Chinese Stocks Erupt On Covid Zero Exit Social Media Rumor

Chinese stocks rebounded from extremely oversold territories amid speculation Beijing is preparing to roll back the draconian Covid Zero policy. The country’s Foreign Ministry denied such reports.

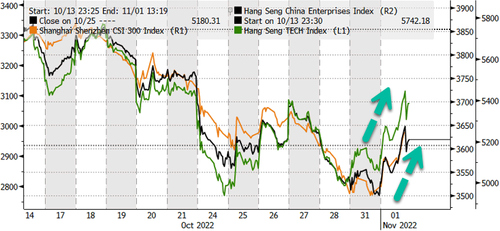

Chinese stocks listed in Hong Kong jumped as much as 7% intraday, rebounding from their lowest levels since 2005 after unverified social media posts circulated a rumor about reopening the economy. The Hang Seng Tech Index surged as much as 9%, the most significant intraday move since April on the speculation.

“Heard that “Reopening Committee” has been formed & led by Wang Huning, Politburo Standing Member. The Committee is reviewing COVID data from US/HK/SG to assess various reopening scenarios, target 03/2023 reopen,” Twitter account “Hao HONG 洪灝, CFA” tweeted.

Heard that “Reopening Committee” has been formed & led by Wang Huning, Politburo Standing Member. The Committee is reviewing COVID data from US/HK/SG to assess various reopening scenarios, target 03/2023 reopen.

HK finally rebounded 3%, A-shares +1%. $EWH $KWEB $FXI $PGJ https://t.co/ZgN2EYqUzH

— Hao HONG 洪灝, CFA (@HAOHONG_CFA) November 1, 2022

Chinese equity indexes pared gains after China’s Foreign Ministry spokesperson Zhao Lijian said he was unaware of any committee preparing to end the Covid-zero strategy.

“I’m not surprised by the rumor circulating online about a conditional reopening,” Liu Xiaodong, a fund manager at Shanghai Power Asset Management Co., told Bloomberg.

China stocks were in a severe rout last week after the Communist Party congress granted President Xi Jinping a third term. Stocks panic crashed the most since 2008 GFC on fears of Xi’s power consolidation and continuation of economically damaging Covid-zero policies.

Meanwhile, last week, JPMorgan’s strategist Marko Kolanovic urged investors to buy the dip in Chinese stocks even though Xi’s tightening grip on power will exact a heavy toll on free enterprise and economic growth.

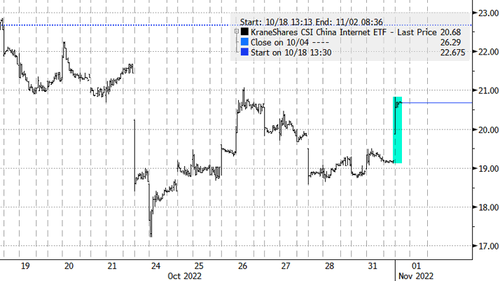

The reopening speculation also led to a jump in Chinese stocks listed in the US. KraneShares CSI China Internet Fund is up more than 7% premarket, while shares of Alibaba Group Holding Ltd., Pinduoduo Inc., and JD.com Inc. are up between 6-8% premarket.

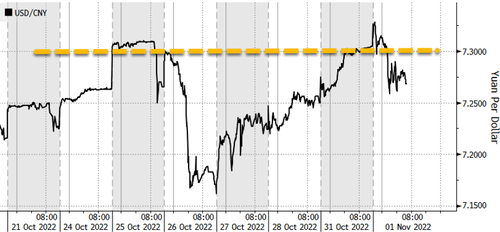

Any confirmation about reopening by authorities could result in a more sustainable upside for Chinese stocks and strengthen the yuan.

“One must be cautious about investing on speculation, particularly because much positive speculation about China Internet in recent months has proven unfounded,” said Adam Montanaro, investment director of global emerging-market equities at Abrdn.

Tyler Durden

Tue, 11/01/2022 – 07:17

via ZeroHedge News https://ift.tt/ZUofYu7 Tyler Durden