Yuan Fades Despite ‘Suddenly’ Strong China Macro Data Across The Board

Just days after Morgan Stanley question whether China could stabilize global growth, tonight’s avalanche of macro data from Beijing suggests the unleashing of various liquidity measures – and the random lifting of some COVID-Zero lockdowns – was just enough to juice the data in August as almost everything beat expectations and improved sequentially…

-

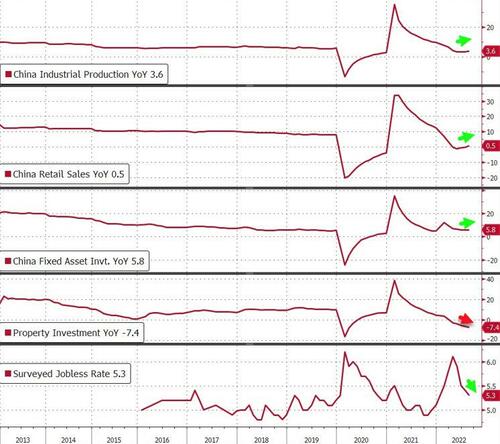

China Industrial Production rose 3.6% YTD YoY in August – IN LINE with expectations of +3.6% and UP from July’s 3.6% MoM rise.

-

China Retail Sales rose 0.5% YTD YoY in August – BEATing expectations of +0.2% and UP from July’s 0.2% MoM drop.

-

China Fixed Asset Investment rose 5.8% YTD YoY in August – BEATing expectations of +5.5% and UP from July’s 5.7% MoM rise.

-

China Surveyed Jobless Rate fell to 5.3 in August – BEATing expectations of 5.4% and BETTER then July’s 5.4% – despite youth unemployment at 18.7%

However, there was was black eye in the bunch:

China Property Investment tumbled 7.4% YTD YoY in August – MISSing expectations of -7.0%% and WORSE than July’s 6.4% decline.

Additionally residential property sales continued their weakness, down 30.3% YTD YoY, suggesting China’s property slump shows little sign of easing…

Digging into the details, Helen Qiao of Bank of America told Bloomberg Television making the point that retail sales has been boosted by auto sales, but broader consumer sentiment remains hostage to the aggressive covid zero strategy.

Looking through the retail sales break down, autos and petroleum saw double digit gains and there was strength also in food, eating out, tobacco/alcohol, medicine. The weakest sectors were cosmetics, furniture and communication appliances

This all seems very well timed – the increase in industrial output is particularly interesting given leading indicators like PMIs and exports have been flagging weakening demand.

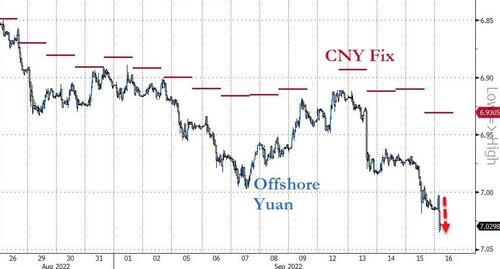

China’s offshore yuan was fading fast after the data – and was rather notably weaker than the RMB Fix – breaking significantly weaker above 7/USD. That is the 17th straight day of Yuan fixing stronger than the offshore rate.

Will China intervene to halt the imported inflation? Judging by the fix – and the flood of suddenly positive data – they are trying.

As Bloomberg’s Enda Curran notes, these numbers will stoke views that the economy has bottomed – but – given the ongoing challenges from extreme weather, the housing data we saw this morning, weakening global demand for China’s exports and of course covid zero, feels like a big call to say things will turn from here.

Ho Woei Chen, economist with United Overseas Bank Ltd. in Singapore, says:

“The improvements in data provided some relief but economic challenges remain. The pace of recovery in production, consumption and investment is still in question for the coming months. The offshore yuan trend is also a function of the Fed’s monetary policy. For PBOC, it is expected to maintain an accommodative policy to help the economy recover.”

Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group, says:

“August’s data does not relieve our concern on China’s growth outlook. It does reflect the impact of Chengdu’s lockdown.”

Furthermore, this is a timely turn for the data given the Party Congress will kick off in four weeks from now and it also runs against the recent narrative that government support isn’t gaining traction.

Tyler Durden

Thu, 09/15/2022 – 22:40

via ZeroHedge News https://ift.tt/FHWdw2Q Tyler Durden