Futures Storm Higher Ahead Of Last Most Important Datapoint Of 2022

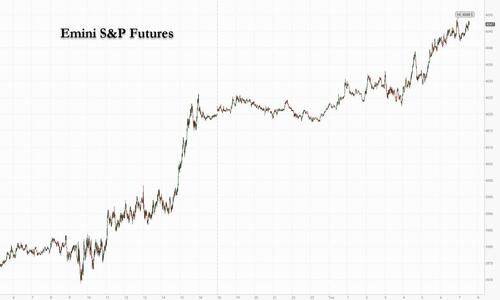

After a dismal start to December, US futures extended their gains to a second day ahead of today’s critical economic data: the final consumer prices print due of 2022 which in turn precedes tomorrow’s final for 2022 FOMC meeting where Powell is expected to slow the pace of hiking to 50bps. Contracts on the S&P 500 rose 0.6% higher by 7:45 a.m. ET while Nasdaq 100 futures gained 0.7%. The underlying benchmarks advanced on Monday in anticipation Tuesday’s inflation data and Wednesday’s Federal Reserve decision will establish a slower pace of interest-rate increases. The greenback halted a two-day rally, while Treasuries gained. Oil futures extended gains by another 0.5% after almost sliding below $70 on Monday on signs of further easing in China’s Covid rules. Oil traded higher by 0.5% on signs of further easing in China’s Covid rules.

Overnight news centered around further re-opening headlines in Greater China (especially Hong Kong) and a decline in German inflation MoM (although in-line with expectations). On the CPI front, Goldman expects a 0.2% rise MoM (vs cons .3%) as a decline in used cars, hotels and apparel prices should help the headline number (on the flip side expect rebound in airfares and another gain in car insurance). Full preview here. There are no major earnings.

In premarket trading, Oracle shares rose 2.5% after the software company reported second-quarter results that beat expectations. Analysts were positive about the company’s execution and revenue growth in the quarter amid tough macro conditions. Pinterest Inc. also gained, rising 3.75%, after Pinterest (PINS US) shares rise 3.7% after Piper Sandler lifted the social networking site to overweight from neutral, noting multiple tailwinds heading into 2023 that are separate from the health of the ad market. here are the other notable premarket movers:

- NetApp stock declines 2.2% on thin volumes as Morgan Stanley cut it to underweight. The broker cut PT to $58 from $66 as a name where the backlog is smaller and estimates are more at risk; raises Coherent (COHR US) to overweight.

- Magenta Therapeutics jumps 48% after the biotechnology company released a positive update on clinical trial data for a drug called MGTA-117 treating acute myeloid leukemia patients.

- Mirati Therapeutics shares rally 18% after the biotech company’s cancer drug Krazati (adagrasib) won approval from the FDA. The drug’s label was as expected, which analysts said was also a positive development.

- Keep an eye on US internet stocks as Citi sees a “significant reset” for the sector in 2023 and says the long-term secular attractions still outweigh the near-term challenges.

- It initiates coverage on 16 stocks, though Amazon remains its top internet sector pick, followed by Meta (META US) within online advertising.

- Watch Carrier Global and nVent Electric as both stocks are downgraded to sector weight from overweight at KeyBanc, which is cautious that sentiment on late-cycle industrial names has peaked.

- Keep an eye on Fiverr, Xometry and Zillow as all three stocks were initiated with buy ratings at Citi, which expanded its coverage of online marketplaces, with a preference for stocks leading their respective categories across autos and real estate.

- Equinix stock may be in focus as it was upgraded to outperform from market perform and named among ‘best ideas for 2023’ at Cowen, with the company seen as strongly positioned to weather a tough economic outlook.

- Credit Suisse says it is positive on the long-term outlook for US industrial tech stocks but more cautious on the near-term, in a note initiating coverage on eight stocks in the sector.

Stocks retreated last week over concerns that strong US economic data will force the Fed to remain aggressive in tightening policy. This inflation print will be closely monitored as traders assess the impact of higher rates on prices. If economists’ projection for a 7.3% expansion in the US consumer price index for November is on target, it would be the lowest reading in 11 months and the fifth consecutive drop. While that would still leave inflation much higher than the Fed’s target of 2%, it could justify a slowdown in the pace of monetary tightening, with a projected half-point move on Wednesday. However, it also leaves the bar low for disappointment and a selloff. A 7.3% print would also spark a 2%-3% gain in stocks according to JPMorgan, which provided the following market reaction matrix:

- Prints 7.8% or higher. Inflation moving higher after the November print would likely have investors questioning whether the Nov was an aberration and if inflation is reaccelerating from here. Further, the near-term inflation outlook is muddled as the Chinese reopening could prove to be inflation. SPX down 4% – 5%; Probability 5%

- 7.5% – 7.7%. If the CPI is to miss hawkishly, the misses this year have ranged from 10bps – 30bps. The 20bps+ misses have triggered an average -2.3% move in the SPX. Should this outcome occur, given the recent bear rally, we could see a more dramatic move here. SPX down 2.5% – 3.5; Probability 25%

- 7.2% – 7.4%. This inline print is a market positive event but given positioning being less light than in November but is historically low. This could initiate short-covering as well as shifting the near-term trading range higher, potentially from 3700 – 3900 to 3850 – 4150. SPX +2% – +3%; Probability 50%

- 7.0% – 7.2%. A bullish outcome that could pull terminal rate lower despite expectations for higher DOTS being released the next day. While 2 data points is not a trend, this may embolden bulls especially if commodity prices continue their decline. SPX +4% – 5%; Probability 15%

- 6.9% or lower. A print here could be the technical end of the bear market, putting this latest rally at a more than 20% move from its lows in October. The logic here is that not only is inflation dissipating but its pace is accelerating. This would give increasing confidence in projections of headline inflation falling ~3% in 2023. Further, if inflation is at 3%, irrespective of the labor market conditions, it seems unlikely that the Fed would hold the terminal rate at 5%. Any Fed pivot will rip Equities. SPX +8% – 10%; Probability 5%

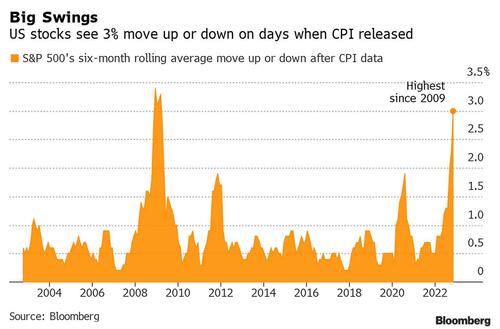

One thing is certain: expect a big move – options are implying a 2.3% move in the S&P today, in line with recent swings which are among the highest in history.

“Today’s US CPI data will give us an idea on how the market pricing for the Fed’s terminal rate will clash with the dot plot projections that will come out tomorrow, and that will, in all cases, hammer any potentially optimistic market sentiment,” Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, wrote in a note. “Therefore, even if we see a great CPI print and a nice market rally today, it may not extend past the Fed decision on Wednesday.”

November CPI is expected at +0.3% m/m and +7.3% y/y; easing supply constraints, discounts to clear excess inventory, a downturn in interest-rate sensitive sectors, and lower energy prices are all factors effecting this month’s print. Our full preview can be found here, and this is the CPI forecast by bank:

- 7.2% – Barclays

- 7.2% – Credit Suisse

- 7.2% – Goldman Sachs

- 7.2% – Bloomberg Econ

- 7.2% – Citigroup

- 7.2% – Morgan Stanley

- 7.2% – Wells Fargo

- 7.3% – HSBC

- 7.3% – JP Morgan Chase

- 7.3% – UBS

- 7.3% – Bank of America

- 7.4% – SocGen

Meanwhile, the US central bank is expected to hike interest rates by 50 basis points on Wednesday.

“I wouldn’t be so bullish on the upside to a softer print. I’m afraid I’d be a bit more bearish on the downside if we get a stronger than expected number,” said Altaf Kassam, State Street Global Advisors’ EMEA head of investment strategy and research in an interview with Bloomberg Television. “I don’t think the market is quite positioned that strongly for the upside. but at the same time, we do expect the numbers to keep trending downwards.”

In Europe, the Stoxx 50 rose 0.5% with tech, banks and energy the strongest-performing sectors in Europe. On the data front, German CPI was -.5% MoM vs cons -.5% (still 10% YoY), while German ZEW economic sentiment improved for the third straight month (highest reading since Feb). Regional focus will turn to central bank decisions later in the week (BOE, ECB and SNB on Thursday. European equity benchmark recovered from Monday’s losses as traders awaited the US release but were also mindful of the European Central Bank’s rate decision due Thursday. The continent’s policymakers are expected to follow the Fed with their own half-point hike. Meanwhile, data showed that UK wages are rising at close to a record pace, maintaining pressure on the Bank of England to keep hiking interest rates despite a worsening economic outlook. Here are some of the most notable European movers:

- Elior climbed as much as 11% after Citi upgraded the stock to buy, saying it sees a pathway toward deleveraging in coming weeks on conclusion of chairman’s strategic review.

- Synthomer shares rise as much as 6% after the company said it would sell its laminates, films and coated fabrics businesses to Surteco North America Inc. for a total enterprise value of approximately $255 million.

- Temenos shares rise as much as 5.2% after the software firm said a US financial institution is extending its relationship with the Swiss company.

- Lufthansa shares jump as much as 4.8% after the German airline raised its earnings forecast for 2022, boosting shares of regional peers Air France- KLM and British Airways-owner IAG.

- Banco BPM gains as much as 4.5% in Milan, the most intraday since Nov. 9, to lead gains on the FTSE MIB index after Fondazione Enasarco completed the purchase of a ~1.97% stake in the lender at a price higher than yesterday’s close.

- Rolls-Royce Holdings slides as much as 4.1% after JPMorgan placed stock on negative catalyst watch as the broker believes that when new CEO Tufan Erginbilgic addresses investors in February, he’s likely to flag weaker-than-expected free cash flow and a strained balance sheet.

- Erste shares fall as much as 3.7% after it was cut to underperform from market perform at KBW on a difficult setup for the Austrian lender into 2023 and an unattractive valuation.

- EMS-Chemie falls as much as 3.4% after it was cut to hold at Stifel with the broker saying it expects a weak 4Q for the polymers maker leading into a tough start to 2023.

- Novozymes shares falls as much as 2.2% after the company was downgraded to equalweight from overweight at Barclays.

Asian stocks eked out a small gain as Hong Kong scrapped more of its Covid restrictions, supporting sentiment ahead of inflation data that could impact the trajectory of future US interest rates.The MSCI Asia Pacific Index rose as much as 0.5%, led by financial and industrial shares. Key gauges in Hong Kong advanced while Chinese stocks linked to reopening were mostly higher, after the city’s leader said restrictions on international arrivals going to bars or eating at restaurants will be removed. Most markets rose as some investors held onto hopes that US consumer price inflation — due later Tuesday — could be soft enough to justify a slowdown in rate increases by the Federal Reserve, which sets policy later this week. The inflation data will be more critical than the Fed’s decision, according to Xi Qiao, managing director for global wealth management at UBS Group AG.

“It’s all going to depend on CPI numbers, whether the Fed is going to pivot or not,” she said on Bloomberg Television. Asian stocks are up about 17% since hitting their lowest level in more than two years in October, boosted by China’s rapid shift away from its zero-tolerance approach to Covid. It remains down about 18% of the year, thanks to its earlier losses from global monetary tightening and China’s draconian lockdown measures.

Japanese equities climbed ahead of US’ reading on consumer prices as a Federal Reserve Bank of New York survey report showed that inflation worries are subsiding. The Topix Index rose 0.4% to 1,965.68 as of market close in Tokyo, while the Nikkei advanced 0.4% to 27,954.85. Takeda Pharmaceutical Co. contributed the most to the Topix’s gain, increasing 2.7%. Out of 2,164 stocks in the index, 1,231 rose and 790 fell, while 143 were unchanged. “If the US CPI growth, released tonight, is as expected, they would have fallen for the fifth month in a row,” said Hideyuki Ishiguro, a senior strategist at Nomura Asset Management. “As the slowdown in inflation becomes decisive, there may have been some moves to adjust positions in the US market.”

In FX, the Bloomberg dollar spot index is unchanged; DKK and EUR are the weakest performers in G-10 FX, NOK and AUD outperform. The greenback was steady to weaker against most of its Group-of-10 peers, though most pairs were confined to recent, narrow ranges. Commodity currencies led the advance while the Swiss franc was the worst performer. The Treasury curve bull flattened

The euro traded in a narrow $1.0528-1.0561 range. Yields on German and Italian debt was mostly steady or slightly higher. Overnight volatility in euro-dollar may be off its 2022 highs, yet remains elevated before the much anticipated US CPI release. The gauge trades at 21.19% after touching a one-month high Monday at 23.32%; this suggests a breakeven of around 100 dollar pips

The pound inched up, advancing a fifth straight day against the US dollar, the longest rising streak in over two months. Gilts extended opening losses, pushing yields 5-7bps higher as money markets raised bets on Bank of England rate hikes ahead of its decision Thursday

Australian and New Zealand dollars advanced as China’s ambassador to the US said that the nation will continue to relax its strict Covid measures. However, gains were slowed by option-related selling attached to large strikes. Bonds in the two nations eased

The yen neared a December low against the dollar before erasing losses

In rates, Treasury futures drifted higher over Asia, early European session and outperforming core European rates with gains led by long-end of the curve. US yields richer by up to 3.5bp across long-end of the curve with 2s10s, 5s30s spreads flatter by 1.2bp and 1.7bp on the day; 10-year yields around 3.58%, outperforming bunds and gilts by 3bp and 8bp in the sector. Gilts 10-year yield up some 7 bps to 3.27% while money markets add to their BOE peak rate bets, pricing the bank rate to climb to 4.75% by August. USTs and bunds 10-year yields relatively muted in comparison, trading within Monday’s range. US auction round concludes with $18b 30-year bond reopening at 1pm, follows Monday’s 10-year note sale which tailed the WI by almost 4bp and a solid 3-year note sale. The US session focus includes November inflation print at 8:30 a.m. New York.

In commodities, WTI drifts 1% higher to trade near $73.91. Spot gold rises roughly $3 to trade near $1,785/oz.

Looking at the day ahead now, and the main highlight will be the aforementioned US CPI release for November. Otherwise though, we’ll get UK employment and Italian industrial production for October, the German ZEW survey for December, and the US NFIB small business optimism index for November. Otherwise from central banks, we’ll get the BoE’s latest Financial Stability Report and subsequent press conference.

Market Snapshot

- S&P 500 futures up 0.3% to 4,003.75

- MXAP up 0.2% to 157.43

- MXAPJ up 0.2% to 513.26

- Nikkei up 0.4% to 27,954.85

- Topix up 0.4% to 1,965.68

- Hang Seng Index up 0.7% to 19,596.20

- Shanghai Composite little changed at 3,176.33

- Sensex up 0.7% to 62,552.76

- Australia S&P/ASX 200 up 0.3% to 7,203.27

- Kospi little changed at 2,372.40

- STOXX Europe 600 up 0.4% to 438.53

- German 10Y yield little changed at 1.95%

- Euro little changed at $1.0538

- Brent Futures up 2.0% to $79.54/bbl

- Brent Futures up 2.0% to $79.56/bbl

- Gold spot up 0.2% to $1,784.14

- U.S. Dollar Index down 0.12% to 105.01

Top Overnight News from Bloomberg

- While equity traders are bracing for potentially significant stock swings after Tuesday’s US inflation data, their currency counterparts look a little more circumspect. Overnight expectations for swings in major currencies like the yen, euro and Australian dollar are elevated but well off their highs of the year. In fact they indicate the currencies are unlikely to break out of their recent trading ranges

- The gap between yields on one-year Treasury Inflation-Protected Securities and similar- dated nominal government notes stands at 2.18%, reflecting market expectations for the average inflation rate over the coming year. That would require price gains to slow by more than 5 percentage points, a pace seen in only three instances in the past six decades

- UK average earnings excluding bonuses were 6.1% higher in the three months through October than a year earlier. That’s the most since records began in 2001, barring the height of the coronavirus pandemic

- Strikes and industrial action had the biggest impact on the UK in 11 years in October — two months before the latest round of protests crippled public services. At least 417,000 days of work were lost due to labor disputes in October, the most since November 2011, the Office for National Statistics said Tuesday

- The BOE has recommended the UK take swift regulatory action to strengthen the pensions market after recent bond market turmoil exposed shortcomings in its oversight

- The investor outlook for Germany’s economy improved to its highest level since Russia’s invasion of Ukraine — the latest sign that concerns over a deep winter slump are receding. The ZEW institute’s gauge of expectations climbed to -23.3 in December from -36.7 the previous month, better than economists polled by Bloomberg had predicted

- China’s Covid wave is rippling through the nation’s financial industry, with currency volumes falling as traders call in sick and banks activating backup plans to keep operations running smoothly

- China is delaying a closely watched economic policy meeting due to start this week after Covid infections surged in Beijing, according to people familiar with the matter

- Hong Kong will remove a ban on international arrivals going to bars or eating at restaurants, and stop requiring people to use a health app to enter venues, Chief Executive John Lee said at a press conference Tuesday. He didn’t mention whether the government will retain the mask mandate

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly kept afloat following the gains on Wall St where the major indices unwound recent losses although the upside was capped in Asia ahead of US CPI data and a slew of central bank rate decisions. ASX 200 was underpinned by strength in tech, industrials and financials, albeit with gains limited by weakness in miners and after an improvement in consumer confidence was offset by a deterioration in business surveys. Nikkei 225 briefly reclaimed the 28,000 level which it failed to sustain amid tentativeness before the risk events. Hang Seng and Shanghai Comp were varied as Hong Kong benefitted from reopening optimism amid reports that quarantine-free travel is to begin in January and with Chief Executive Lee announcing an easing of restrictions, while the mainland lacked conviction after weaker-than-expected financing data and with Japan and the Netherlands agreeing in principle to join the US in controlling exports of chipmaking equipment to China.

Top Asian News

- China’s ambassador to the US Qin Gang said he believes China’s COVID-19 measures will be further relaxed in the near future and international travel to China will become easier, according to Reuters.

- China-Hong Kong quarantine-free travel is to begin in January, according to a report citing local press. Hong Kong Chief Executive Lee later announced an end to the COVID contact tracing app requirement and will eliminate the three-day arrival monitoring period, while the Amber code on international arrivals is to be lifted on Wednesday.

- Japan and Netherlands have agreed in principle to join the US in tightening controls on exports of advanced chipmaking equipment to China, according to people familiar with the matter cited by SCMP. Japanese Trade and Industry Minister Nishimura stated that they will take appropriate measures on chip-related export curbs to China taking into consideration each country’s regulations, while they are checking with Japanese companies on the impact of chip curbs to China and are not hearing of any major impact.

- Japan’s government is to use construction bonds for part of SDF facilities as part of efforts to boost spending, according to Kyodo. However, Japanese Finance Minister Suzuki later stated there was no decision yet on whether to issue construction bonds to pay for developing self-defence forces facilities and that generally speaking, it is difficult to regard bonds as a stable funding source, according to Reuters.

- China intends to allocate over CNY 1tln as a support package to bolster the domestic semiconductor industry, via Reuters citing sources.

- China will delay its economic policy meeting amid a surge in COVID cases in Beijing, Bloomberg reports.

European bourses are firmer across the board Euro Stoxx 50 +0.8%, though action has been choppy with fresh drivers limited. Sectors were initially mixed, but have since moved more convincingly into the green, with Tech outpacing. Stateside, US futures are firmer across the board, though have been choppy alongside European peers but the magnitudes less pronounced pre-CPI, ES +0.5%.

Top European News

- EU lawmakers agreed to tougher draft labour rules for the gig economy ahead of negotiations with EU countries to work out the details, according to Reuters.

- Swiss SECO Forecasts: confirms its previous assessment. The Swiss economy is expected to grow at a significantly below-average rate of 1.0% in 2023, followed by 1.6% in 2024.

- Germany VDMA engineering group confirmed 2022 and 2023 forecasts for German engineering production; sees +1% real production growth in 2022, and a 2% decline in 2023.

- BoE Financial Stability Report: Urgent and robust measures needed to fill gaps in LDI fund regulation; must remain resilient to higher level of rates than they can now withstand.

FX

- DXY is bid, but has been unable to convincingly breach the 105.00 mark despite a brief foray to 105.09, with peers generally contained vs USD.

- At the top of the pile is the AUD despite NAB data with Westpac consumer metrics assisting ahead of RBA’s Lowe, lifting to 0.6800.

- CAD & NOK have seen a modest rebound given benchmark pricing and in wake of recent pressure, particularly in the CAD.

- EUR is modestly softer despite constructive ZEW data, albeit mixed vs exp., while USD/JPY has slipped after a failed test of 138.00.

- PBoC set USD/CNY mid-point at 6.9746vs exp. 6.9758 (prev. 6.9565)

Fixed Income

- EGBs have been pressured throughout the morning, with Bunds initially lagging though they have staged a marked rebound to downside of just 20 ticks.

- Amidst this, Gilts were dented by relatively soft UK supply, though have since reverted to pre-auction levels while BTPs were bid on their own outing.

- USTs buck the trend and remain modestly firmer ahead of 30yr supply and US CPI.

Commodities

- Overall, the crude benchmarks have been relatively steady throughout the European morning posting upside in excess of 1.0% and remain towards the top-end of yesterday’s parameters.

- Spot gold and silver are modestly firmer despite the choppy, but ultimately modestly constructive, risk tone. Though, the yellow metal is capped by USD 1790/oz and the 200-DMA a dollar below.

- Ecuador’s state oil firm Petroecuador said a weather power outage affected hundreds of wells in its most productive blocks, according to Reuters.

- Italy PM Meloni says the majority of EU member states back a dynamic gas price cap; EU Commission’s energy proposal is still in adequate.

Geopolitics

- US shipped the first portion of its grid equipment aid to Ukraine, according to US officials.

- EU ambassadors unanimously approved in principle a financial support package to provide Ukraine with EUR 18bln in 2023, according to the Czech Republic.

- South Korean envoy for Korean peninsula peace said North Korea is becoming more aggressive and blatant in its nuclear threat, while South Korea, Japan and the US will coordinate sanctions and close gaps in the international sanctions regime. Furthermore, the US envoy for North Korea said Pyongyang’s behaviour presents one of the most serious security challenges in the region and beyond, while the Japanese envoy for North Korea said the three countries have elevated their security cooperation to an unprecedented level and they will examine all options including counter-strike capabilities and will be more vigilant against North Korea’s cyber threat, according to Reuters.

US Event Calendar

- 06:00: Nov. SMALL BUSINESS OPTIMISM, est. 90.5, prior 91.3

- 08:30: Nov. CPI MoM, est. 0.3%, prior 0.4%

- 08:30: Nov. CPI YoY, est. 7.3%, prior 7.7%

- 08:30: Nov. CPI Ex Food and Energy MoM, est. 0.3%, prior 0.3%

- 08:30: Nov. CPI Ex Food and Energy YoY, est. 6.1%, prior 6.3%

- 08:30: Nov. Real Avg Hourly Earning YoY, prior -2.8%, revised -2.7%

- 08:30: Nov. Real Avg Weekly Earnings YoY, prior -3.7%, revised -3.5%

DB’s Jim Reid concludes the overnight wrap

I’m still trying to recover from watching the last episode of one of the most popular TV series this year last night, namely “The White Lotus”. It was a brilliantly uncomfortable series to watch. No spoilers here though. On the last EMR before Xmas I always list my top 10 TV series/box sets of the year. This will feature highly but there is currently an unusual number one that we just finished watching over the weekend. It was brilliant but I suspect not many of you will have seen it. The clue is that it is a dramatised true story about an event that happened 50 years ago this year. Anyone that gets it from that clue will win the highest-value prize our compliance team can authorise – a very big well done email.

Today we have the last in the series of another 2022 epic and that’s the final US CPI to be released this year. Indeed, we don’t get many days as important as the next two, and the US CPI today and the FOMC tomorrow are likely to be the difference between a big Santa Claus rally and a visit from Scrooge ahead of Christmas. Bear in mind the S&P 500’s best and worst day of the year so far have both come on a CPI day, and it was only last month that the downside surprise triggered a seismic market reaction, leading to the biggest one-day gain for the S&P 500 (+5.54%) since April 2020, and the largest daily decline in the 2yr Treasury yield (-24.7bps) since 2008. Since close of business the day before the last release the S&P 500 is +6.46%, 2yr yields -20.4bps, 10yr yields -49.6bps and the USD index -5.05%.

The big question now is whether last month’s positive surprise was like July’s, which was then followed by far more negative prints in August and September, or whether this is the start of a more durable shift in inflation that would allow the Fed to ease off.

Our colleagues in the Asset Allocation team (link here) wrote on Friday about event vol heading into the CPI data and the FOMC decisions. Their view is that a build-up of massive vol premium heading into the last two CPI prints (and its subsequent dissipation) was a key driver of the outsized rallies. They think that if the event vol premium stays at current levels, then a post-event rally is still more likely, whereas a selloff would require inflation to surprise strongly on the upside. So if they’re right the risk/reward favours a rally after these two big events this week.

In terms of what to look out for today, our US economists are expecting a +0.21% monthly gain in headline CPI (consensus 0.3%), which in turn would take the year-on-year measure down to +7.2% (consensus 7.3%). On core CPI, they see it coming in at a stronger +0.29% (consensus 0.3%), which would take year-on-year measure to +6.1% (consensus 6.1%). And if we do get a surprise on either side, look out for whether that’s broad-based or driven by outliers, since one of the factors driving last month’s rally was optimism that this was a broader decline in inflation. That said, whatever the number is there won’t be any chance to hear from Fed officials, since they’re now deep into their blackout period ahead of tomorrow’s decision.

Ahead of the CPI release, yesterday saw 10yr US Treasuries edge +3.3bps higher to 3.61%, albeit having come back from an intraday low of 3.52%. The intraday turnaround started early in New York trading but was probably helped by a 10yr auction that didn’t have the best reception. It remains to be seen if that was the result of wary investors ahead of CPI or just holiday-induced lack of liquidity. For their part, 2yr Treasuries largely moved in parallel, climbing +3.1bps to 4.38%.

There was a bit of an increase in terminal rate pricing, with Fed funds futures for the May 2023 meeting up +2.0bps to 4.98%. But fundamentally it’s still in the range around 5% where it’s been for the last two months, and the big question is whether today’s release will see it durably break out from that zone in either direction. Over in Europe, there was also a modest rise in yields ahead of Thursday’s ECB decision, with those on 10yr bunds (+0.8bps) and OATs (+0.8bps) moving higher, with BTPs (-0.6bps) retreating a touch.

In the meantime, US equities posted a strong recovery following last week’s declines, with the S&P 500 up +1.43% on the day. Energy stocks were the biggest driver of that amidst a rally in oil prices, and Brent crude (+2.48%) advanced to $77.99/bbl, moving back into positive territory on a YTD basis. Overnight they’ve risen a further +1.31%, advancing to $79.01/bbl on the back of optimism about China’s reopening boosting the demand outlook. However, at the other end of the equity leaderboard were the megacap tech stocks, with the FANG+ index down -0.14% on the day. And back in Europe, equities lost ground as they caught up with the late US selloff on Friday, with the STOXX 600 down -0.49%.

Overnight, Asian equity markets have put in a mixed performance after rising shortly after the open. The Hang Seng (+0.38%) is in positive territory following the news that Hong Kong is further easing its Covid restrictions, and it was confirmed that the ban on international arrivals going to bars or restaurants would end, and people would no longer require to scan a QR code to enter venues. That was particularly beneficial to more Covid-sensitive assets, such as airlines and leisure stocks. Elsewhere, the Nikkei (+0.40%) is trading higher whilst the Shanghai Composite (-0.06%), the CSI 300 (-0.19%) and the KOSPI (-0.25%) have moved lower. In the meantime, US equity futures are pointing modestly lower ahead of today’s CPI release, with contracts on the S&P 500 (-0.06%) and the NASDAQ 100 (-0.13%) both down a bit.

There wasn’t much on the data side yesterday, although the Fed did get some promising news on inflation expectations, since the New York Fed’s latest survey showed expectations decreasing over all time horizons. For instance, the one-year measure fell to a 15-month low of +5.2%, and the three-year measure ticked down to +3.0% (vs. +3.1% previously). Elsewhere, UK GDP rose by a slightly faster-than-expected +0.5% in October (vs. +0.4% expected), but that growth was partly driven by the bounceback from the September bank holiday for the Queen’s funeral.

To the day ahead now, and the main highlight will be the aforementioned US CPI release for November. Otherwise though, we’ll get UK employment and Italian industrial production for October, the German ZEW survey for December, and the US NFIB small business optimism index for November. Otherwise from central banks, we’ll get the BoE’s latest Financial Stability Report and subsequent press conference.

Tyler Durden

Tue, 12/13/2022 – 08:08

via ZeroHedge News https://ift.tt/VpMn58b Tyler Durden