Not Just Nancy: Lawmakers Have Been Trading Like Drunken Insider Sailors

Approximately 3,700 stock trades reported by 97 current lawmakers posed potential conflicts of interest, as their financial dealings intersected with the work of committees on which they serve, according to an extensive analysis by the New York Times of trades spanning a two year period (2019 – 2021).

To examine the potential for conflicts, The Times used a comprehensive database called Capitol Trades, which was compiled from congressional trading disclosures by the German financial data firm 2iQ Research.

The Times then matched the trades against committee assignments, hearings and investigations to construct a picture of how members’ congressional work and their personal financial transactions could potentially intersect. -NYT

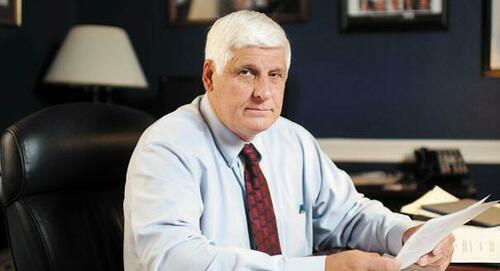

In just one example, Rep. Alan Lowenthal (D-CA) reported that his wife sold shares in Boeing on March 5, 2020, the day before a House committee on which he sits released a scathing report on the company’s handling of its 737 Max jet, which had been involved in two fatal crashes.

In another case, Ohio Republican Bob Gibbs, who sits on the House Oversight Committee, bought shares in pharmaceutical company AbbVie in 2020 and 2021 while the committee was investigating the company and five rivals over high drug prices.

Democratic Rep. Ro Khanna of California’s filings show that his family members bought or sold shares in AbbVie during the committee’s review, as well as seven other companies under scrutiny by the oversight panel on which Khanna sat.

According to the report, “many instances show how legislative work and investment decisions can overlap in ways that at a minimum can leave the appearance of a conflict and that sometimes form a troubling pattern — even if they technically fall within the rules.

13 lawmakers were found to have traded in companies that were under investigation by committees they werved on.

“The American people don’t want us day trading for profit, and engaging in active trading of the very equities that are connected to the policies that we are deciding on and voting on every day,” said Rep. Chip Roy (R-TX), who is co-sponsoring a bill in the House that would require members to put investments in a blind trust – a portfolio managed by an outside adviser who takes no input from the owner.

The 3,700 potentially conflicted trades constitute over 10% of transactions by members of Congress over the period in question.

44 of the 50 members of Congress who were most active in the markets bought or sold securities in companies over which their committee assignments could give them some degree of knowledge or influence. –NYT

Under the 2012 STOCK Act – the sole piece of legislation designed to rein in lawmakers’ trades, most members of Congress are still allowed to make trades that could conflict with their legislative duties – as long as a disclosure is made within 45 days.

“You’re not getting members of Congress to self-regulate the money they can or can’t make,” one DC insider told the NY Post. “Why would they do something that doesn’t benefit them?”

Hilariously, Nancy Pelosi isn’t mentioned in the report, because she does not sit on any legislative committees.

It’s good to be queen…

Tyler Durden

Tue, 09/13/2022 – 17:50

via ZeroHedge News https://ift.tt/MIi625q Tyler Durden