Nomura: A Few Observations Into CPI…

Nomura’s Charlie McElligott’s note this morning begins with a warning of sorts:

Fear of the dovish “right-tail” response to CPI is back… Bigly!

Expectations into today’s CPI print for a continuation of the “past peak inflation = past peak tightening = FCI EASING” theme are building, which is contributing now to this ongoing “bullish” tilt towards Upside optionality in US Treasuries / STIRS and Equities.

Remarkably in Bonds, despite yesterday’s $32B 10Y UST reopening yesterday going pear-shaped and tailing by a wild 3.7bps…Treasuries still couldn’t generate any follow-through weakness thereafter, as there were plenty of buyers backstopping the initial dip who need to take advantage of pullbacks and add / cover, despite many having already begun turning the boat around on the move from 4.30 to 3.50…modest selloffs now meet buyers, which is a change.

- Short-covering CTAs and Leveraged, Macro Steepener unwinds into the persistent “recession” pricing impact flattening via long-end, Pension STRIP-ping demand for Duration, Japan halting selling / paying and some now looking to receive while others are buying long-end, increasing talk of central bank buying with USD reversal lower, AMs rebuilding Duration vs signif underweights, Dealer “short Gamma” to upside (TY 114.50, 115, 116 strikes) and MBS convexity hedging overhead

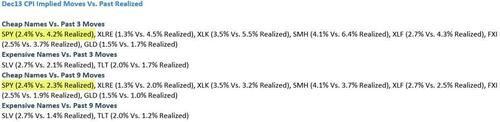

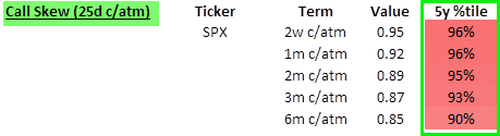

Within US Equities Index / ETF Options yesterday, we saw an impulsive “Spot Up, Vol Up” day yesterday, as traders & funds scrambled to re-price CPI expectations after weeks of us telling you that this event was underpriced, as for nearly the entire year, CPI’s have “over-realized” vs too-low implieds

Source: Nomura

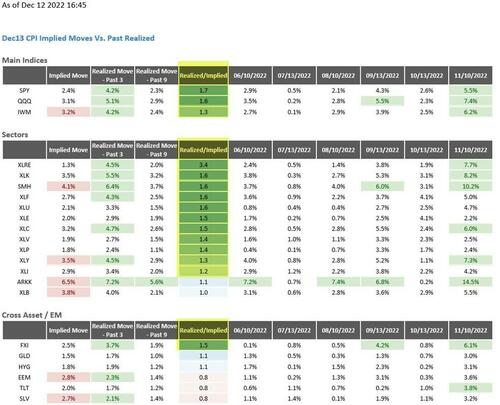

This surge in short-dated iVol was supported by some grabbing into deep OTM Calls in 0-1 DTE SPX Options: it was remarkable to see that 5% of all SPX 0-1DTE Call Options volume traded yesterday were >105% moneyness…which is a LOT of volume at “extreme” Deep OTM Upside strikes in such short-dated / highly convex Options

Source: Nomura

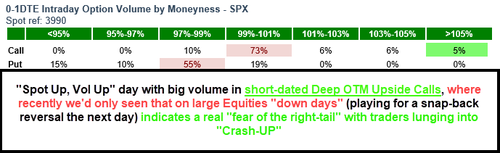

That is 2nd highest %age of overall 0-1DTE Call Options volume up at that such deep OTM strikes going back back start November, outside of Nov 9th (6%) and equal to Nov 2nd (5%)…where critically / rationally, it should be noted that both of those days were big SPX drawdowns, -2.1% and -2.5%, respectively…as funds hedged for a next-day snapback / reversal.

Further, this was the highest overall SPX 0-1 DTE Call Option volume allocation to that >105% moneyness on any “up” date since at least start October

Source: Nomura

Point-being, this very different dynamic yesterday vs those prior two days of “short-dated Call Options showing outlier volume in big (Upside) moneyness” really clarifies to me that the market remains terrified of being caught short the “right tail” into the potentials for a “light” CPI print today

Source: Nomura

All of that said…as per the rally in Spot which is forcing covering / netting-up as funds begin to pick-up exposures again, there is also a need for some *actual hedges* again—so we did see Skew steepen yesterday, with VVIX rising 4.5 points (LOTS of VIX Call buying, FWIW)

WHY THE “FEAR OF THE RIGHT-TAIL?”

CHRONIC UNDER-POSITIONING / UNDER-EXPOSURE TO AN EQUITIES RALLY AGAINST BEARISH EARNINGS EXPECTATIONS AHEAD OF CONSENSUS “RECESSION” VIEW FOR ’23:

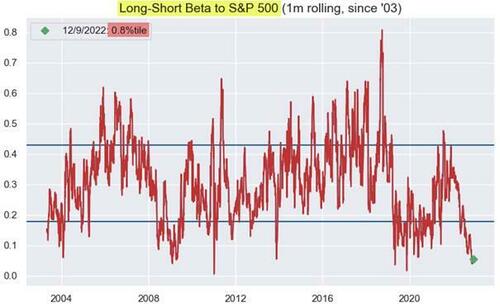

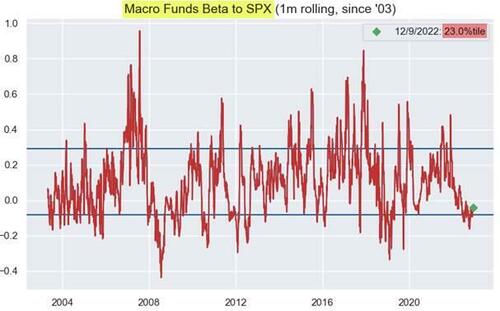

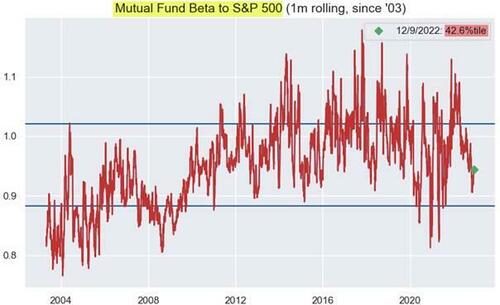

Simply put, Fund under-positioning / under-exposure (low nets / grossed-up shorts / high cash / highly “Low Risk” & “Defensive” vs low “High Beta” exposure) means the “pain trade” in Equities remains HIGHER, particularly into the accelerating “past peak inflation = past peak tightening = de facto FCI EASING” expectations ahead of the new CPI print:

Equities Long-Short Fund Beta to S&P 500 = 0.8%ile since ‘03

Source: Nomura, HFR

Macro Fund Beta to S&P 500 = 23.0%ile since ‘03

Source: Nomura, HFR

Equities Mutual Fund Beta to S&P 500 = 42.6%ile since ‘03

Source: Nomura

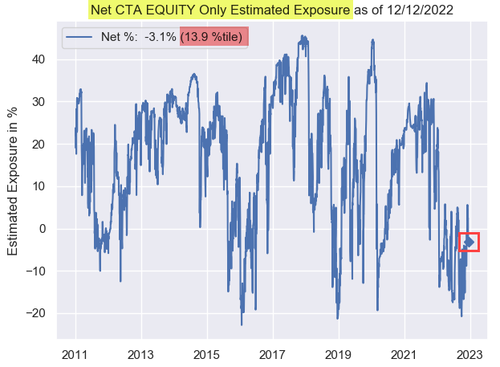

CTA Trend Global Equities estimated Net Exposure = 13.9%ile since 2011

Source: Nomura / QIS

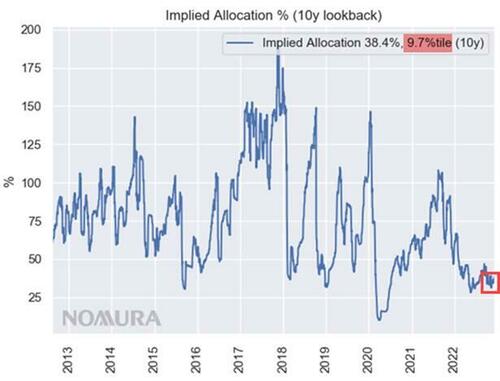

Vol Control- / Target Volatility- Fund Estimated Exposure = 9.7%ile since 2012

Source: Nomura

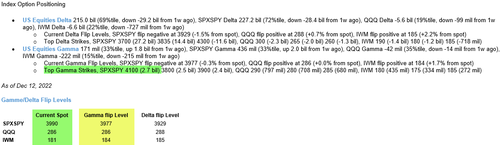

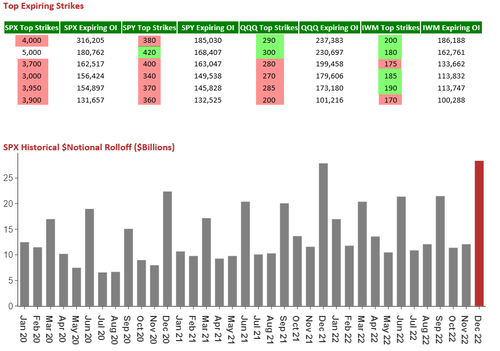

AND ALL AHEAD OF “SERIAL OP-EX” FRIDAY, WITH ENORMOUS ROLL-OFF OF $GAMMA / $DELTA:

Source: Nomura

Source: Nomura

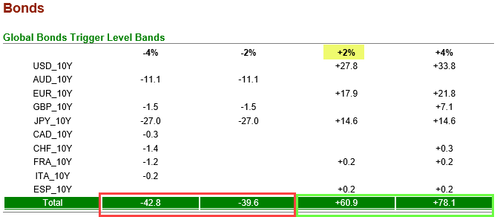

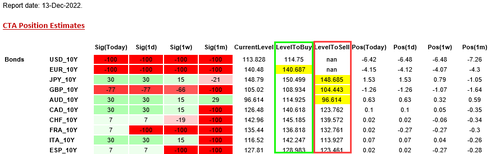

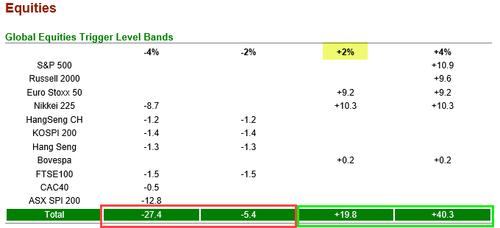

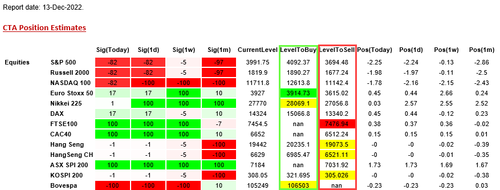

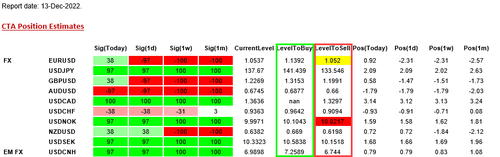

WHILE “CTA TREND” SIGNAL TRIGGERS SHOW SIGNIFICANT “TWO WAY” RISK,

LARGER $NOTIONAL SIZE REMAIN TILTED TOWARDS “BUY-TO-COVER / FLIP LONG” FLOWS IN BOTH EQUITIES AND G10 GOVIES, WHILE FX SHOWS CREEPING “SHORT US DOLLAR” EXPRESSIONS, AS LEGACY “LONG USD” TRADES UNWIND WHILE FCI EASES:

Source: Nomura / QIS

Source: Nomura / QIS

Source: Nomura / QIS

Source: Nomura / QIS

Source: Nomura / QIS

Source: Nomura / QIS

Tyler Durden

Tue, 12/13/2022 – 08:13

via ZeroHedge News https://ift.tt/N9wo84g Tyler Durden