“Labor Hoarding”: New Theory Emerges To Explain The Lack Of Labor Market Collapse

Setting aside how credible any data released by the BLS now is – considering that not just this website but even the Philly Fed has challenged the accuracy of the Payroll reports’ Establishment survey, while Goldman recent found that actual layoffs as indicated by state WARN notices are far higher than those seasonally adjusted by the Department of Labor, there was one data point that prompted quite a few commentators to scratch their heads. Recall that one of the reasons stocks were pleasantly surprised by the jobs report is that not only did payrolls dip again (if printing as usual above average), but average hourly earnings slumped. But there was more: alongside the decline in wages, average hours worked also declined (which had a material impact on the average wages, and had hours been flat, the decline in average wages would have been even more pronounced).

Why does this matter? Well, as Goldman trader Rich Privorotsky wrote on Friday, the deceleration in wage gains as of late and “the shirking of hours worked is in no way consistent with a wage spiral, and in fact suggests something unusual might be happening as corporates reluctant to shed hard to find labor are shrinking the work-week/hours worked rather than cutting payrolls.” This would make intuitive sense if one assumes that employers are still smarting from the difficulty to find workers in the post-covid months when millions of low and medium-income workers simply exited the workforce. As such, if everyone is convinced that the coming recession will be light, employers are more tempted to shrink (in some cases aggressively) their employees’ hours rather then engage in layoffs, especially if they are concerned they will have difficulty finding workers in a few months (all of this, of course, assumes that the recession will be “shallow” whatever that means).

As evidence, Privorotsky shows the decline in the average employee workweek as proxied by both the Philadelphia and Empire Fed’s surveys.

Others at Goldman agree, and in a note published by the bank’s economist team looking at the ongoing rebalancing in the labor market (available to pro subs), they found that while Labor demand still remains high it is now falling: “The trend has admittedly become murkier recently as measures of job openings have diverged. But the average of these measures is still declining, and business surveys also suggest that total labor demand is still coming down.”

Here is the interesting part in the Goldman report, :

Labor supply has at most a bit more room to recover. The discussion about labor supply during the pandemic has mostly centered on “missing workers,” and for the first couple of years there was indeed room for the labor force participation rate to rebound as fiscal support and Covid fears faded.

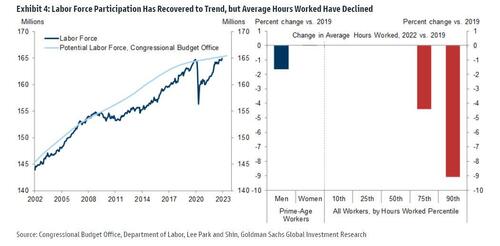

But we noted last summer that the participation rate had already largely recovered, and the small increase in December to 62.3% brought it to our year-end target that embedded some further cyclical recovery to offset an ongoing downward trend driven by demographics. While prime-age participation is still a bit below its pre-pandemic rate, the overall participation rate has now nearly returned to the CBO’s estimate of the trend implied by demographic changes, as shown on the left of Exhibit 4, and a new paper by economists Bart Hobijn and Ayşegül Şahin also suggests that the gap is largely closed.

The remaining labor supply shortfall relative to pre-pandemic trends actually comes less from reduced participation than from a decline in average work hours. In another paper, Şahin, R. Jason Faberman, and Andreas I. Mueller use data from a supplement to the New York Fed’s consumer survey to show that workers’ desired work hours dropped sharply during the pandemic and remained depressed at least through the end of 2021, when their data end, with much of the decline coming from people classified as outside of the labor force who occasionally enter it, such as retirees. New research by Dain Lee, Jinhyeok Park, and Yongseok Shin shows that average hours have fallen since 2019, especially among college-educated prime-age men and among those who work the longest hours, as shown on the right of Exhibit 4. Because, as the authors note, these workers work far longer hours than is typical for US workers let alone those in other high-income countries, this change might persist to some extent.

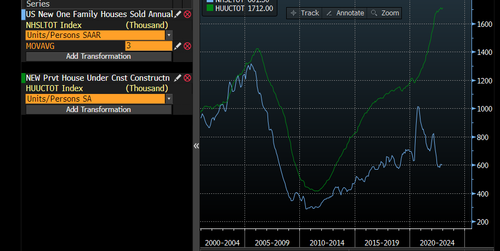

Maybe the best discussion on this topic comes from Amberwave co-founder Stephen Miran, who earlier today tweeted some of his observations on why the US is still not in a recession, and concludes that “the principal reason is the missing construction layoffs. Mortgage rates shot up from 3% to 7%, making buying a home unaffordable for many folks. Normally, one expects a slowdown in construction activity and layoffs. But, construction employment is at all time highs!”

The principal reason is the missing construction layoffs. Mortgage rates shot up from 3% to 7%, making buying a home unaffordable for many folks. Normally, one expects a slowdown in construction activity and layoffs. But, construction employment is at all time highs! pic.twitter.com/AepOyF113r

— Stephen Miran (@SteveMiran) January 22, 2023

Arguing that in light of the dramatic slowdown in activity in the construction sector, “we’d expect huge layoffs” with “expected layoffs in the neighborhood of 500k to 800k jobs, and with multipliers, this would be 1 to 3 million total losses. That’s a real recession.”

But these layoffs still haven’t taken place, prompting Miran to proposed several explanations why not:

1. They will. (Maybe, but I don’t see -any- sign of them in the data…yet.). There are some reasons for expecting the layoffs to eventually come. In particular, the huge divergence between the number of homes being sold and the number of homes currently under construction, which will presumably come down as homes are completed.

2. The extraordinary backlog of homes demand due to pandemic changes in the economy like wfh. This is a possible explanation, but presumably at some point runs out?

3. Labor hoarding by builders, i.e. holding onto employees for fear of being able to replace them if necessary in a tight labor market. Miran says that he is “generally dismissive of labor hoarding for the economy as a whole, but more sympathetic in the building sector. Why?”

The principal reason is the Infrastructure Investment and Jobs Act, passed in 2021. As I pointed out at the time in WSJopinion, the IIJA is going to further fuel inflation.

Going into CY2023, there’s going to be ~$38 billion of Federal spending on construction and other projects kicking in. In CY24, it’ll be closer to $54 billion. Assuming some multipliers, these go a long way to offsetting a big chunk of the decline in private structures spending. (Ignore the decline in direct spending here, that’s largely the offsets from reduced spending on phrama or subsidies to GSEs)

In other words, I suspect builders are holding onto employees because the $$$ being spent by Uncle Sam on construction are going to start kicking in this year. Given a historically tight labor market where employees seem to have all the power, they’d rather hold onto the workers

Why lay off your workers now if you expect real difficulty in hiring them back if building starts to pick back up, particularly for nonresidential construction?

While this may well be the most likely explanation, and one which will be tested most easily by the severity of the coming recession (if indeed there is labor hoarding within construction, an extended deterioration in the sector will only result in an even more acute collapse in construction jobs in the near-term), there is another possible explanation, namely that financial conditions have eased significantly since September: stocks, mortgage rates, the dollar.

It’s not difficult to imagine a world in which home prices fall by 10% or so, but given strong wages, resilient stocks, and falling mortgage rates, final demand stays robust. Given the historic run up in home prices, builders are still very profitable at those levels. In other words, maybe builders expect a surge of private demand in the near future and are therefore holding onto their employees.

Miran’s conclusion is spot on, and boils down to the following: The missing construction layoffs ARE the missing recession. If they come, we’ll have a recession. There’s a reason for expecting them to come (homes under construction lagging sales), and reasons for expecting them not to (future demand picking up, private & public)

Watching this sector will give us a clue as to whether we’ll see a recession or not. In the meantime, real incomes are accelerating on lower inflation, and as I’ve stressed 100x, financial conditions easing ought to induce a pickup in GDP growth

There is thus some chance the economy reaccelerates before those layoffs come, and the recession is avoided. However, in that case, the Fed will be goaded into a new hiking cycle, as inflation will pick back up, and the recession will be delayed and not avoided.

Afternote: there’s a race between the exhaustion of the backlog & the coming construction layoffs, vs. a reacceleration of the economy on easing financial conditions & IIJA boosting construction demand. Which of these forces wins the race determines whether we have:

- Recession, or

- Burst of growth, followed by new hiking cycle, followed by recession

In other words, we will either get a recession, if construction employment suddenly tumbles, or we will get a transitory growth burst – largely on the back of the market pricing in the coming Fed pause – which will avoid a round of mass layoffs in construction, which will however lead to even more inflation, and an even more aggressive hiking cycle, leading also to recession.

Tyler Durden

Mon, 01/23/2023 – 18:00

via ZeroHedge News https://ift.tt/udMNvqZ Tyler Durden