Nomura: Yields Soar As Europe Unleashes Fiscal Stimulus Tsunami Which Will Require Debt Monetization

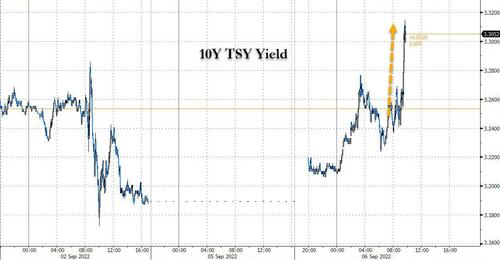

Equities are rallying, and yields are surging, with the 10Y rising above 3.30%…

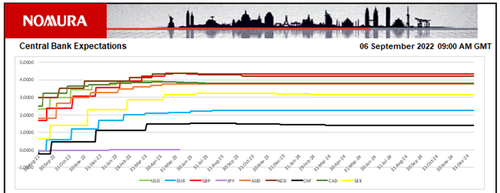

… on what according to Nomura’s Charlie McElligott is one clear catalyst – the same one we laid out in “Europe Unleashes Energy Hyperinflation Bailout Bazooka” – namely Europe’s “moment of intervention” from various euro governments with regard to the Euro Energy crisis via mega-stimulus, while a report from MNI citing “ECB sources” and stating that President Lagarde is “likely to opt for 50” bps hike only at the upcoming meeting, which is a de facto easing relative to recent expectations which have built for 75bps hike, certainly helping.

Regarding the EU / UK “Minsky Moment” Energy situation, which we profiled extensively over the weekend, McElligott writes that “the worse the crisis gets, the more asymmetric the crisis response becomes, and he we are now entering the “sovereigns take on the credit- and market- risk via stimulus and intervention” phase, as European and British leadership assume the fiscal bill (price caps, tariff deficits) and or directly engage in Energy markets.

In other words, from PPP for covid, we have shifted to PPP for energy hyperinflation.

Case in point on magnitude/scope of what they have to solve for, earlier we noted that the ongoing European bailout will have to pay at least $1.5 trillion in margin calls, according to Norgwegian energy giant Equinor (f/k/a Statoil):

“European energy trading risks grinding to a halt unless governments extend liquidity to cover margin calls of at least $1.5 trillion, according to Norwegian energy company Equinor ASA.

Aside from inflating bills and fanning inflation, the biggest energy crisis in decades is sucking up capital to guarantee trades amid wild price swings. That’s putting pressure on European Union officials to intervene to prevent energy markets from stalling.

“Liquidity support is going to be needed,” Helge Haugane, Equinor’s senior vice president for gas and power, said in an interview. The issue is focused on derivatives trading, while the physical market is functioning, he said, adding that the company’s estimate for $1.5 trillion to prop up so-called paper trading is “conservative.””

… or the even bigger shock, namely what we showed last night was Goldman’s estimate of a $2 trillion surge in European Energy bills by 2023, roughly 15% of Europe’s GDP (more in a subsequent post).

RIP Europe

“At current forward prices, we estimate that energy bills will peak early next year at c.€500/month for a typical European family, implying c.200% increase vs. 2021. For Europe as a whole, this implies a c.€2 TRILLION surge in energy bills, or c.15% of GDP” pic.twitter.com/8LUpt1iEn9

— zerohedge (@zerohedge) September 5, 2022

Here McElligott says that speaking pragmatically, he is “not really sure how fiscal stimulus works to address Energy supply shortage realities…but hey, I’m just a grunt laborer.”

In any case, with Europe now on a collision course with the hard, cold, commodity-free reality, one should get out of the way of governments according to the Nomura strategist (at least in the beginning), “because the left-tail scenario odds get slashed by “moving the goalposts,” “kicking the can” and re-writing the rules mid-game, despite likely unintended and / or second-order consequences of solutions which are normally associated with “money-printing” down-the-road.”

Here the x-asset strategist asks another rhetorical question, one which we – and rabobank – have been comtemplating this morning: “Honestly, how does one handicap the market impact of the reported Truss’ fiscal package upwards of £130B to cap energy bills for UK households and businesses, as it relates to Gilts and Sterling?” His answer:

On one hand, the govt is planning to somehow cut taxes while simultaneously and violently expanding their deficit…big yikes

And as Jordan Rochester notes, the UK / Truss plan as it relates to GBP could actually make trade flows WORSE as it supports consumption

But on the other, the outlook for CPI inflation will dramatically shift if the UK govt does indeed freeze energy prices, which then seemingly risks downside to current BoE hike trajectory

Being realistic regarding the eventual “footing the bill” for this largesse, Charlie says that it always “boomerangs” back to the central banks and quasi- “monetization”—so this will be an FX / Rates trade long-term, which locally then risks an unruly squeeze higher in US Dollar as the “cleanest dirty shirt.”

The more nuanced message is that with yields now blowing out as governments foot the fiscal stimulus to offset the massive costs, central banks will need to resume QE in the very near future to avoid a bond market collapse!

And separately, as we have seen throughout the life of this particularly idiosyncratic energy crisis, the Nomura strategist repeats what we first said yesterday, namely that nearly all of the response from governments and authorities have been forms of solutions (whether subsidies, price caps and tax unwinds) which perversely create “demand construction”…

ECB: we must crush demand to stop energy hyperinflation

Germany: here’s another €65BN

— zerohedge (@zerohedge) September 5, 2022

… which not only offset what central banks are trying to do, but also contributing to higher likelihood of further shortages, as opposed to allowing for higher prices to do the work of “demand destruction” and force behavioral “consumption” change…

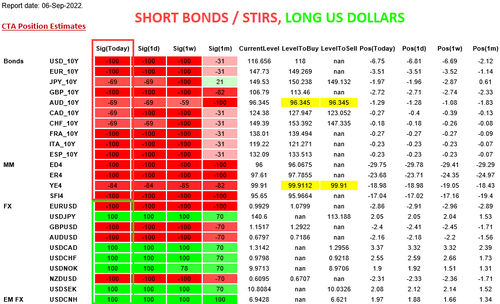

What does this mean for markets? Well, as McElligott notes, as this 1) “eventual monetization” relates to the current global interest rates trajectory zeitgeist, it’s just another source of negative pressure outside of 2) “higher for longer” global theme, 3) max cap US QT and 4) bearish Fall seasonality. Hence, Nomura sees G10 Bond Yields continuing higher yet-again, as “Shorts” are further emboldened, and indeed yields are surging this morning as markets now will demand central banks to start monetizing bonds again!

This too risks strengthening the global FCI tightening sledgehammer that is “higher US Dollar” (what currency do you want to be “long” on the other side?!), occuring alongside the recent surge in US Real Yields, both conspiring to further “choke-out” global inancial conditions

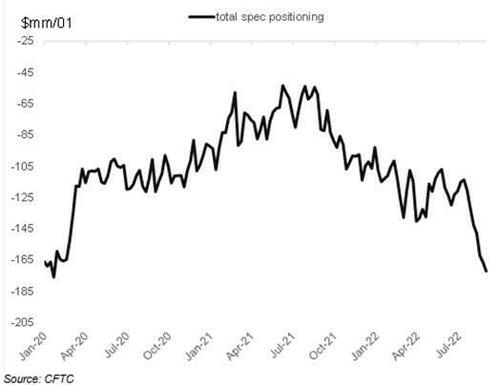

Finally, a part of this flow is likely showing-up in futures Spec positioning, with last reporting week (8/30) showing another sale of -$5.6mm / 01 and making seven consecutive weeks of selling—with the aggregate at ~-$180mm of Shorts being pressed (of course, a short squeeze is inevitable… but not yet).

Tyler Durden

Tue, 09/06/2022 – 10:33

via ZeroHedge News https://ift.tt/a3ICy0B Tyler Durden