NY Fed Guru Says Powell Will “Overdo It” And Cause A Recession

When BofA’s top Rates strategist, and former NY Fed analyst, Marc Cabana speaks, investors, the Fed – and even his former Fed co-worker and repo guru, Zoltan Pozsar – listen. And what Cabana has to say is always extremely important.

Two months after Cabana’s rates team published a must read note in which it predicted that the Fed will be forced to end QT much sooner than expected…

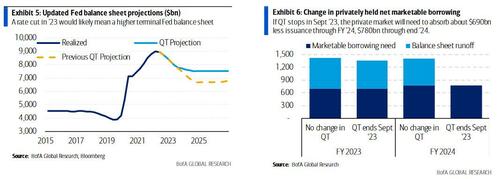

“Fed QT that is stopped in Sept ’23 will result in $1tn less balance sheet reduction vs our prior estimates through end ’24. Over a similar period, early QT end would result in $780b less UST financing need + $350b of additional Fed UST demand (from Fed MBS paydowns reinvested into USTs).”

… today the former NY Fed guru warned of precisely the same thing that we have been saying for years, namely that the Fed won’t stop – and probably can’t stop – until it breaks something. Or some things.

as a reminder, Fed will keep hiking – as it always has – until it breaks something (i.e., the $20T USD short squeeze) pic.twitter.com/AzzEgtfKHr

— zerohedge (@zerohedge) September 13, 2022

Speaking to Bloomberg TV just one hour before today’s CPI print came in far hotter than expected and convinced markets that a 100bps hike is likely on deck next week, Cabana said the Fed is so intent on stopping inflation it will likely raise rates until the US economy is in a recession.

“The Fed is probably going to overdo it,” the global head of US rates strategy at BofA, told Bloomberg TV. “We have seen them turn very hawkish with the labor-market strength. We think that the Fed will try and stick to this higher-for-longer mantra. That’s probably going to result in a recession.”

Shortly after Cabana’s interview, the CPI print sent stocks plunging to their worst daily loss since the summer of 2020, as Treasury yields soared across the curve, with the two-year rate soaring as much as 18 basis points to about 3.75% — the highest since 2007 — while the terminal rate, or the implied rate for where the tightening cycle will top out next year, leaped to about 4.3%.

And since by then the Fed will have broken more than just the economy (last week we had our first major credit event as Mike Hartnett noted), expectations that the Fed will have to cut even faster than before in 2023 also jumped.

Cabana also picked up on a point we made over the weekend, namely that “the Fed probably won’t trust that until they see the labor market soften more meaningfully. It certainly seems like the Fed is dead-set on ensuring that they get that labor market slowdown.”

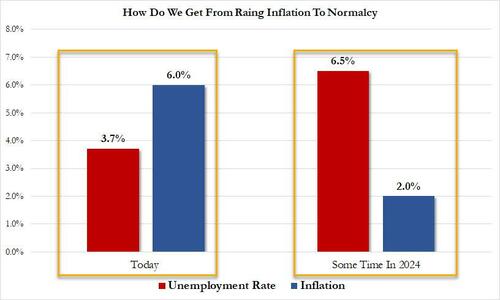

Translation: as Jason Furman wrote late last week, for the Fed to lower inflation to ~2% by the 2024 presidential election, unemployment will have to rise to 6.5% from 3.7% currently…

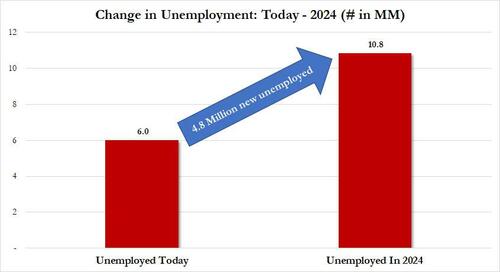

… resulting in a tidal wave of job less equal to at least an additional 4.8 million unemployed.

Fed Chair Jerome Powell and other officials have said the bank is committed to its goal of cutting inflation down to 2% over time. Cabana provided a warning to investors on that point.

“I do worry that this is a Fed that wants to see even more tightening of financial conditions in order to have faith that they will be able to achieve their 2% inflation target,” he said. The risks are skewed in the Fed continuing to sound hawkish, with that being be “a headwind for risk assets,” Cabana added.

And of course, he is right… to a point, the point being when enough Democrats scream bloody murder at the coming unemployment tsunami and force Powell to reverse. What happens then? Why the exact thing we have been saying for over a year: the Fed’s only option will be to raise its “inflation target” from 2% to 3%, something even Fuhrman agrees is coming…

Fed Chair Jerome Powell and other officials have said the bank is committed to its goal of cutting inflation down to 2% over time. Cabana provided a warning to investors on that point. “I do worry that this is a Fed that wants to see even more tightening of financial conditions in order to have faith that they will be able to achieve their 2% inflation target,” he said. The risks are skewed in the Fed continuing to sound hawkish, with that being be “a headwind for risk assets,” Cabana added.

… and an event which will send all assets to fresh all time highs, which may explain why so many stubbornly refuse to sell stocks, well aware that when the Fed pivot comes, all markets will reprice exponentially higher within nanoseconds.

Tyler Durden

Tue, 09/13/2022 – 21:50

via ZeroHedge News https://ift.tt/gcNdHhk Tyler Durden