Dismal 30Y Auction Tails Amid Lowest Demand For The Year

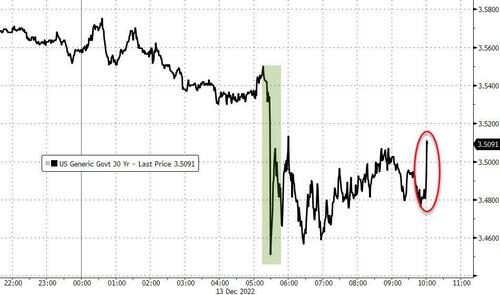

One day after the ugliest 10Y auction since 2016 (which however saw a blowout in yields ahead of the 1pm deadline) moments ago the Treasury sold the last coupon bond of the week ahead of tomorrow’s FOMC meeting when it found buyers for $18BN in 30Y paper (technically 29-Year 11-month reopening of Cusip TL2). In a nutshell, the auction was almost as ugly as the 10Y even though yields tumbled this morning after the far weaker than expected CPI print.

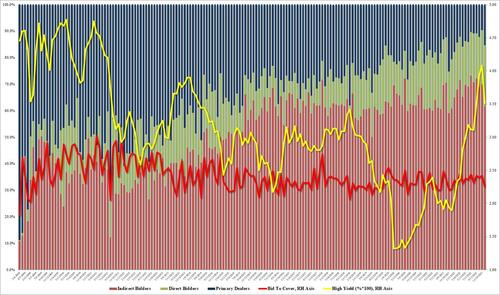

Pricing at a high yield of 3.513%, the auction tailed the 3.482% When Issued by 3.1bps, the biggest tail since December 2021.

The bid to cover tumbled to 2.249 from 2.422, the lowest since Dec 21 and a far cry from the 2.387 six-auction average.

The internals were even more dismal, with Indirects taking down just 61.6% which was also the lowest since Dec 2021. And with Directs jumping to 23.1% from 20.4% – the highest since 2014 – it meant Dealers were left holding just 15.33% (which was an increase from last month’s 9.7%).

In response to the ugly auction, yields jumped although they are still down materially from pre-CPI levels.

Tyler Durden

Tue, 12/13/2022 – 13:26

via ZeroHedge News https://ift.tt/jRi5Wbt Tyler Durden