Blackstone Might Delay New Private Equity Fund After Redemption Panic

Blackstone shares are down 39% year-to-date, as two of its funds, Blackstone Real Estate Income Trust (BREIT) and Blackstone Private Credit Fund (BCRED), enforced redemption limits given challenging macro conditions.

With both BREIT and BCRED redemptions capped, we can only envision investment advisors and portfolio managers have become increasingly concerned about whether they can pull money out of the non-tradeable funds. Increased panic by investors to withdraw could weigh on the performance of both funds and or spark liquidity issues.

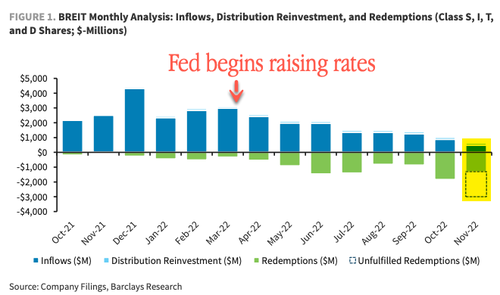

“Redemption limits, rising rates and softening performance are likely to give investors and advisors pause going forward,” Barclays told clients in a recent note. Monthly data shows BREIT’s unfulfilled redemptions erupted in November.

Problems for Blackstone are only spreading. According to Financial Times, citing sources, the New York-based investment manager could delay the launch of the Blackstone Private Equity Strategies Fund, or BXPE, due to the unresolved issues surrounding BREIT and BCRED, dismal fundraising conditions, volatile financial markets, and aggressive Federal Reserve tightening monetary conditions to tame inflation.

BXPE was designed to invest in corporate buyouts and search for equity-oriented opportunities, including late-stage venture investments, musical royalties, and the purchase of stakes in other private equity firms.

Blackstone funds target wealthy investors. The question remains what do these high-net wealth people and their financial advisors know that has caused such a panic with BREIT and BCRED — could it be the understanding of increased risks of a hard economic landing in 2023?

Tyler Durden

Tue, 12/13/2022 – 17:05

via ZeroHedge News https://ift.tt/Nax3L6c Tyler Durden