Your Last Minute FOMC Preview: Here’s What To Watch At Today’s Meeting And How Markets Will React

Even though we published an extended FOMC preview yesterday coupled with a look at what the new dot plot may looks like, below we share some last minute observations on what to expect today at 2pm from the FOMC statement and the Fed’s economic projections, and then, 30 minutes later, from Powell’s press conference.

Starting with Bloomberg’s Ven Ram, the cross-asset strategist lists the following key drivers that will determine how markets react to the outcome of the meeting:

The Known Unknown:

By now, everyone knows that the expectation is for a 50-basis point increase, and considering it will take the Fed funds rate to exactly the level outlined in the September dot plot, this should be a unanimous decision.

Dot, Dot, Dot:

- The Fed’s self-made jigsaw — aka its dot plot — is bound to keep interest-rate traders spellbound for a fair while. Will the plot for 2023 show an increase in the median rate? That is most likely, with a revision likely to take the median to 4.875% (See what to expect from the dot plot here). Note that this isn’t equal to the terminal rate, which is likely to be higher.

- Of great interest to the markets will be what the dots show for 2024. That is when we are likely to be in a weaker economic regime, and traders will be keen to find out how much the Fed will bend over to accommodate such an economy. As of September, the expectation was for 3.875%, but a Fed concerned about still- aloft inflation may paint a higher rate this time.

- Together, the dots for 2023 and 2024 will kindle the market’s reaction. A dot higher than outlined above for 2023 will lead to a selloff in rates, revive appetite for the dollar and roil stocks.

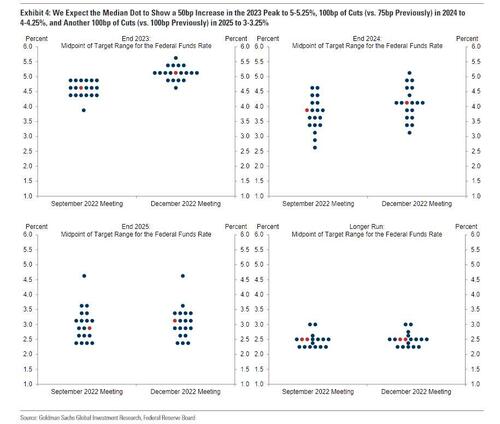

- Goldman’s dot plot forecast is shown below.

Summary of Economic Projections:

- Of course, those numbers on the Fed funds rate on the dots are a function of the jobless rate, economic growth and inflation outcomes that policymakers see. Expect to see a higher unemployment rate in 2023 as the Fed re-aligns demand in tune with supply and a far weaker growth picture.

- Expect also the core PCE inflation numbers to come marching down (yes, it does happen very well — on projection materials, at least).

- I wouldn’t expect any changes to the longer-term inflation projection of 2.50% even though the University of Michigan’s latest survey showed that five-year expectations are running at 3%. The last thing the Fed would want is to acknowledge that price expectations are spiraling away.

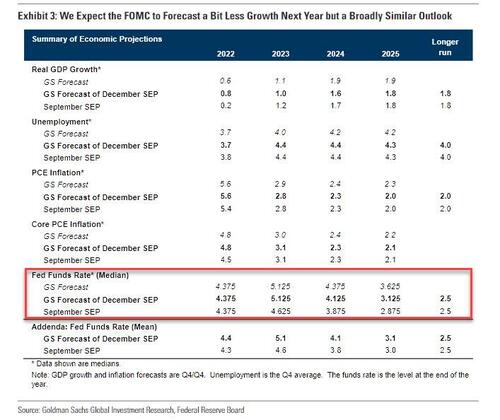

- Goldman’s SEP is below:

Thus Will Speak Powell:

- One thing’s for sure: Chair Jerome Powell will keep up with his rhetoric against inflation in his post-meeting remarks. While he is bound to acknowledge weakness in the economy, he will warn against ending the battle against inflation prematurely.

- Here’s what he’s likely to say on the various themes that come up during his press conference.

- On yield curves: “We are watching the inversion, but I would see what’s happening as a consequence of our efforts to get inflation down.”

- On the economy: “Yes, the economy is losing momentum, but we still see a tight labor market. A jobless rate around 3.7% is pretty robust.”

- When the Fed will be done: “When we are done raising rates, you will have a substantial real funds rate.”

Taking a closer look at how markets may react to the statement/Powell, SpotGamma writes that while it has no idea what Powell will say, “we continue to give edge to the idea that the large 12/16 OPEX will function to suppress volatility – particularly to the upside. The positions are fairly think in the 4100-4200 range and we still feel comfortable with a max upside of 4200 into 12/16.”

To the downside, markets should have some support into 3900. This means that mean reversion and/or options flow that supports equities is likely in place. If we close down into the 3900 area today, then traders need to likely anticipate higher relative volatility for Thursday and Friday (the OPEX pinning function is removed).

Below 3900 things could get squirrelly, as dealers may flip to a negative gamma position which helps push downside price action.

Further, we get the sense that the market may now be underpricing volatility into the year end. This could be particularly true to the downside, as the market appears under-positioned for a downside surprise.

For those seeking a somewhat more insider view, here is the WSJ’s Fed whisperer, Nick Timiraos this morning laying out what to watch at today’s meeting:

1) The statement: There’s been some speculation by Fed-watchers over when the FOMC modifies the “ongoing increases” language (to “further” or “some further” increases). Most of them think that *doesn’t* happen today. As Timiraos adds, in Dec 2005 and Dec 2018, when they thought they might have a couple rate increases left, the statement introduced language saying “some further” policy tightening would be warranted. Adding to the statement would be interpreted very dovishly.

- To that point, in its FOMC preview, Goldman wrote that “at some point the FOMC statement will likely be revised to say that “further” rather than “ongoing” rate hikes are appropriate, but not yet.”

- Morgan Stanley echoes this, writing that “the Fed will now enter 2023 just 50bp shy of where it sees the likely peak and it will seek more flexibility in its approach. In the statement, it could replace “ongoing increases” with “some further increase”, intended to be interpreted as plural or singular. The Chair will then have the opportunity in the Q&A to underscore that there is more work to be done.”

- Speaking of the statement, MS also writes that it will continue to highlight elevated inflation and participants will still see the balance of risks to the upside. On balance these changes will allow Chair Powell to justify the step down in pace while maintaining the Fed’s commitment to fighting inflation.

2) There’s also intense focus on the median of officials’ 2023 interest rate projection. In September, six officials each projected rates ending 2023 at 4.4%, 4.6%, and 4.9%, respectively, for a median of 4.6%. Powell et al have teased “somewhat higher” projections today.

- In his last FOMC preview, Goldman chief economist Jan Hatzius wrote that while he continues to expect a 50bp hike at Wednesday’s Fed meeting, “we now see the median funds rate for 2023 in tomorrow’s Summary of Economic Projections as a close call between 5-5.25% and a smaller rise to 4.75-5%. We continue to expect three 25bp hikes in 2023. At the margin, today’s report reduces the risk of a 50bp hike in February.”

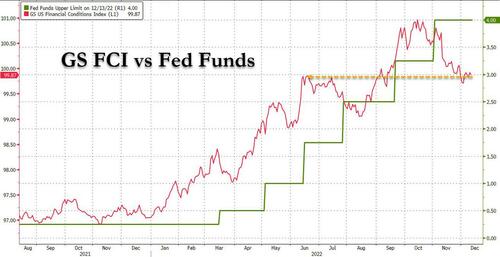

- Separately, Goldman also notes that Fed officials had hoped that pairing a slower pace of tightening with a higher terminal rate would prevent a large easing in financial conditions. That plan has not worked, in part because a softer inflation report added to the easing pressure. As shown brelow, the Goldman financial conditions index has now eased by about 100bp from its recent peak, and estimates of the drag on growth in 2023 from the tightening in financial conditions has shrunk meaningfully and “unhelpfully.”

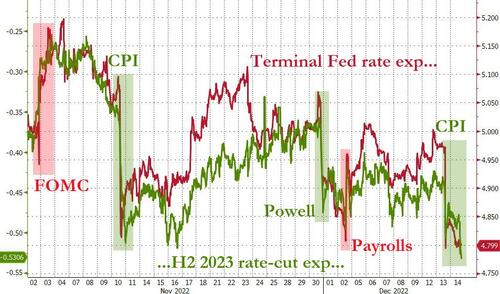

3) Terminal Rate. Going back to Timiraos, he says that “the question, then, is whether the median is a shade below 5% (at 4.9%) or above (5.1%). Analysts are split over this.” (A wrinkle: if FOMC participants anticipate hiking in H1 and then cutting them in H2 ’23, the 2023 dot—which is as of 12/31/23—won’t reveal their “peak” rate). One thing to note: since the last FOMC, the market-implied terminal rate has dived from 5.20% to below 4.80.

4). The Presser. Timiraos concludes that at 2:30 pm, the focus turns to Powell’s press conference, including whether he offers any hints around the direction of travel for the February meeting and how he characterizes the outlook and risk management after two much better CPI reports. As a reminder, one month ago, stocks soared after the dovish FOMC statement which was reportedly drafted by Lael Brainard, only to plunge during Powell’s much more hawkish press conference.

* * *

We conclude with the FOMC preview from JPMorgan’s trading desk

Equity derivatives markets had priced in ~2.3% move for CPI. For today’s Fed decision, those markets are pricing in ~2% move. The primary points of uncertainty are:

- (i) how high DOTS move, 25bps – 50bps; Bond markets are pricing a ~4.8% terminal rate effectively achieved at the March 2023 FOMC meeting;

- (ii) the degree of hawkishness of Powell’s press conference. Investors are wondering if Powell delivers Jackson Hole (SPX -3.4%) or more like Brookings/Nov 30 (SPX +3.1%). It may be the case that Powell focuses on the length of time Fed Funds will remain elevated rather than pace or level.

The key on whether we see this rally extended likely lies in the press conference. According to JPM trader Jay Barry, it will take strongly hawkish language to get bonds to re-price higher. If that fails to come to fruition, then yields may stay around these levels which could mean a tactical drop in the USD. Both factors would be positive for Equities. If this outcome is achieved, this is not a long-term bullish call. As long as the Fed is tightening, stocks generally cannot have a sustainable rally.

Finally, here are JPM’s extended thoughts on the terminal rate:

- Mike Feroli currently forecasts a 50bps hike in Dec and then 25bps hikes in Feb and Mar, bringing Fed Funds to the 4.75% – 5.00% range. As part of this forecast, Mike sees GDP growth slowing to 1.5% in Q4 and then in 2023 he sees 1.0%, 0.8%, 0.5%, and -0.5% across the quarters. Further, he sees Headline CPI averaging 4.1% YoY for FY23. Separately, JPM Economist Nora Szentivanyi forecasts the following Headline CPI YoY prints: Jan = 7.0%, Feb = 6.5%, Mar = 6.1%, Apr = 5.1%, May = 5.0%, June = 4.2%, July = 3.1%.

- The Fed typically will hike until Fed Funds exceeds CPI, which intersect in May 2023, should JPM’s Fed and CPI forecasts prove correct. Should CPI prove a bit more stubborn than forecast, could we see the Fed continue with a series of 25bps hikes beyond the March meeting? Conversations with our EM client base reveal views that Fed Funds likely needs to reach the 6 – 7% range. Why? For DM countries that see CPI exceed 5%, it takes ~10 years for CPI to fall back to 2%. A higher terminal rate than 5% has been mentioned in recent Fedspeak by Evans and Williams last week.

- In recent notes from Bruce Kasman and Mike Feroli, they acknowledge that there are upside risks to the current 5% terminal rate view. Feroli acknowledges that recent Fed language supports a move higher in the DOTS to reflect an additional 100bps in tightening, in line with current expectations, but that the DOTS could still exceed that level given Friday’s NFP print. Bruce tells us that, “Incoming news suggests this inflation slide is underway and is promoting near-term resiliency as anticipated. But US and Euro area labor demand remain surprisingly strong. Alongside a recent easing in financial conditions, the risks are shifting toward higher-than-anticipated terminal rates for both the Fed and the ECB.” These comments may indicate that the market needs to place a higher weighting on labor market metrics, eg, YoY wage growth of 5.1% remains above ~3.5% level that is consistent with 2% inflation.

- The above scenario is aligned with Marko and Dubravko’s 2023 outlooks where they see the Fed hiking into a weakening economy inducing Equities to retest 2022 lows. The Fed will have an updated dot plot with the December meeting. Does this re-price yields higher? Jay Barry sees the 10Y moving back to above 4% by year-end and Jay sees 10Y closing 23Q1 at 4.0%.

And also some thoughts from Morgan Stanley on terminal:

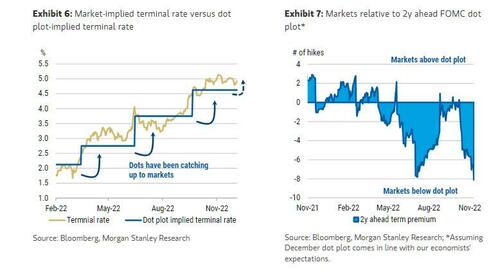

- With a dot plot at the upcoming meeting, there will be more specificity on the terminal rate instead of the “somewhat higher than September” language that we have heard from Fed officials recently. In recent meetings, the Fed has generally delivered a terminal rate right in line with market expectations (see Exhibit 6), or even a tad higher, so a terminal rate of 4.875% – or lower at 4.625% like our economists expect – could steepen the 2s5s curve, and cheapen 5s on the 2s5s10s fly.

- However, if the Fed keeps a lid on the terminal rate, it would be offset by its signal to hold rates at the terminal rate for at least 2023, and then a shallow pace of cuts in 2024, as is likely to be signaled via the dot plot (see Exhibit 7) – both factors which support underperformance of 5s on a 2s5s10s butterfly, and a steeper EDM3Z4 curve.

- We think that the set-up going into the December FOMC is too bearish with respect to the path of the economy and too sanguine about rate cuts from the Fed. The market has priced nearly 6.5 cuts from peak by the end of 2024. Based on what MS economists expect for the December FOMC dot plot, the Fed could show four cuts by the end of 2024.

Much more in the full “FOMC Preview” section available to pro subscribers in the usual place.

Tyler Durden

Wed, 12/14/2022 – 12:46

via ZeroHedge News https://ift.tt/kv2cPfp Tyler Durden