Watch These Names Ahead Of The Open As $509 Billion Single-Stock Options Expire

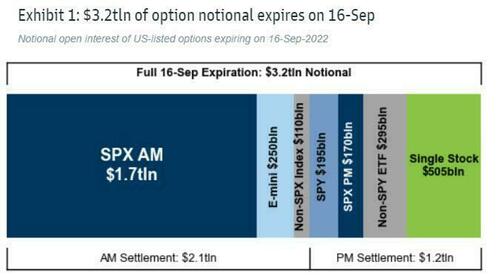

As we noted earlier, today sees $3.2 trillion notional of options expire in the equity markets.

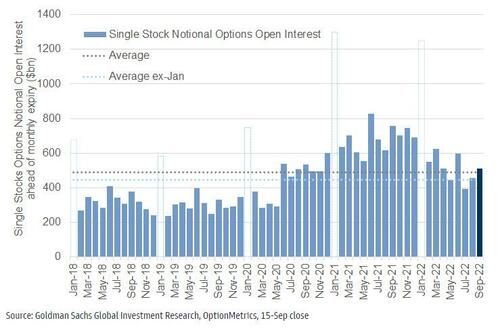

Of that, $509bn of single stock options will expire today, up 30% since the July lows.

This compares to an average of $489bn since 2018, and $448bn outside of the larger January expiries.

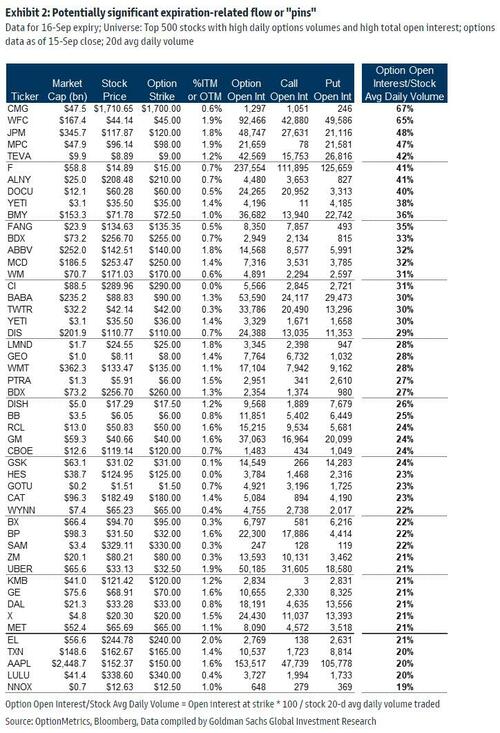

As Goldman’s Vishal Vivek notes, despite the broad decline in single stock options volumes, days around monthly expirations remain important for investors.

At major expirations, options traders track situations where a large amount of open interest is set to expire. In situations where there is a significant amount of expiring open interest in at-the-money strikes (strike prices at or very near the current stock price), delta-hedging activity can impact the underlying stock’s trading that day.

If market makers or other options traders who delta-hedge their positions are net long ATM options, expiration-related flow could have the effect of dampening stock price movements, causing the stock price to settle near the strike with large open interest. This situation is often referred to as a “pin” and can be an ideal situation for a large investor trying to enter/exit a stock position.

Alternatively, if delta-hedgers are net short ATM options (have a “negative gamma” position), their hedging activity could exacerbate stock price moves.

Vivek reveals a list below of stocks where a large percentage of contracts, relative to their average daily volume traded, expire today, potentially leading to “pinning”.

Tyler Durden

Fri, 09/16/2022 – 08:30

via ZeroHedge News https://ift.tt/9bvaGUN Tyler Durden