Meanwhile Over At Lehman-Suisse…

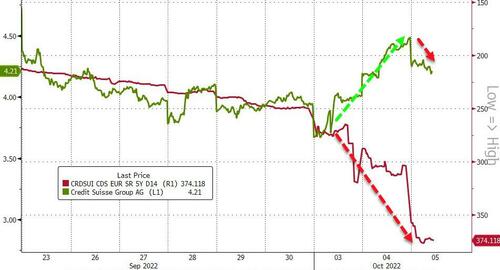

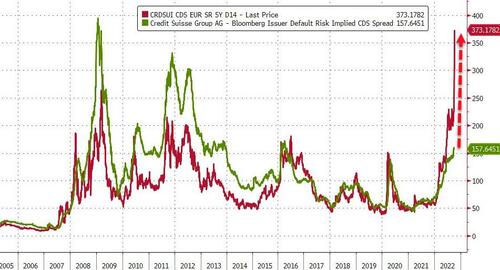

What do credit traders know that equity traders are ignoring?

While equity prices had risen for the last two days, dragged higher by the market’s melt-up, Credit Suisse credit risk continued to wide dramatically…

For context, with CDS trading at around 373bps, the equity market (price and volatility) is implying a spread around 157bps…

So either CDS is drastically too high, and/or CS stock price is too high (or implied vol too low).

SocGen analysts wrote this morning that Credit Suisse needs to aggressively deleverage its investment banking operations, suggesting that the stock’s recent decline reflects management leaning toward retaining IB trading operations and reports of it resurrecting the First Boston name.

Analyst Andrew Lim says capital and liquidity ratios are robust, aggressive restructuring plan can be self-funded and wouldn’t need a capital increase.

Additionally, HSBC said Credit Suisse has no immediate concerns around liquidity and funding.

From a more systemic risk perspective, we note that, according to Neue Zürcher Zeitung, the Swiss government could provide liquidity to struggling lender Credit Suisse Group AG, tapping a state-backed safety net for big banks it plans to introduce.

The government voted in favor of introducing a public liquidity backstop for systemically-relevant banks in March, the newspaper said.

Officials commissioned the ministry of finance to work out details until mid-2023.

Specifically, the state would be granted ‘bankruptcy privilege,’ putting it first in line among creditors, to avoid losses to the public coffers in case of default.

Even though the law would not be passed until next year, officials could move to help Credit Suisse on that basis, NZZ reports, since the Swiss government in early September also gave a credit line of 4 billion francs ($4.1 billion) to struggling electricity company Axpo Holding without a specific legal basis.

Which may explain why professional credit traders bidding protection still.

Finally, Reuters reports that the Swiss National Bank is monitoring the situation at Credit Suisse Group AG “closely”.

“We are monitoring the situation,” Governing Board member Andrea Maechlersaid according to Reuters citing an interview on the sidelines of an event Wednesday.

“They are working on a strategy due to come out at the end of October.

Additionally, Swiss regulator Finma has already said it is monitoring the bank’s stability.

Tyler Durden

Wed, 10/05/2022 – 11:07

via ZeroHedge News https://ift.tt/S5e0ZQ3 Tyler Durden