Was There An Election This Week?

By Peter Tchir of Academy Securities

Was There an Election this Week?

There was an election this week. The results apparently suited the market. I use “apparently” because the final results are not in. I’ve lost the ability to figure out if this is due to people being extremely cautious about calling elections, the fact that the results are still too close to call because of all the remaining uncounted ballots, or because of the run-offs. Maybe you have found websites that explain the uncalled seats better than the ones that I’ve found. In any case, it looks like Republicans will win the House, which is enough to create some gridlock. There were no red, blue, or green waves.

But it wasn’t the elections that drove stocks, it was mostly the inflation story! CPI sparked a massive one-day rally in spite of the Michigan data (which a few weeks ago would have been viewed negatively) and the “demise” of FTX. Technically the phrase I’m looking for is “filed for bankruptcy,” but demise seems more appropriate.

Two Ways to Lose Money

We will dig into inflation and the Fed, but let’s start with FTX and what happened to crypto this week. I think that it is important because Crypto Crashes Impact the Economy & Markets. We will address that, but let’s start with the two ways to lose money:

-

You buy something that goes down in price (or short something that goes up). There are a myriad of ways to do this and 2022 has given us plenty of opportunities to lose money the “old-fashioned” way. Whether you bought bonds, stocks, or many other things (other than energy), it has been easy to lose money this year. Sometimes it is easy to figure out how you lost money (the Fed tightened a lot, earnings were weak, etc.). Sometimes you can assess “intrinsic” value (based on cash flow, property, plant, & equipment, etc.). And sometimes you just don’t have a clue! I don’t know what a Polkadot is or does, but it still has $6.5 billion of market value according to coinmarketcap.com, even with the price at $5.68 (down from a high of $52.20 on November 7th, 2021). Losing money in something where it is difficult to figure out the intrinsic value is a frustrating way to lose money. Making it even worse, it is even more difficult to figure out when people might step in and buy.

-

You trust your money (or asset) with a counterparty that doesn’t fully pay you back. You can make good or bad investment decisions, but if you cannot get your money (or asset) back, you have lost. This, to me, is the absolute worst way to lose money, because to a large degree, it is often preventable. Some amount of due diligence can help determine the counterparty’s ability and willingness to pay you back. Some analysis of corporate structure, domicile, etc., can help identify risks. Examining the character of the individuals may also help spot risks. I will never forget (and I’ve mentioned this before) the time that the Head of Credit at Bankers Trust spoke to the trainee program (mostly a bunch of derivative nerds) about credit. It seemed like a dull topic, but it was the only part of the training program that I remember (other than betting on Series 7 scores). He emphasized that the ability to pay is the “easy” part of credit analysis, but it is the “willingness” to pay that is difficult and often the more important. In hindsight, at least for those holding assets at FTX, there should have been more soul searching given what went on with Three Arrows Capital and Celsius. I expect a lot more scrutiny in the crypto space now.

When people lose money, they take measures to avoid it. On the asset side, maybe you sell to mitigate losses. Maybe you buy more to dollar cost average, which allows you to claw back a little extra money on any rebound. On the “custodial” side you can figure out a “safer” place to move your assets, assuming you decide not to sell them outright.

Will there be opportunities in crypto?

-

Could we be oversold/have we over-reacted? That is possible, but I don’t think so. Remember, Lehman was NEVER a moment, it was just one part of a story that started playing out a year before they went bankrupt and played out for another 6 months or more after their bankruptcy. FTX is just too big and too mainstream (the list of investors in their seed rounds is a literal who’s who of the private equity space) to not have knock-on effects. I expect to see crypto struggle from here. Not that there can’t be bounces, but I’m looking for bitcoin to break $10,000 before year-end (this is not a new call – see Traditional versus Disruptive Portfolio Construction).

-

Could some entities that offer the best transparency, audited financials, and possibly even regulation be big beneficiaries of the chaos? That is possible. I certainly expect “smart” investors in the crypto space to do more to “secure” their holdings! There are some companies that purportedly are much more diligent on custodial services, have better backing, and have better internal systems than others. They should benefit, but for me, the question is if they will just get a bigger market share of a market that is dying rapidly.

Does this mean anything for markets or the economy?

-

Fortunately, it means less for MARKETS than it did even a few months ago. The “disruptive” portfolio has already had so much pain, the positioning is lower, and any use of leverage has decreased dramatically (ARKK as a metric for disruptive investing is down 57% YTD, 65% for one year, and 75% since its peak in February 2021). Crypto returns have been worse (in many cases) than that. It has been impossible to maintain leverage in the “disruptive” portfolio. More importantly (from my perspective) is that people have stopped equating disruptive stocks with crypto. Companies conduct business, have customers, cash flow, etc. These are the things that help investors put valuations on them. While some of those valuations may have been way off (many stocks are down 75% or more), at least there is a process to figure out what these companies might be worth. For the last six months or so (since the Disruptive Portfolio piece was published), investors have treated crypto very differently than stocks and that is a good thing for markets right now because crypto losses won’t have such an immediate impact on the broader stock market.

-

I’m more worried about the ECONOMY. Many of the crypto haters are so dismissive that they don’t give crypto the credit that it is due! Cryptocurrencies grew to as much as $3 trillion and are well under $1 trillion now. This is my best estimate after taking a look at CoinMarketCap and seeing that bitcoin is down to $350 billion. That is an immense loss in a relatively short period of time! That should (must) affect some spending! At a time when people could quite literally make a living waiting for NFTs to “drop” so they could sell them, there was a lot of “free” money available to be spent. Do not underestimate the fact that much of the inflationary pressure we felt in 2021 was attributable to people making money in cryptocurrencies and NFTs. But that is only one part of the equation. The second part of the equation is the companies in the space. FTX allegedly raised over $1.5 billion in various funding rounds (the Crunchbase stories came up high enough in my searches for FTX funding rounds and seem in line with other stories I’ve read). How much of that money went into buying technology? At its heart, FTX was a technology company that presumably needed servers (not just so Sam could play Lord of Legends with minimal lag), cloud services, etc. What were they spending on ads? They got an arena in Miami named for them, but presumably that was just a small portion of their ad spending. Who knows how much was paid to promoters. How much energy were they using? FTX spent money on technology, ads, and paying people and they likely were significant users of energy. That might actually help decrease energy usage (though watching hash rates, this might not come down for a bit). In any case, companies involved in the crypto space have raised and spent a lot of money (billions) that won’t be spent going forward! In addition to the tightening of purse strings by virtually every private company that now needs to avoid funding at what they view as extremely low valuations, mega-caps like META have had several headlines related to cost cuts recently. The spending that was generated by crypto and disruptive tech was a big part of the inflationary (easy money) push post-COVID and will be greatly diminished (in fact, it is already greatly diminished). Those who benefited from the spending (often big tech of all types) could face pressure and it looks like that already happened in last quarter’s earnings for a lot of big tech companies. That could further slow spending in the economy because when one’s customers suffer, you often also have to take steps to cut costs.

In the coming days and weeks, I am less worried about how crypto will affect markets, but I am EXTREMELY worried that we’ve only seen the beginning of spending cuts related to crypto wealth and crypto/disruptive companies! That will be bad for the economy and it will bleed into certain stocks if I’m correct.

Five More Weeks!

We have almost 5 weeks until the next FOMC meeting and presser on December 15th. Plenty of time for the Fed to Stop Seeing Dead People. There is one more jobs report and a few more inflation prints (including another CPI print).

On jobs, you know that we’ve questioned the disparity between the Household and Establishment data, questioned the potential overstatement of JOLTS data (I’ve been seeing some interesting work in this space), and even questioned the birth/death model adjustments (which is something some serious economists are also questioning). Jobs may remain strong, and it is the one thing that the Fed can use to justify its hawkish stance (though it would be nice to declare victory on inflation and not force Americans into the unemployment lines.)

On inflation:

-

See Inflation Dumpster Dive and More Inflation Dumpster Diving.

-

If you skipped the previous section, all you need to know is that I believe crypto and NFT profits and spending by disruptive companies fueled inflation (tech/semiconductors, various services, advertising, and even energy usage) and that trend has abated and may be reversing. This was a really big contributor to spending that was largely off the radar of mainstream economists (crypto deniers in particular) and is now helping the case for deflation. If you didn’t model it as inflationary before, you won’t pick it up as deflationary now, but two wrongs don’t make a right and won’t help you find inflection points!

-

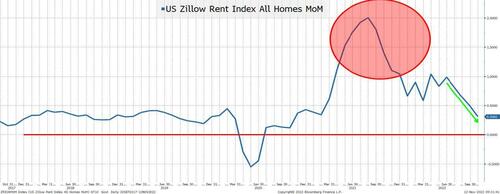

The rent calculations in CPI are absurd. Talk about two wrongs not making a right! Using data that is “knowingly” lagged (amongst other potential flaws) to determine current policy is so wrong that it continues to make my head hurt! A month ago we sent out OER Seems Crazy. The only thing that I could bring myself to send regarding Thursday’s CPI print was from the BLS Report:

“The index for all items less food and energy rose 0.3 percent in October, following a 0.6-percent increase in September. The shelter index continued to increase, rising 0.8 percent in October, the largest monthly increase in that index since August 1990. The rent index rose 0.7 percent over the month, and the owners’ equivalent rent index rose 0.6 percent.”

-

Are they trying to tell me that October rents experienced the biggest monthly gain since 1990 and the second highest gain was in September? That is just unbelievable! If you told me that last summer (when we were still doing QE with rates at 0) was out of control on the rent front and the worst in 3 decades, I would have believed you, but now?

-

On the bright side, even the erroneous data will start picking up the smaller increases that started late last year (and early this year) in the real world as opposed to the BLS world.

-

On the commodity side (see chart below), we might see some month-on-month upticks, but the annual data will look great for many commodities!

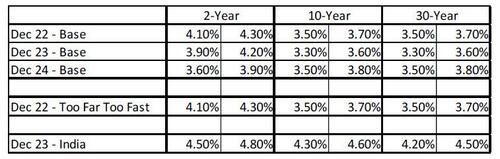

A few weeks ago, I was asked to do a yield forecast for a client (though I’m really more about figuring out the next few months or big moves). What I sent at the time seemed almost outlandish, but it feels like it has some hope now as we get more (non-inflationary) inflation data! Yes, my “base case” is “too far too fast”! The India inspired commodity boon is also an interesting possibility in 2023.

While the Fed is likely to jawbone to the hawkish side, I fully expect 5 more weeks of data to weaken the case for more hikes rather dramatically!

Other “Stuff”

I feel obligated to discuss a few other “things” that could impact the market in the coming weeks:

-

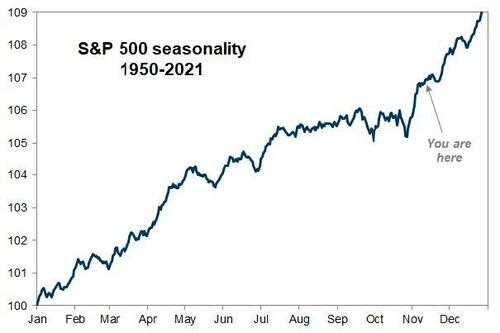

Seasonality. Seasonality could help the market as we head into the holiday season. Recent upward price action could be enough to chase some money off of the sidelines. My sense of “sentiment” is that it remains heavily skewed towards inflation, the Fed, and higher bond yields/lower stock prices despite some chatter about seasonality. Basically “fade the move” still dominates the “seasonality” chatter, but I think that will reverse.

-

Russia. Our Geopolitical Intelligence Group expects little change in the war (Russia will make another push west once the rivers freeze, but Ukraine will defend itself well with all their weapons). However, there is a chance that with the midterm elections behind us and new and more severe energy related sanctions starting to approach (which will hurt the West more than Russia), we could see attempts to cobble together some sort of a deal. China also seems to be gently nudging (if not pushing) Russia in that direction.

-

China COVID 0.1 policy. China is unlikely to back off COVID 0 until after the winter, but with our demand down (and potentially shrinking further) the inflationary supply pressures are receding anyway! Baltic Dry (one measure of international shipping costs) has been receding again and it is down 56% in the past 6 months.

Bottom Line

Let the “everything” rally play out a bit longer.

-

For stocks, I think somewhere between the middle of August and the middle of September levels are a good target. On SPX, we were at 4,305 on August 16th and 4,110 on September 12th, which I guess is a complex way of saying the S&P target is 4,200. This also seems to be the right stopping point if we breach the 200-day moving average of 4,080 (causing a wave of panic buying).

-

On rates, look for bull steepeners! All yields should come down, but the front-end should respond extremely well if I’m correct on the inflation and jobs data and what that means for the Fed.

And there it is: the final curve inverted – Powell’s personal favorite, the 3M-3M18M fwd.

And now we go all-in steepeners pic.twitter.com/43BVckRdGM

— zerohedge (@zerohedge) November 12, 2022

-

Credit should rip tighter here, with high yield poised to do extremely well as credit risk gets priced out of the market, even with an overhang of some big deals that banks will want to offload on any strength (ideally ahead of year-end).

-

Don’t touch crypto, but also don’t expect weaker crypto to drag stocks down!

Ultimately, I think that this all ends with risk-off trading taking us to much lower yields AND lower stock prices, but it is too early to bet on that as we first need to get through the “lower yields are good for stocks” phase!

Tyler Durden

Sun, 11/13/2022 – 14:00

via ZeroHedge News https://ift.tt/jEg8XHU Tyler Durden