Watch Live: Trading Vol Triggers & Event Risk Into Friday’s Massive Option Expiration

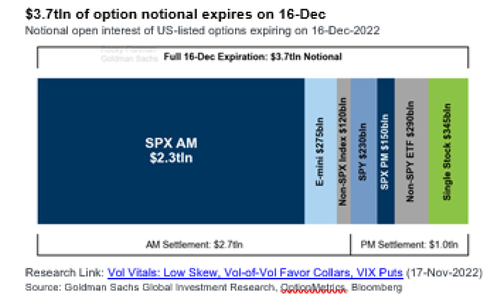

As we detailed over the weekend, this week’s options expiration is a doozy with a massive $3.7tln of option notional expires on 16-Dec…

With today’s event risk trigger out of the way (CPI) – prompting an insta-bid and slow fade in stocks…

We look ahead to tomorrow’s event risk trigger (FOMC) and SpotGamma explains below that they generally feel that the expectation of absolutely massive moves in the next few sessions is overdone.

This is based around the view that as soon as the CPI/FOMC events pass, the extreme implied volatility should come off sharply.

This should lead to large changes in 12/16 OPEX values which are supercharged due to this event volatility.

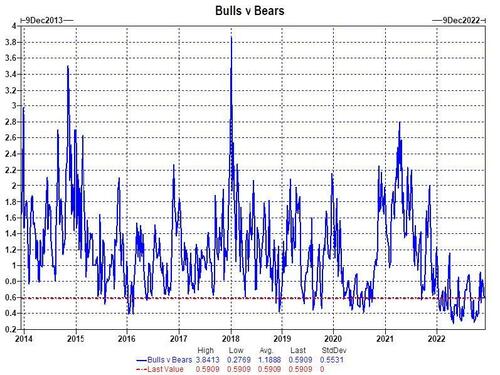

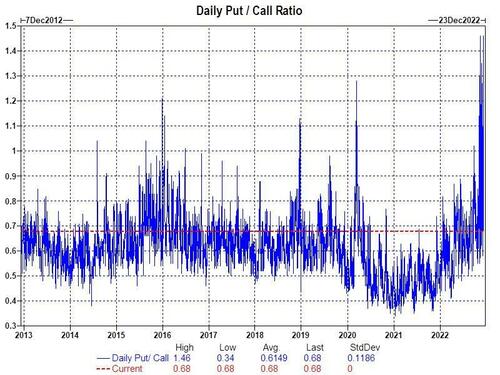

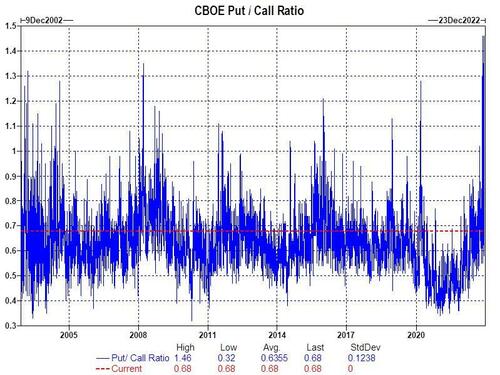

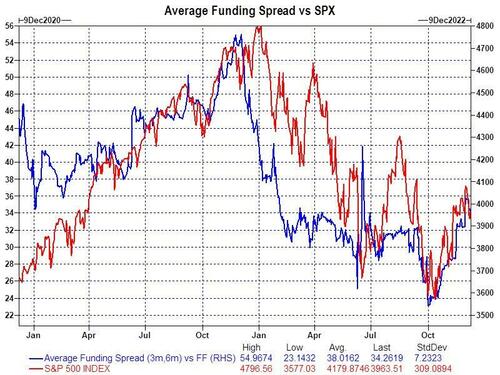

Normally people associate the decline in implied volatility with a market tailwind, but that is generally strongest in put heavy environments (put values declining leads to equity hedge buyers).

In this case we have a very neutral call/put positioning, and there is this idea that a “right tail” move is just as high as a “left tail” move. Therefore we think this likely drop in implied volatility (starting with CPI) serves to drain the momentum off of an equity move – both higher or lower.

Watch Brent and Imran’s live discussion (due to start at 1400ET):

Earlier this weekend, we laid out the rather gloomy (it hardly catastrophic) outlook from Goldman’s headge of hedge fund sales, Tony Pasquariello, who previewed both the short-term case as well as the medium-term (namely the next 3 or so months), and concluded that he can’t see the argument for lasting, significant upside: “with QT and negative earnings revisions just starting to really kick in — alongside money market rates that are assuredly heading higher — we’re going into 2023 with a stock market that charges an 18 multiple for the prospect of 0% earnings growth.”

But while Pasquariello’s bearish bias is hardly a secret (alongside that of his permabearish S&T colleague Matt Fleury), their bullish foil on the Goldman trading floor, flow of funds expert Scott Rubner, has never missed a beat in emphasizing that the technicals solid and that a year-end meltup is his base case. Or rather was: because when reading his latest note titled “Tactical Flow-of-Funds: January Inflows (likely Bonds > Equites to start 2023)” (and available to pro subs in the usual place) much of Rubner’s usual bravado and infectious optimism was certainly missing.

While we leave the bulk of Rubner’s note to the personal perusal of our professional subscribers, we will highlight several things which were notable, starting with his top 4 bullets as we close out 2022 and enter 2023:

- 2023 60-40 performance following drawdowns

- $ Money Flows in January #JanuaryEffect

- Passively Allocated from TINA to BARB (Bonds are Back)

- Flow of Funds for the Next Three Weeks after $3.7 Trillion Option Expiry.

Next, some facts on just how bad 2022 has been and why 2023 points to a rebound:

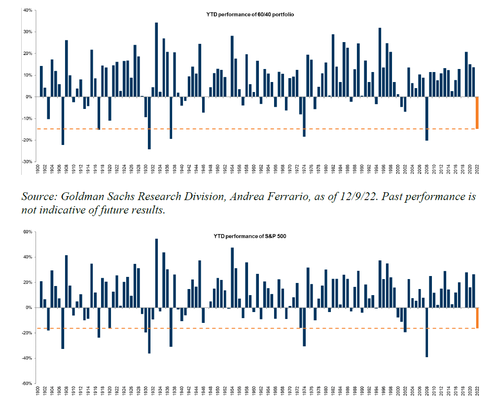

- 1. Since 1900, 122 years of data, YTD the US 60/40 “worlds and voting retirement” portfolio is down -15%, for the 7th worst year on record (only were worse 1907, 1917, 1931, 1937, 1974, 2008). 7/122

- 2. Since 1900, 122 years of data, YTD S&P 500 is down -16%, for the 10th worst year on record. 10/122

- 3. Since 1900, 122 years of data, YTD 10 year USTs are down -13% for the worst year on record, 1994 was second worse, and bonds were down -8%. 1/122.

- 4. The median return for the 10 worst “60/40” performance years in our 122 year history is -16%, so 2022 is in line with the worst years for asset allocation on record.

- 5. The 60-40 portfolio rebounded in 9 out of the 10 of the following years, by a median return of +17%. The only year that did not rebound was the great depression of 1931.

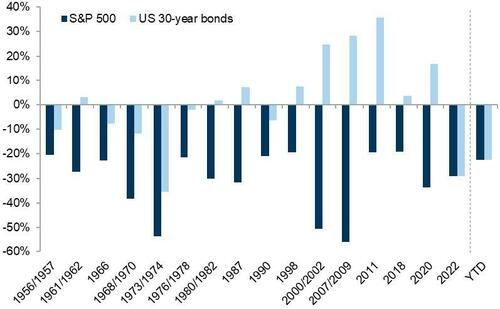

- 6. Out of all the 35 years when equities were down on a comparable time period (from the start of that year to the 7th December), US 10-year bonds were down only 8 times, of which only 3 times bonds have been down more than -5%: -8% in 1931, -8% in 1994, -13% this year

- 7. Bonds selling off alongside equities was not so unusual before 1990. The chart below shows you the real return of equities and 30-year bonds during S&P 500 sell-offs since 1950. What is interesting is that this year has been the only equity sell-off since 1950 where 30-year bonds sold off as much as equities.

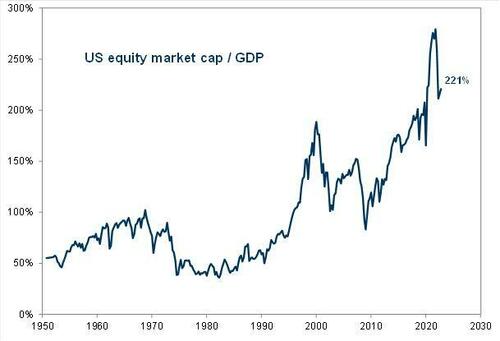

- 8. US Equity Market Cap relative to GDP has declined by a large amount. The most recent drawdown shows the measure dropping from 279% to 211% peak to trough, a decline of -68 pp. The other two large drawdowns you see in this time series were slightly bigger. The measure declined by -88 pp from 2000 to 2002 and by -69 pp (2007-08).

- 9. The 2023 January Allocation = a) buy bonds in 1H23 (from TINA to BARB, “Bonds are Back”) for a recession trade b) buy stocks (NDX) in 2H23 for a recovery in growth

* * *

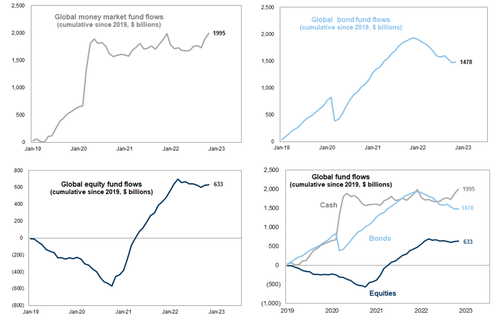

Hartnett then goes through the big picture trends in flow of funds, starting with cash (which is at $1.995 Trillion and increasing with T-bills >4%), equities (roughly unchanged for the year and $633BN) and bonds (a big outflow to end 2022 with room to add)…

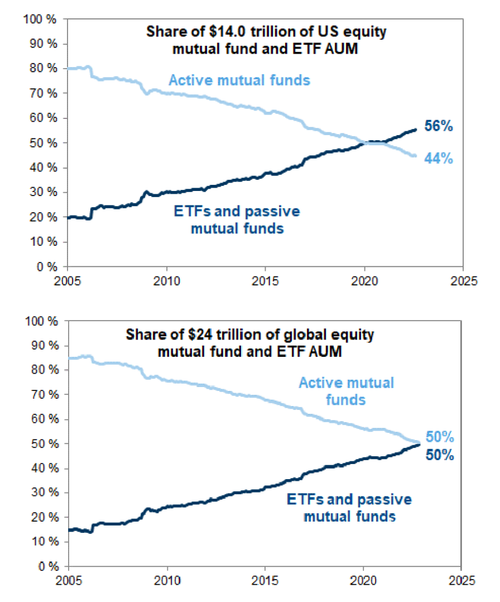

… before turning his attention to capital allocation, namely the split between Passive and Active (USA Equities Total Assets = 56% Passive vs. 44% Active… Global Equities Total Assets = 50% Passive vs. 50% Active)…

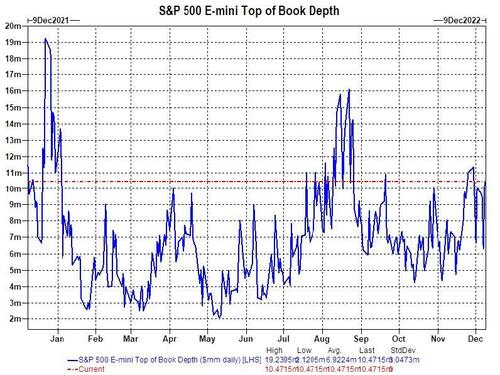

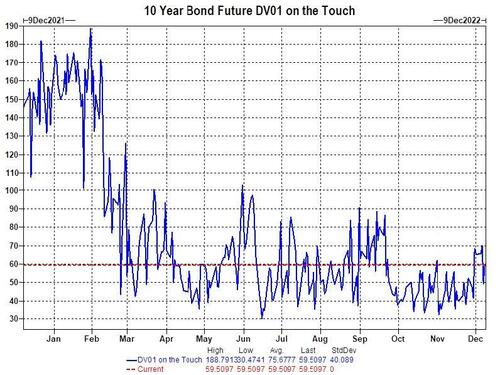

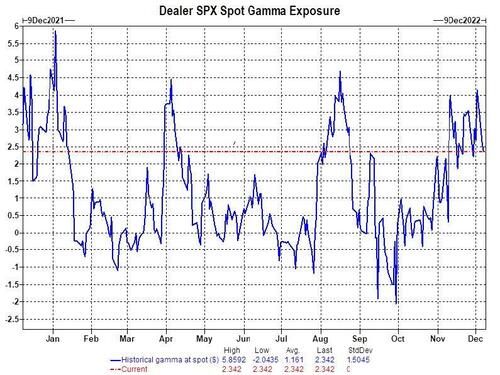

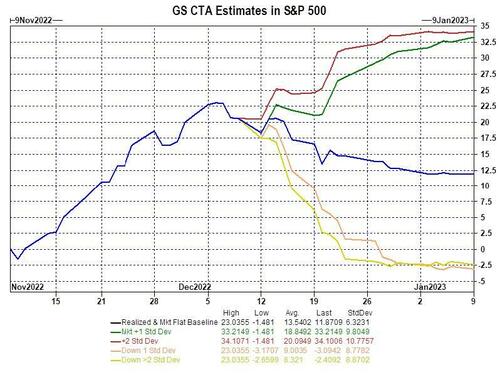

… and finally focusing on what is the most interesting topic of his latest report: the potential for a violent market repricing this week, when we have not only the two final catalysts of 2022 – the Tuesday CPI report and Wednesday’s FOMC – but a massive $3.7 trillion option expiration on Dec 16 which will lead to a huge gamma uclenching. Here is Rubner:

UNCLENTCH THE GAMMA ON DEC 16th = $3.7 TRILLION: IF THE MARKET IS GOING TO MOVE…. THAT STARTS NEXT WEEK

- Liquidity is low…. vacations are high.

- money is coming in January.

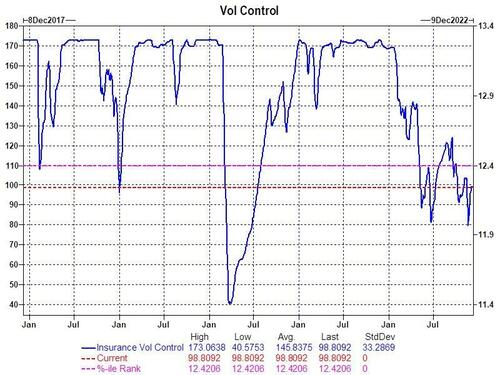

- var is low

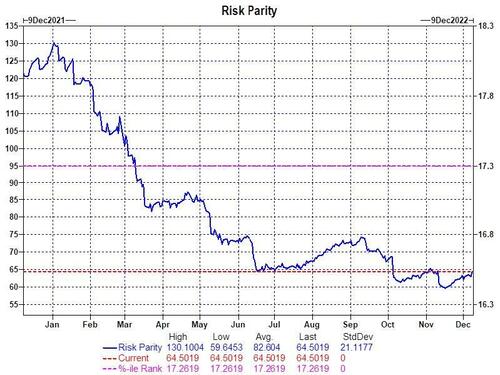

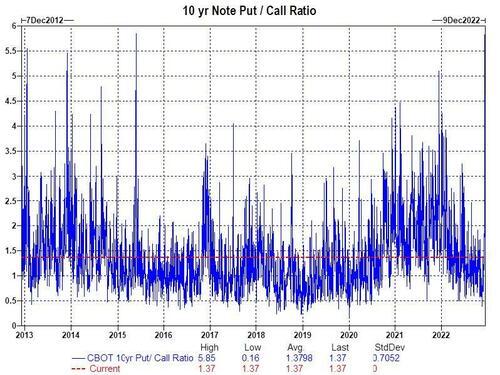

- hedges too high.

- expect conditions to move A LOT next few weeks.

$3.7tln of option notional expires on 16-Dec…

We concludes with Rubner’s Flow-of-funds checklist: “15 days to trade: who ya hot?”

Much more in the full note available to pro subscribers.

Tyler Durden

Tue, 12/13/2022 – 13:55

via ZeroHedge News https://ift.tt/Egzbkrd Tyler Durden