Ugly, Tailing 20Y Auction Prices At Highest Yield On Record As Foreign Buyers Flee

While it’s safe to say that nobody expected a solid 20Y auction today, today’s reopening of 19-year 10-month cusip TK4 was a debacle.

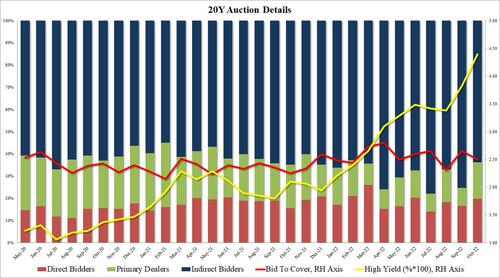

Pricing at a high yield of 4.395%, this was the highest yield since the 20Y tenor returned in May 2020 (and far above last month’s 3.820%). It also tailed the 4.370% when issued by 2.5bps, the biggest tail in the auction’s 2.5 year history. Ugly.

The bid to cover was 2.50, below both last month’s 2.65 and the six-auction average of 2.58. Also ugly.

But what was most notable is that while Foreign buyers took down just 63.7% of the auction, the lowest since February, and far below the 72.4% recent average – extremely ugly; and with Directs awarded 19.9% (above the recent average of 16.8%), Dealers were left holding 16.4%, far above the six-auction average of 10.8% and the highest since January. Definitely ugly.

So in case you missed it, a very ugly auction, which is hardly a shock considering the mauling TSYs have been subject to all day as US holders of duration are selling TSYs to buy gilts now that the BOE capitulated and said it wouldn’t be selling long-dated bonds.

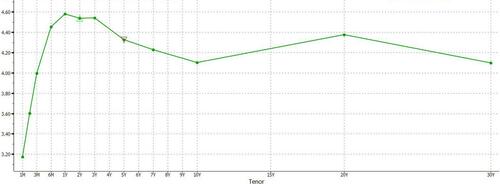

As for the biggest shocker, well the yield curve itself – because if the Treasury was hoping to somehow normalize that 20Y kink on that massively inverted landscape, it has lots more work to do.

Tyler Durden

Wed, 10/19/2022 – 13:24

via ZeroHedge News https://ift.tt/7MDyQk9 Tyler Durden