US Services Sector Weakest Since ‘Peak COVID Lockdown’ (Or Strongest Since April)

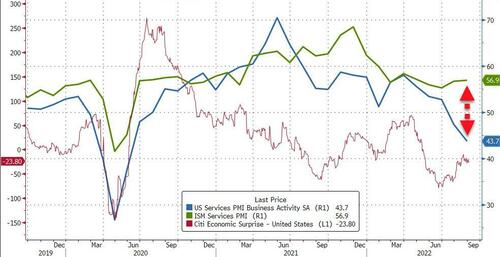

After a mixed picture from the manufacturing side of the US economy (ISM stable, PMI weak), US services surveys were expected to both show more weakness in August.

S&P Global’s US Services PMI did indeed fall and disappoint, printing 43.7 vs 44.1 expected (and below its flash print) and well below its 47.1 print for July – that is the lowest since May 2020.

Of course, in keeping with the utter insanity of the ‘baffle em with bullshit’ data we are seeing, US ISM Services unexpectedly rose in August – extending July’s unexpected rise – at 56.9 (above 55.4 expected) and its highest since April.

Source: Bloomberg

Take your pick – either US Services are contracting at the fastest pace with the lockdowns or are expanding at their fastest pace in 5 months… and the picture was the same mixed view in Manufacturing…

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“August saw the US economy slide into a steepening downturn, underscoring the rising risk of a deepening recession as households and business grapple with the rising cost of living and tightening financial conditions.

“Businesses are reporting a deterioration in output and order books of a degree exceeded since the global financial crisis only by that seen during the initial pandemic lockdowns.

“While orders are being lost across the board as a result of rising prices and the cost-of-living squeeze, the steepest downturn is being recorded in the financial services sector, reflecting the additional impact of higher interest rates and worsening financial conditions.

“Jobs growth has meanwhile cooled as companies grow increasingly reluctant to expand in the face of falling demand and an uncertain outlook, which will serve to further dampen growth in the coming months.

“One positive form the survey was a substantial fall in the rate of input cost inflation, which should help to moderate consumer price growth in the months ahead, albeit with the rate of increase remaining stubbornly elevated.”

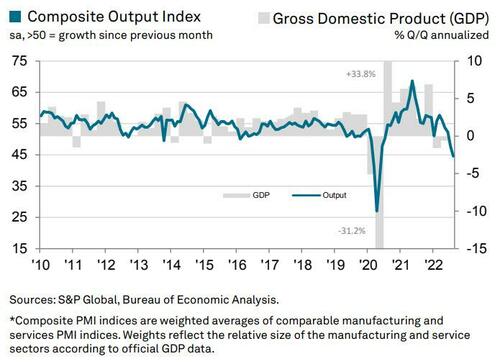

Overall, the S&P Global US Composite PMI Output Index posted 44.6 in August, down from 47.7 in July, to its weakest since peak COVID lockdown.

The US is now the weakest on a composite PMI basis of all the majors…

This signals a sharp contraction in business activity across the private sector.

Despite the degree of confidence rising to a three-month high, weak client demand led to a softer increase in employment in August.

Tyler Durden

Tue, 09/06/2022 – 10:06

via ZeroHedge News https://ift.tt/cx4P7bN Tyler Durden