is still someway beneath their closing peak at €339 a week and a half ago, but is nevertheless almost five times the level they were trading at a year ago. German power prices for next year also rebounded +12.10% (after falling -48.35% last week), which came as Bloomberg reported people familiar with the matter saying that Germany was now unlikely to meet their target to hit 95% gas storage by November following the recent news on Nord Stream.

In terms of the next policy steps, EU energy ministers are set to meet on Friday, and EU Commission President von der Leyen tweeted that the Commission was “preparing proposals to help vulnerable households and businesses to cope with high energy prices”. She said the aim was to reduce electricity demand, as well as “Enable support to electricity producers facing liquidity challenges linked to volatility”. Let’s see what they come up with, but we also heard from French President Macron, who said he was in favour of an EU-wide windfall tax on energy profits.

Against this backdrop, Brent crude oil prices (+2.92%) moved higher for a second day after the OPEC+ group announced that they would cut production by 100k barrels per day next month. That reverses the increase from September that was one factor helping to lower oil prices, and won’t be welcome news for policymakers as Europe grapples with its own energy issues. In particular, it’ll be interesting to see how this week’s ECB forecasts are affected by the latest energy shock, and how long they expect it to take before inflation returns back to target. In early Asian trade, Brent futures (-0.74%) have reversed a bit of yesterday’s gains.

Speaking of the ECB, the latest shock from the Nord Stream headlines led markets to price in a further +6bps of rate hikes over the rest of 2022, which brings the total amount expected to +174.9bps. That takes the expected rate implied by year-end to its highest level yet, and means that markets are pricing the equivalent of a 75bps move this week, and then two further 50bps moves in October and December, so a pace unlike anything we’ve been used to seeing over recent years. And in turn, with investors expecting more aggressive rate hikes and faster inflation, sovereign bonds also sold off significantly, with yields on 10yr bunds (+4.0bps), OATs (+4.6bps) and BTPs (+10.8bps) all moving higher on the day.

Here in the UK, we got confirmation that Foreign Secretary Liz Truss would become the next Prime Minister today, after she defeated former Chancellor Rishi Sunak in the Conservative leadership election. Truss’ victory was somewhat narrower than recent polls had implied, with a 57%-43% win among party members, and it was also the smallest margin of victory for a new leader with Conservative members since the current system was brought in over 20 years ago. UK assets were unaffected by the news, since it had been widely expected in advance, but they’ve significantly underperformed over the last month as the contest has proceeded, with gilts down -8.2% over August (vs. -5.1% for Euro Sovereigns and -2.6% for Treasuries). Furthermore, since Prime Minister Johnson announced his resignation on July 7, sterling has been the worst performer among the G10 currencies, having fallen -4.21% against the US Dollar. Our FX strategist Shreyas Gopal even put out a report yesterday assessing the risks of a UK balance of payments crisis (link here).

In terms of what happens now, Truss will be invited to become PM by the Queen after Johnson resigns today. After that, she’s expected to deliver a speech from 10 Downing Street, and start putting together her new cabinet. The key post of Chancellor of the Exchequer (the UK’s finance minister) is widely expected to go to current Business Secretary Kwasi Kwarteng, who wrote in an FT op-ed on Sunday evening that the Truss government would “take immediate action” on the cost of living, and that there would “need to be some fiscal loosening to help people through the winter”. There were also some lines to reassure markets, saying that they would “work to reduce the debt-to-GDP ratio over time”, and they “remain fully committed to the independence of the Bank of England”. Overnight all the newspapers are reporting that Truss is close to sanctioning the freezing of energy bills for the next 18 months which could cost an eye watering £130bn. For context the entire covid spending has been estimated at somewhere between £300-400bn.

Asian equity markets are trading higher this morning following yesterday’s announcement by Chinese officials that they will speed up stimulus efforts in the third quarter to boost the economy as evidence points to a further loss of momentum for an economy marred by pandemic related losses and a property slump. The RRR cut yesterday is also helping. As I type, Chinese stocks are leading gains across the region with the Shanghai Composite (+0.96%) and CSI (+0.54%) both moving higher while the Kospi (+0.10%) is also up. Elsewhere, the Nikkei (+0.02%) is recovering from its earlier losses whilst the Hang Seng (-0.33%) is sliding after its opening gains this morning.

S&P 500 (+0.50%) and NASDAQ 100 (+0.63%) futures are edging higher after the holiday. Meanwhile, 2 and 10yr US Treasuries are +6.8bps and +4bps higher respectively, following the global move yesterday.

In monetary policy news, the Reserve Bank of Australia (RBA) raised its official cash rate (OCR) to the highest level since 2015, increasing it by 50 bps to 2.35%, its fifth hike in a row to curb soaring inflation that is pushing up prices in the nation. In a statement, the RBA Governor Philip Lowe indicated that the central bank would continue to adjust rates as inflation continues to run above its 2%-3% target range. He added that prices are expected to increase further over the months ahead before peaking later this year. Our economists think the move and comments leans slightly more hawkish which is reflected by Aussie yields rising as I type.

In terms of data releases yesterday, we got the final services and composite PMIs for August from Europe, where there were generally downward revisions relative to the flash readings. In the Euro Area, the composite PMI was revised down to 48.9 (vs. flash 49.2), and in the UK, it was revised down to a contractionary 49.6 (vs. flash 50.9), which is the first time in 18 months that the UK composite PMI has been in contractionary territory. Otherwise, Euro Area retail sales grew by +0.3% in July (vs. +0.4% expected).

To the day ahead now, and in the political sphere the main event will be that Liz Truss succeeds Boris Johnson as UK Prime Minister. Otherwise on the data side, we’ll get German factory orders for July, the German and UK construction PMI for August, and from the US there’s the final services and composite PMIs for August, and the ISM services index too.

Tyler Durden

Tue, 09/06/2022 – 07:51

via ZeroHedge News https://ift.tt/5X4aKcE Tyler Durden