Manhattan US Attorney Office Probing FTX Collapse

With Bahamanian regulators and local police investigating SBF – who last night was so drunk and/or high he tried tweeting and failed miserably…

2) H

— SBF (@SBF_FTX) November 14, 2022

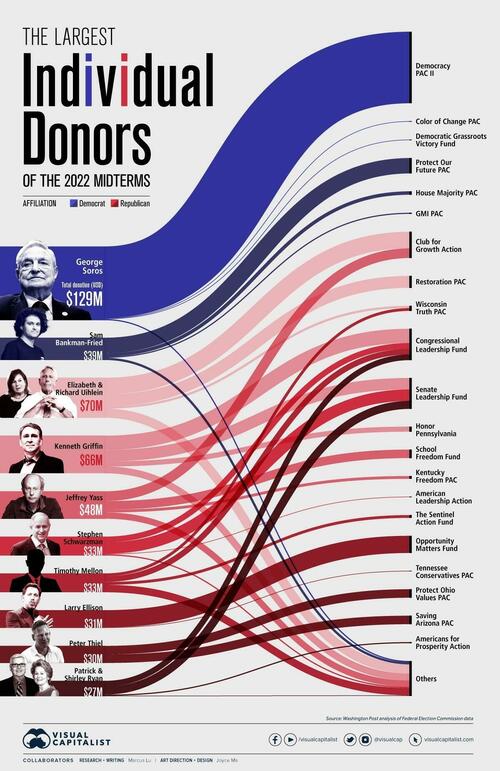

… for “criminal misconduct“, the democrat-controlled US judicial system has finally been dragged kicking and screaming into investigating the single biggest fraud in crypto history, and the second biggest Democratic donor in recent history…

… just one day after Elon Musk saying that SBF will be spared any real punishment precisely because of his generosity (with other people’s money).

SBF was a major Dem donor, so no investigation

— Elon Musk (@elonmusk) November 13, 2022

According to Reuters, prosecutors with the Manhattan district of New York are now probing FTX’s collapse, days after the crypto exchange filed for bankruptcy protection last Friday following a rush of customer withdrawals.

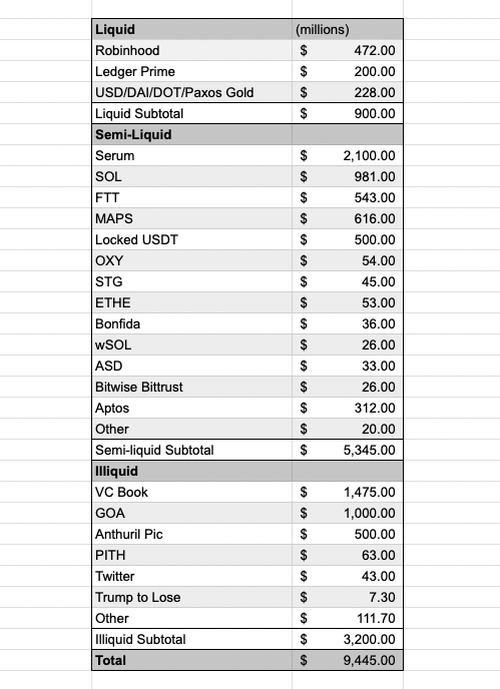

Reuters reported last week that at least $1 billion of customer funds have vanished from FTX, citing sources; others have said the number is much bigger, with FTX holding less than $1 billion in liquid assets vs $9 billion in liabilities.

Of course, the prosecution’s case here is a slam dunk: all that is needed is for the DA to find a recording of the video conference that took place last Wednesday in which 27-year-old Alameda CEO Caroline Ellison (also known as @carolinecapital) said that she, Bankman-Fried and two other FTX executives, Nishad Singh and Gary Wang, were aware of the decision to send customer funds to Alameda. That should be all the vidence of criminal commingling the jury needs to send FTX’s entire senior management team to prison for a long time. But of course, if Elon is right and if the prosecution instead focuses on them being Democrat Donors first and foremost, then SBF will be living a cozy life in some non-extradition country (UAE, Maldives) until the next crypto bubble helps everyone forget what happened.

Tyler Durden

Mon, 11/14/2022 – 10:41

via ZeroHedge News https://ift.tt/HS0oUxb Tyler Durden