Tchir: Wake Me Up When September Ends

Authored by Peter Tchir via Academy Securities,

Summer has come and passed. It was a long and difficult summer and I don’t see that changing as we head into September.

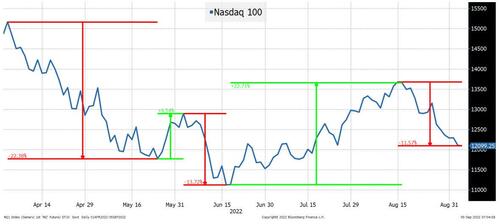

Admittedly I started this chart back in April, but we had a 22% drop in the Nasdaq 100, followed by a short (but sharp) 10% rally, which led to a quick and ugly drop of 14%. Then we managed to rally 23% from the “lows” only to end the summer with a 12% drop. Not exactly a restful or stress-free summer. I could have pulled up similar charts in rates, credit, curve shapes, commodities, or pretty much anything we trade and they would have been just as gut wrenching. That ignores the other problem managers and traders faced this summer – rapid shifts in correlation.

Before diving into this week’s September outlook, please see last week’s reports:

-

Around the World with Academy Securities where we focus on China, Taiwan, Russia, Ukraine, Africa, Afghanistan, Pakistan, and Iran.

-

Academy’s ESG Report which dissects the Inflation Reduction Act in detail.

-

Peter’s appearance on Bloomberg TV on the 29th of August.

Four Main Themes for September

There are a lot of moving parts for the global economy and markets, but a few stand out. I suspect that getting these factors right will determine success in navigating markets and the economy this autumn.

Russia and the European Energy Crisis.

Academy’s Geopolitical Intelligence Group has been saying since March that the conflict in Ukraine is likely to grind to a standstill with no resolution in sight. Advanced weaponry helps Ukraine defend against Russia, but attrition of their personnel is a major issue. Russia has a seemingly endless supply of conscripts to continue the relatively ineffective advances they continue to make. Sadly, but quite realistically, the attention has shifted from the fighting in Ukraine to energy in Europe. The narrative there is getting worse by the day. The “leak” that Gazprom said it found in Nord Stream 1 (ensuring that the pipeline would remain closed) caused gas prices to spike in Europe. Even the most naïve person in Europe is now being forced to accept that Russia has weaponized energy availability (and prices) against them. This is having a widespread impact on morale in the region and it will affect spending (energy bills are already out of control, and winter isn’t even here yet). I am hearing that companies are struggling with what to do as costs become prohibitive. Nothing that Europe can do in the next few months will alleviate this pressure. Europe, quite literally, is dependent upon a mild winter (less demand) and more wind (so Germany’s commitment to wind can pay off). Sanctions have backfired. Virtually every part of the West’s sanction policy can be deemed to have been marginally useful (to actually backfiring on us). More on that in a separate piece, but this winter is shaping up to be costly and dangerous for Europe.

Inventories and New Orders.

My single biggest fear for the U.S. economy is clear evidence that inventories are too high and that orders and shipments are slowing dramatically in response.

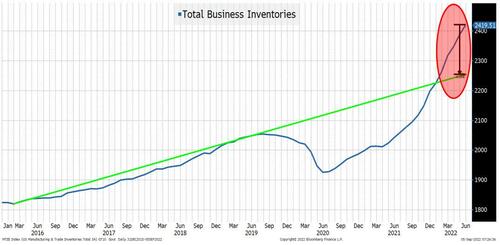

On a simple straight line extrapolation, inventories are easily 7% or more above where they should be.

Inventories slightly built up for years (on average). The pattern of build, drawdown, build, drawdown was nice and reasonably symmetrical. Now we’ve seen inventories build 14 months in a row! Many of those months saw relatively high increases and we have built inventories for 23 out of the last 24 months (yes, a post Covid recovery was needed, but this seems absurd).

In the past few months, we have seen new orders roll over. ISM has been 49.2, 48, and 51.3 for the past three months (not conducive for the pace of inventory build that we are seeing). According to the U.S. Census Bureau, new orders dropped 1% in July, the largest monthly decline since Covid hit.

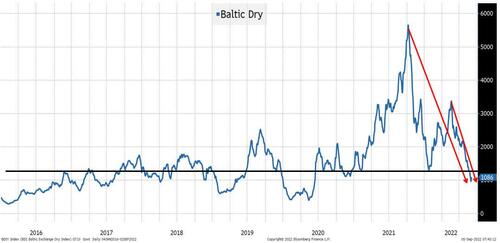

Baltic Dry shipping costs have dropped dramatically. That is clearly linked to fewer exports from China. The economic bulls will argue that the decline in Chinese exports is a function of lockdowns, but the bears (of which I am one of them) will argue that this is more likely a response to already having been over-ordered. China is stimulating their economy (they did more over this long weekend) because they are seeing weakness not just domestically, but globally. I’ve seen a number of pieces recently highlighting rapidly declining costs for freight, which indicates that the problem with inventory overbuild is widespread and is starting to be addressed.

Higher Yields, Housing, Real Estate, and Autos.

The 10-year yield gets a lot of attention. Deservedly so, but I’m more concerned about shorterterm rates and mortgage rates. Lots of companies fund themselves on a relatively short-term basis (many did a great job locking in low yields for long maturities, but there is still sensitivity to short-term rates, especially as inventories build). The housing market is dependent on mortgage rates to a large extent. The housing data has been ranging from bad to abysmal for months. I’m told that “home prices won’t go down because there won’t be forced selling”. Against that, I would argue that forced selling does come in over time, but more importantly, people aren’t stupid and they understand that their house is worth less than it was a few months ago and that the outlook for at least the next few months isn’t positive. With over 60% of U.S. households owning their homes, that is a big deal. On the auto front, my inbox went from being clogged with messages about people wanting to buy my used car to receiving some interesting offers. Just like mortgages, auto loan costs are going up, which has to have some impact. Finally, consumers responded to shortages by buying more cars (a surge in demand was also related to work from home/work local). That surge may be over. Commercial real estate remains very “local” and many companies (especially those with a big exposure to commercial real estate) are pushing for a return to office, but if that push fails and rates remain stubbornly high, there could be more pressure on that space.

Wealth Effect.

Add in crypto and disruptive stocks to the losses in more traditional stock indices (and the housing market) and we have a recipe for less spending. While the jobs data remains decent, Friday’s NFP had a revision of -105,000 jobs to the June report. June jobs went from 398k to 293k (not a bad number, but off by 26% from the original estimate). Call me skeptical, but I suspect that when they get done revising July and even August, the numbers won’t look so great.

We could discuss the possibility of China being more aggressive against Taiwan (see link above to our Around the World report), how quantitative tightening is a risk to asset values, Europe’s quagmire of no growth but high inflation, or any number of topics, but I’ll stick to the big 4 for now.

Rates

Given my outlook on the economy I’m looking for lower yields and steeper (or at least less inverted) curves.

Yes, the Fed is going to raise rates at least 50bps at the next meeting, but if I’m correct on the direction of the economic data, they will have to tone down after that. We are already seeing many commodity prices roll over (energy is bouncing with Russia’s latest pipeline gambit), but I’m convinced that by the end of this year there will be as much concern about deflation as inflation! Many of the same people who brought us “transitory” (when we felt it wasn’t transitory) have “magically” appeared in the “inflation will be higher for longer” camp. There are factors that support this (rise of India and the rapid buildout of the energy industry), but for now, I think that we will lament the day that we wished for much lower inflation (historically, lower commodity prices go hand in hand with weaker equity prices).

In order of preference:

-

Buying 2 years and in.

-

2s vs 10s steepeners (or the steepener of your choice).

-

20-year Treasury. I think I’d have an easier time convincing someone to run blindfolded through traffic than buy the 20-year Treasury. In a world where nothing is free or easy, the 20-year stands out like a sore thumb and while I still can’t find any takers, it does seem that the relentless pressure on this part of the curve has been exhausted.

Credit

Credit is a little more nuanced.

Given my outlook on the economy:

I prefer investment grade to non-investment grade.

While credit spreads will be linked to equity market performance (IG tends to be better correlated to the S&P 500 while HY is more tied to the Russell 2000), this remains more of a “valuation” and “profit margin” story than a real credit concern.

To the extent that lending standards are tightening (and they are), there will be no shortage of capital available to IG, but some lower rated companies may find it difficult to raise money (at least from banks).

I prefer high yield bonds to leveraged loans and really like new private credit while wanting to avoid “old” private credit.

The high yield bond market has fewer issuers than it used to. They are typically bigger companies and more often than not are publicly traded. This is NOT the high yield bond market of the Milken era or even of 2008! The “small”, the “tricky”, the “non-public”, the “pro-forma”, and the “favor” deals typically went into the leveraged loan market. The need to ramp up CLOs (more than anything else) also drove the leveraged loan market. If 10 CLOs were pricing in a month, you could be aggressive in what you brought to market. I haven’t seen the exact percentage lately, but new issues have always made up a decent part of any CLO’s holdings because it is easier and more efficient to use that to ramp up when the market is hot. I’m not overly concerned about the credit markets, but I’d steer towards high yield bonds over leveraged loans.

On the private credit side, if you can tap into a fund that doesn’t have much exposure, this could be a home run. As banks are pulling back on lending, private credit should have the ability to demand favorable terms and get them (companies will pay up for credit before they will lock in equity financing at what they deem to be low levels). What concerns me about investing in existing funds is my view that few have marked assets appropriately. Private credit, like private equity, can argue why public market valuations are incorrect. I’ve seen too many cases in my lifetime where mark to market forces further selling and creates irrational prices. But I’m not seeing that now as public markets seem to be rationally priced. This reminds me of bank accrual accounting books where everything was “money good” until it wasn’t. That statement is a bit over the top, but just because something doesn’t necessarily have to get “fully” marked to market doesn’t mean it shouldn’t be. So, I’d find ways to allocate capital to dry powder private credit funds, while wanting to do a lot more due diligence before buying into one that is already substantially ramped up.

Comfortable with IG

We can be patient as widening will occur if equities go lower. I’d be tempted to get long risk by selling credit protection versus buying bonds.

The cost of funds is less important. Leverage will be more stable, even as banks tighten their lending (and margining) standards. The shorts are likely to be in the “beta” products (so LQD and some of the ETFs could be in play as well). Finally, if I’m right on QT, it will hit bonds more than CDS. Issuance remains a wildcard. Finally, as a contrarian I’m desperate to favor Europe over the U.S., but this winter seems too fraught with danger relative to what is being priced in.

Senior tranches of CLOs.

While I’m nervous about leveraged loans themselves (the building blocks of CLOs), I’m not worried about senior tranches. I continue to believe that it is easier to pick a perfect bracket in the NCAA tournament than blow up a AAA tranche (even if you are trying to blow it up). There could be a bit more downside here as early in the moves the senior tranches tend to follow the leveraged loan market more than they should, but I like this. While I think that the Fed will have to scale back on hikes, they won’t cut too soon. I’d steer towards the weakest managers largely because the structure is supportive against bad management, and you pick up incremental yield while reducing the risk of the manager being able to refinance. You will be exposed to more mark to market volatility, so follow this approach cautiously. It you are buying into lower rated tranches or equity, do NOT follow this advice – it is a highly rated tranche strategy only.

The Rest

Equities unfortunately follow the same pattern we’ve seen YTD. Weakness, led by the companies with the least obvious path to positive/strong free cash flow.

Crypto. New lows, if not a crash.

Commodities. Lower and it will not be a good thing for stocks as I’m convinced that the inflation fears are overblown and recession fears are coming next and that will be evidenced by commodities.

FX. Every fiber in me wants to bet against the dollar. I like the Yen as I expect Japan to become more important in Asia as investors and companies get more nervous about Taiwan and the entire region. In Europe, FX seems to be ahead of other markets in terms of pricing in a dysfunctional winter, so it is tempting to be the contrarian here, but so far, all I can do is book some travel to Europe because the only thing better than eating, drinking, and sightseeing in Europe is doing those things with the Euro below parity!

Despite the title, I have no intention of sleeping through September and if the summer is any indication, September could be as volatile as anything we’ve already seen.

Tyler Durden

Tue, 09/06/2022 – 14:09

via ZeroHedge News https://ift.tt/Gz4UBd7 Tyler Durden