Tesla Earnings Preview: Sales, Semis, & Shanghai In Focus

With the looming sale of Twitter playing out in the background (along the capital needs necessary to facilitate it coming due), we can’t say we’d be surprised by an “optimistic” spin on Tesla’s earnings this afternoon.

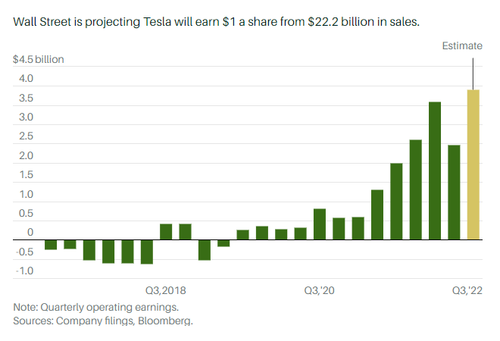

The company is expected to post earnings of $1 per share, down from $1.06 per share, and $22.1 billion in revenue, down from $22.7 billion. “Analysts are penciling in an operating profit of about $3.9 billion, compared with $4.1 billion earlier,” Barron’s reported on Wednesday.

Of the largest questions up in the air for the company is going to be demand. With extra production facilities coming online in the months prior to a global economic slowdown and increased competition, Wall Street will be looking for cues as to whether or not Tesla can remain competitive in the increasingly saturated EV space.

At the end of September that the company was urging employees to help keep up with incredible delivery demand. electrek dutifully reported at the end of September that Tesla was expecting a “very high volume” of vehicle deliveries during the end of the quarter.

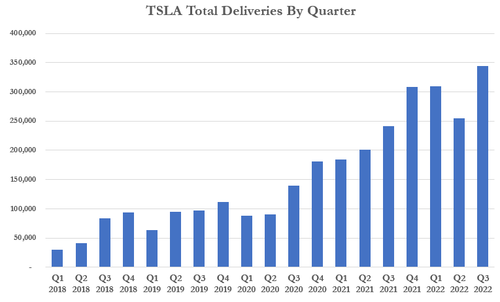

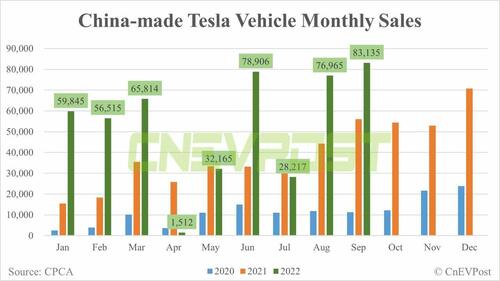

While they did produce a record for the quarter, the numbers fell short of some Wall Street estimates. Tesla also recently set a record for the number of vehicles it delivered in China, despite the fact that the number missed some Wall Street estimates.

The China Passenger Car Association revealed the numbers earlier this month. They mark an 8% increase from August and “outpaced the more than the 5% month-over-month growth of all wholesale electric vehicle sales in China”, CNBC noted.

The prior sales record was set in June when the company sold 78,906 China-made vehicles. The new record comes after Tesla shut down Shanghai for a portion of the summer in order to upgrade the facilities.

Recall, the automaker also broke total delivery records for Q3, despite the fact that it missed expectations from Wall Street for the quarter. Tesla reported 343,830 deliveries for Q3 2022.

The company delivered 325,158 Model 3 and Model Y vehicles, and delivered 18,672 Model S and Model X vehicles. It blamed logistics for its miss of estimates and noted that a number of vehicles were “in transit”.

“Historically, our delivery volumes have skewed towards the end of each quarter due to regional batch building of cars. As our production volumes continue to grow, it is becoming increasingly challenging to secure vehicle transportation capacity and at a reasonable cost during these peak logistics weeks,” the company wrote in its press release earlier this month.

“In Q3, we began transitioning to a more even regional mix of vehicle builds each week, which led to an increase in cars in transit at the end of the quarter. These cars have been ordered and will be delivered to customers upon arrival at their destination.”

During today’s conference call, which Elon Musk has said he will be attending, investors will likely be looking for more details on:

- The company announcing that its first semi trucks would be shipping to Pepsi in December. We noted a video a couple of days ago that showed a Tesla Semi broken down on a highway.

- As we noted days ago, Tesla is dealing with increased scrutiny from the NHTSA, who is investigating a number of Autopilot-related accidents involving motorcycles that took place over the summer. The NHTSA is already in the midst of an ongoing investigation into Autopilot/Full Self Driving (updates may come via the company’s 10-Q filing, instead of the conference call, if any less than stellar developments have occurred).

- The status of the company’s Shanghai plant, which was recently reported to be running under maximum capacity at the end of September. The plant will be running “at about 93% of capacity through the end of year,” Reuters reported in late September. The pace is despite the fact that the factory was recently upgraded to handle more production. The factory is capable of producing 14,000 Model Ys and 8,000 Model 3s per week. The company’s target is 20,500 units a week for the rest of the year, the sources told Reuters.

- The status of Germany, where Tesla has said that it is seeking to double vehicle sales in the country to 80,000 this year.

The call comes following Tesla’s disappointing “AI Day”, in which it revealed its “Optimus” humanoid robot. While the sell side might still be sticking with Musk, AI and robotics professionals had a different take on the company’s robot reveal.

AI researcher Filip Piekniewski called the robots “next level cringe-worthy” and a “complete and utter scam” on Twitter. It would be “good to test falling, as this thing will be falling a lot,” he said.

“Extraordinary claims require extraordinary evidence. What they’ve shown was a lame robotic demo and they bragged about ‘solving’ what everyone in the field already ‘solved’ years ago, and didn’t mention a word about any actual progress in solving the stuff nobody yet solved,” he continued.

“Feels very 101. None of this is cutting edge,” tweeted robotics expert Cynthia Yeung. “Hire some PhDs and go to some robotics conferences Tesla.”

Here’s where analysts stand into tonight’s report:

- Wedbush (outperform, PT $360)

- Tesla’s 3Q deliveries came up short and its “likely logistics driven more than demand concerns”

- “Clearly Tesla had some delivery challenges in the quarter with some isolated soft spots in China”

- Cannaccord (buy, PT $304)

- Production was materially greater than deliveries, the largest difference over the last 15 quarters on absolute basis

- Trust Tesla’s explanation that the gap between production and deliveries is due to logistical issues related to end-of- the-quarter deliveries

- Oppenheimer (outperform)

- TSLA 3Q22 deliveries missed expectations as the firm “transitioned to a new regional delivery system”

- There might be some “incremental downward pressure on shares with these results” but would be “buyers on weakness”

- Cowen (market perform, PT $244)

- There could be early signs of a demand issue and will need to track monthly registrations and 4Q results “to better assess the situation”

- TSLA 3Q delivery figures missed estimates as more vehicles were in transit as production beats expectations

- Morgan Stanley (overweight, PT $383)

- It is unlikely Tesla will compensate for the full-year shortfall fully in 4Q

- “Combined with a mostly non-event AI day, we’d expect shares to give back recent relative strength”

- JPMorgan (underweight, PT $153 from $137)

- While Tesla continues to point to supply constraints as limiting deliveries, the potential for demand destruction looms large given the price increases

Tyler Durden

Wed, 10/19/2022 – 14:21

via ZeroHedge News https://ift.tt/feb7D3G Tyler Durden