Tech Tumbles To Worst Streak In 6 Years; Crypto, Credit, & Commodities Clobbered

No rescue from Powell’s pain as Putin’s promises pissed off more people from Poland to Paris over the weekend…

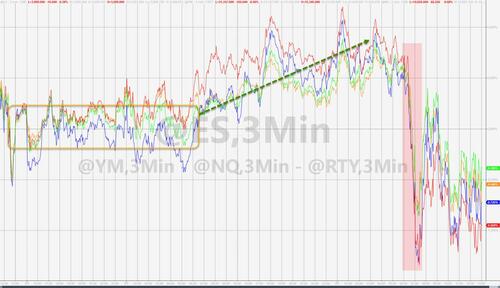

US futures attempted a half-arsed rally overnight but that was all puked back as the cash markets opened…

This left Nasdaq down 7 straight days – its longest losing streak since Nov 2016…

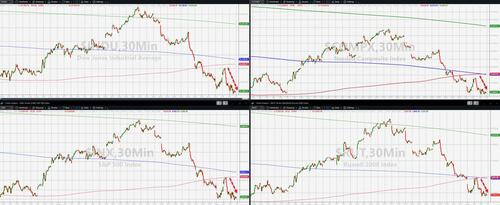

All the US majors attempted rally up to thjeir 50DMAs last week have now failed as fresh cycle lows and being made….

But the Nasdaq has further to fall to catch down to STIRs’ reality…

Source: Bloomberg

Bonds were also clubbed like a baby seal on the day, with yields up 13-14bps across the entire curve (only the short-end saw modest outperformance – up ‘only’ 10bps)…

Source: Bloomberg

Rate-hike (and subsequent rate-cut) expectations both tightened hawkishly today with the terminal rate now above 3.91% (March 2023)…

Source: Bloomberg

The dollar extended recent gains to fresh highs against its fiat peers with the EU session seeing the biggest bid once again…

Source: Bloomberg

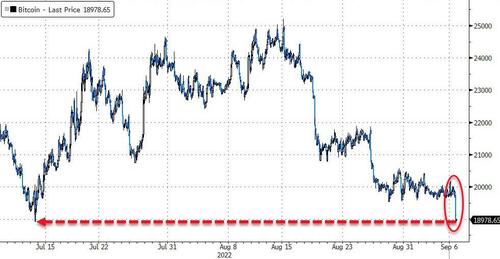

Crypto crashed around 1300ET as some suggested (unsourced) this may be initial dump of MtGox holdings. This pushed Bitcoin down below $19k – testing the spike lows from 7/13…

Source: Bloomberg

Gold fell back after bouncing off $1700 late last week…

Oil prices slipped back after rallying yesterday on OPEC+ production cuts. WTI fell back after failing at $90 once again…

US NatGas plunged over 7% today, hitting a four-week low, as soaring output coupled with lower demand forecasts drags prices down, despite the fact that inventories are 11% lower than their five-year norm.

For context, European NatGas is now trading at around $400/bbl equivalent – triple that of US Natgas…

Source: Bloomberg

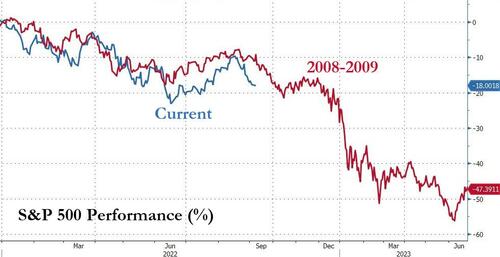

Finally, Dr.Doom himself is back with some ominous warnings. Nouriel Roubini said that stubborn inflation and the coronavirus pandemic might force the Fed to drive the US economy into an even deeper recession than the one it has avoided.

“I worry about a stagflationary debt crisis, because you have the worst of the ’70s in terms of supply shocks, and you have the worst of the global financial crisis because of too much debt, and that combination is dangerous,” he said.

“If you’re behind the curve, eventually the recession is going to be more severe, the loss of jobs and income and wages is going to be more severe,” the economist explained, referring to the Fed’s rate hikes relative to inflation. “You need to be ahead of the curve.”

What does that mean for stocks?

Source: Bloomberg

And Roubini says Fed actions will cause crashes across not just stocks, but bonds, housing, credit, private equity, and other assets in bubble territory. However, he warns, if the central bank gives up on fighting inflation, price increases could spiral out of control.

Tyler Durden

Tue, 09/06/2022 – 16:00

via ZeroHedge News https://ift.tt/SRbEFa1 Tyler Durden