2023 Outlook: Pain

By Peter Tchir of Academy Securities

2023 Outlook – PAIN

First, I need to apologize for last weekend’s Bah Humbug! T-Report. I meant to give a shout out to “Christmas Wrapping” by the Waitresses, which starts with the line “Bah Humbug, now that’s too strong”. If I had to listen to one holiday song on infinite replay all December, that song would be the one (apologies to Mariah Carey). But enough delaying, let’s get to the heart of the matter, which is why I think that 2023 (at least for the start of the year) will be a big bust! Maybe, much like the A-Team always won in the end, this year could finish well (for markets and the economy), but it will start with “PAIN” (okay, I’m mixing Mr. T lines, but let’s just roll with it).

-

Not much help from the bond markets. I’m a bond bull and expect a “risk-off” trade early in the year, but bonds just aren’t going to help portfolios or the economy enough to stem the tide.

-

The wealth effect (on individuals, companies, and governments) will weigh on the economy and markets. The amount of wealth destruction was large by historical standards and was more “circular” than in previous bouts of wealth destruction.

-

Unlike Weebles (which wobble, but don’t fall down), economic data will fall down. Consumers and jobs, two areas that have given many people reasons to support an optimistic outlook, will succumb to the same problems that the rest of the economy is facing and it will finally show up in the data.

-

There is a chance for some geopolitical respite, but globalization in 2023 and beyond will never go back to where it was in 2017.

-

The valuation re-valuation is not done, and that will reduce whatever earnings (or free cash flow) we have to multiply these metrics by to calculate valuations. Credit contraction is a risk.

Those are the main points driving much of this very bleak outlook (but just because it is bleak, doesn’t mean that it is pessimistic because bad things can and do happen).

The Foundation – Key Building Blocks

There are some ongoing themes in last year’s work that set the stage for some of this analysis. We will refine the points listed in the first section, but it is important to lay the foundation.

We had several non-traditional factors that drove inflation, many of which are gone. Using responses that worked for “traditional” inflation when we have a unique fact set this time around is going to lead to large and difficult policy mistakes.

-

See Rise and Fall of Inflation Risk Factors which examines the roles of the Fed, Stimulus, Supply Chains, War, and “Disruption” on inflation.

-

2 + 2 = 5 explores why the Fed seems to be looking at data very “weirdly” and the problems that these views are likely to cause.

-

The last piece in this series, the Path to Q1 Deflation, lays out how this comes together to shock the system (deflation is not healthy when it is caused by an economy hitting a wall).

These are important pieces of the “PAIN” outlook, but they are not the only elements. Even if you disagree with the above, there is plenty of wiggle room to come to the “PAIN” conclusion and those arguments just help make the case stronger.

Relationships with China have changed and aren’t going to revert to what passed as “normal” any time soon. It isn’t just at the government level (where national security concerns are paramount), but at the company level where there is a threat to IP and supply chains. There is also unwillingness to truly provide open and equal access to the domestic economy. All these factors have left C-Suites working on alternatives to China.

It is almost sad (but true) that by the time markets and the mainstream media catch up to Academy’s view on China, our view will have become more negative. However, the gap is finally narrowing for most investors and corporations.

-

The Beijing Olympics as Cultural Bookends is a “thought” piece but looks at the changes since China’s “coming out” party at the Beijing Summer Olympics and their “going away” party at the Winter Olympics last year. Topics include the reassertion of the Communist Party, Digital Yuan, Debt Diplomacy/Economic Colonization, Military Expansion, and the Real-Estate bubble. While that report is almost a year old, it sets the tone for much of how people should think about China.

-

The Recentralization of China (August 2021) set the stage for the move from seeing China as a Strategic Competitor (December 2019) to more of an enemy across the globe.

-

China’s zero-COVID policy. I dismissed the re-opening as being a “big deal” on national TV just a couple weeks ago (supply chain issues have been largely dealt with and the last thing this economy needs is more cheap goods). However, it is still interesting that it failed to help markets rally. Maybe that is because few people want to risk travelling to China at this stage (getting COVID there seems precarious at best in terms of treatment). Maybe it is because China’s importance to our economy has been greatly diminished. The full story hasn’t played out here, but I remain in the camp that China’s re-opening is only helpful at the margins given how companies and countries have adapted to the past few years of behavior.

Again, this “foundation” isn’t critical in coming to the “PAIN” conclusion, but it is an important building block.

Bond Market – Supply/Demand Imbalances?

I want to be bullish on bonds despite the fact that this is rapidly becoming a consensus view. I’m fully committed to the high probability of a “risk-off” trade that brings bond yields lower and takes stocks below their 2022 lows. Yet, things seem “off” in the bond world.

It is somewhat “difficult” (at least from this seat) to put a finger on exactly what is wrong, but let’s highlight a few potential risks to the bond world. These are primarily risks to the Treasury market, but many of those risks would cause problems for credit especially if the economy slows as rapidly as I expect it to (it is already slowing rapidly based on PMI data and other reports).

-

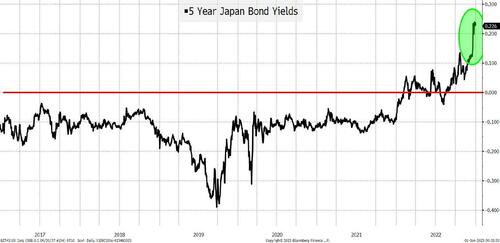

Will foreign buyers of dollar denominated debt continue to buy? This question first got some serious attention as dollar strength and FX volatility made it more difficult for foreigners to buy dollar denominated debt and hedge out the FX risk (primarily a Treasury and investment grade bond issue). With Japan starting to increase the target levels on their bonds, will we see more buying of yen denominated bonds vs. buying dollar denominated bonds with the associated FX hedging? I am a strong believer that the “0% bound” is non-linear. Basically, a number of market participants will do a lot to avoid 0 or near-0 returns and will quickly revert to “simpler” strategies once they can achieve even a modicum of yield. Large/sophisticated institutions don’t think that way, but many smaller institutions seem to.

-

Japanese investors (for the first time in well over 5 years) can achieve a little over 20 bps by investing in 5-year JGBs. Certainly not an earth-shattering return, but it isn’t a particularly long maturity and it alleviates the need to run FX hedging strategies. This will be a small problem for bond markets, not material, but not entirely inconsequential. It is a risk that increases as Japanese yields rise (presumably while global bond yields are also rising) creating a negative feedback loop. This isn’t keeping me awake at night, but I am keeping an eye on it.

-

Higher deficits? As yields rise, the cost of running existing debt burdens for countries goes up. Yes, it takes a long time for rising yields to have a significant impact on average coupons outstanding, but the U.S. has $3.8 trillion of bills and $2.6 trillion of bonds maturing in 2023, all of which will need to be refinanced at higher coupons than the bonds that are maturing. In 2021, the Federal Reserve helped reduce the government deficit by $107 billion. Since the Fed uses accrual accounting, the higher cost of borrowing impacted the remittance for 2022 (guessing around breakeven). This means that at the end of 2022, the Treasury Department did not receive the $100 billion it got in 2021. Unless the Fed does some form of “Operation Twist”, where they work with Treasury to retire longer-dated bonds (trading well below par) to book profits, this year’s number will end up being a significant loss. We could also see decreased remittances, especially if financial assets continue to struggle (which is my base case). Lots of moving parts, but we could see increased supply from governments which won’t be completely offset by lower supply from corporates.

-

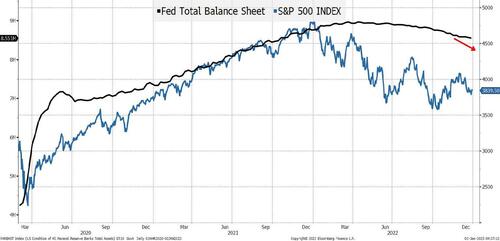

Quantitative Tightening. Quantitative tightening does not behave like rate hikes (see Rube Goldberg Translating QT to bps). I find quantitative easing much easier to explain. Every day, investors in every asset class get forced to take on more risk to get a similar expected return. If a T-bill is bought by the Fed, someone who used to be able to buy that T-bill now either needs a longer T-bill or something with slightly more risk (say Agency Discount Notes or CP) or something slightly less liquid (maybe ABS related or private credit). Their decision thrusts the same decision on the investors who used to buy what they are now buying. That goes on and on until it impacts the riskiest of assets (unprofitable tech and crypto certainly seemed to fit the bill). This is Newton’s Cradle in action (where you drop a ball at one end and the ball it hits doesn’t move, but the ball at the far end of the chain moves). Quantitative tightening acts in reverse (though with less impact since it is relying on bonds that are maturing, limiting the “duration” being taken out of the market). But every day investors seem to wake up with the ability to take less risk (less credit risk, shorter maturities, or more liquidity) for similar expected returns.

- This is not the “best” chart (and I’m sure that there are some Chart Crimes committed here). However my view is that QE is extremely prone to asset price inflation and the Fed knows it (even if they don’t harp on it) and they will keep QT even when they are done hiking rates because they want to “fix” this “problem”. This doesn’t get enough discussion in the inflation dialogue. This point also bothers me when thinking about the potential for bond or stock strength this year.

- The shape of the yield curve is not conducive to a great year for bonds. With 2s vs 10s still inverted by 55 bps, we need one heck of a bull market across the entire curve to generate big returns. While 20-year bonds seem to offer some respite, no one wants to touch them because the long bond only highlights these issues. As much as bond investors want long duration, the pickup in yield (relative to the risk/reward by moving to shorter-dated bonds) could be attractive and would be completely in line with how we see QT working.

- Corporate bond risk/reward. High end corporates should do “okay”, but if our theory plays out, there will be pressure on credit spreads. My “rough” thinking is that for every basis point Treasury yields rise, corporate spreads will tighten by less than a ½ of a bp. Overall yields on corporates will go up if Treasury yields rise. For every bp Treasury yields fall, beyond a threshold of say 10 to 20 bps from current levels, spreads will widen 1:1 or worse (it will be a risk-off trade, not as bad as in March 2020 or 2008, but still serious considering the IG level of risk). From an all-in yield basis, the risk/reward for corporates seems slightly worse than for Treasuries themselves. Less supply will help corporate credit, but liquidity is worse, which amplifies any hiccup. If I was an issuer I’d start the year trying to issue, but if I was an investor, I’d start the year reducing exposure.

I want to be a “pound the table” bond bull, but I struggle due to all these risks (5-year, highest quality paper is the best option here.)

The “Circular Error” in “Disruption”

Company XYZ raises money (public or private) at a new (and higher) valuation.

Company XYZ’s employees feel richer as the new valuation increases the value of their options.

Company XYZ’s other investors are also richer based on these new valuations.

Company XYZ’s employees spend money because they are (in some cases) “rich”. They buy fancy cars (mostly EV), big houses, and expensive vacations. They also take some of their newfound wealth to invest in companies similar to XYZ (and apparently in crypto).

- Real estate agents, lawyers, house sellers, auto dealers, etc., benefit from this surge in spending.

Company XYZ spends money on equipment (mostly tech), office spaces (to highlight their prowess in a physical manifestation), and on advertising so people hear about their product. Their mentality is “the faster I spend, the sooner I can do my next raise at an even higher valuation”.

- Real estate agents, lawyers, big tech, small tech, venues, ad sites, etc., all benefit from this spending.

The “second” order effect of this spending is smaller, but not only do the outside investors spend more, so do the real estate agents, lawyers, house sellers, tech companies, etc. The money multiplier increases the wealth “shock” that spreads throughout the economy.

Peloton, a company whose product I’m trying to use with more regularity this winter, went from $6 billion to $49 billion in market cap. This was one of hundreds of public companies that saw that sort of gain! That doesn’t include crypto/private equity investments and doesn’t even try to put a number on SPACs (though NKLA hit a market cap of $28 billion and is now at $1 billion). This is a good segue to the “circular” nature of all this.

If there was a “virtuous cycle” on the way up, it seems plausible that the cycle will be “unvirtuous” on the way down. That is the problem with “circularity”. Things circle back on themselves and you do not have the ability to get the correct answer.

This is probably the area on which I seem to differ most from many economists (I’m just a strategist). I see circularity and spirals where others see straight line extrapolations. Maybe I’m wrong, but this feels an awful lot like 2000/2001 (tech bubble), 2007/2008 (housing was the main culprit), and 2015/2016 (energy boom/bust), but with the focus being on “disruption” this time around in 2022/2023.

This keeps me awake at night.

Weebles

We will get a lot more information on jobs in the first week of January. I expect that the data will disappoint and we can do a retrospective on that in next weekend’s T-Report. At that point, it will hopefully be clear whether we were right or wrong (though given the quality of the data collected, the week will probably prove to be far less conclusive on the job front than it should be).

The health of the consumer is a big question mark.

- 2022 hurt low wage earners the most. Low income households were hit by inflation, but they had benefitted the most from stimulus (as a percentage of income) and an incredibly robust job market.

- 2023 may play out as the “high income” hit year. The wealth effect is taking a toll, but more importantly this part of the work force seems to be facing the brunt of recent layoffs. This year won’t be about the number of jobs lost, but it will be a function of the number of jobs lost multiplied by the average income (which could be surprisingly high). Employees at the “granular” level are still in high demand (though that could tail off too), but it will be a combination of job fears (even if unfounded) coupled with the wealth effect that will make the consumer seem much weaker in 2023 than in 2022.

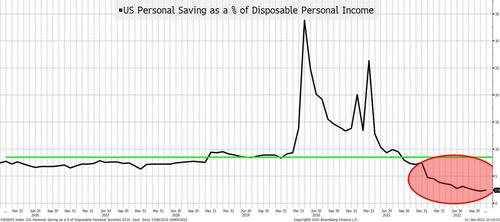

I need to improve my charting capability on the “consumer” health side of things, but this chart caught my eye.

Similar to the alleged “inventory” build story (which we will revisit next week), this is just playing catch-up to the “excess savings”. But what if consumers are living beyond their means to an uncomfortable degree? Will Q4 and the holiday season be the last binge as the consumer embarks on a “dry January”?

I’m not optimistic on the consumer coming into 2023. Again, not keeping me up at night, but a definite concern and one that we need to do a lot more work on in the coming days and weeks.

“Positive” Geopolitical Surprises?

Last year we saw a shock to the system with a war in Europe! A year into this, it is still difficult to conceptualize that there is a war in Europe.

Academy’s current take is that Russia will make one more big push this winter, but if that fails, some sort of negotiations should begin, which would be a boost to global markets. But, like so many other things, nothing is returning to how it used to be! Russia has found new buyers for its energy products. These buyers care little about their behavior and are in no rush to shift away from traditional energy products. Probably, from the Russian perspective, this is a better client base.

I need to highlight that the U.S. changed the nature of global commerce permanently the minute “we” weaponized Russia’s dollar reserves. That was not lost on any country, but was most noticed by autocratic nations swimming in natural resources. This will impact policies and trade negotiations for decades to come and will put “us” at a distinct disadvantage to China and India. As we deal with the reality of what resources we will need in the future, this will be another hurdle.

So, the situation in Russia could result in some change globally, but more of a “Potemkin village” than a real change to the global commodity industry (and therefore to the global economy).

China may back down on some rhetoric (they are good at taking “5 steps forward, 1 step back” and highlighting their “1 step back” hoping that no one noticed they gained 4 steps.)

There is the opportunity to work with China, but they are now truly viewed as a competitor and a possible threat, so we cannot and will not go back to how it was (this applies to both nations and companies).

Geopolitics might provide some boosts, but they will be mild and temporary, and we will need to remain vigilant with China, Taiwan, Russia, Turkey and many other regions in the world as the geopolitical landscape continues to evolve, and not in a good direction!

Bottom Line

I’m not optimistic on risk (equities will do worse than IG credit spreads, but risk across the continuum is still not priced cheaply enough).

I’m not as optimistic on bonds as I’d like to be. That, sadly, is not comforting.

Hopefully I’m wrong! Maybe like Mr. T, we can go from being the adversary to a much-loved character, but for now my New Year’s message is anything but happy.

I’ll be looking for reasons to become more optimistic and a “pound the table bull” (I’m okay being “long for a trade” here), but think that we are best served by being cautious and seeing if whether the “straight line extrapolation” people were correct or there is a spiral effect that has been put in motion and has its own energy.

Good luck and on behalf of Academy Securities; we look forward to working with you in 2023.

Tyler Durden

Mon, 01/02/2023 – 13:40

via ZeroHedge News https://ift.tt/WH4eJ9p Tyler Durden