‘Leading Indicators’ Roar Recession As Nasdaq Soars To Best Start To Year Since 2001

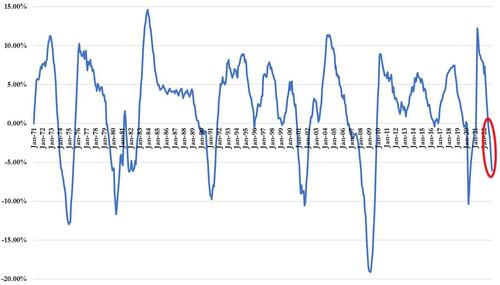

US Macro data has been ugly recently, crushing the ‘soft landing’ narrative and today we get the clearest signal of that imminent ‘hard landing’ recession as Leading Economic Indicators (LEI) tumbled for the 10th straight month, plunging most since the GFC (ex COVID lockdowns), “continuing to signal recession for the US economy in the near term.”

Stocks ramped on that ‘bad news’ but oddly, rate-trajectory expectations drifted hawkishly in the face of that ‘recession’ risk…

Source: Bloomberg

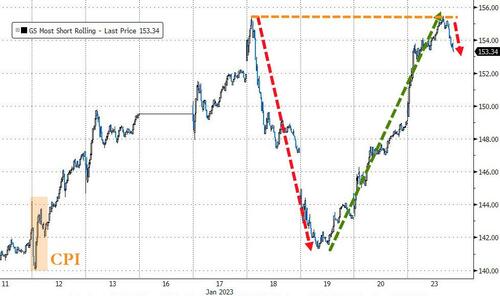

BUT… “Most Shorted” stocks have now soared over 10% from Thursday’s opening dip lows, but stalled at last Wednesday’s peak and rolled over later in the day today…

Source: Bloomberg

Which lifted Nasdaq over 2.5% today at its peak. Futures were very very quiet overnight until the US cash markets opened and unleashed squeezey hell. The Dow lagged (but still managed a solid day) while Nasdaq led and Small Caps and the S&P rallied over 1% on the day…

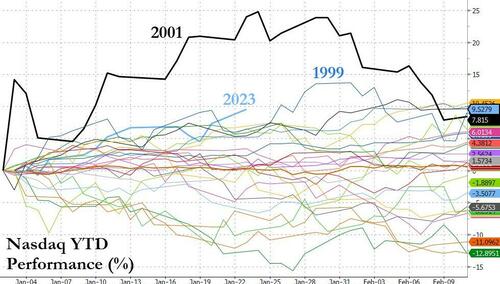

The Nasdaq’s 10% or so rise so far in 2023 is the best start to a year since 2001…

Source: Bloomberg

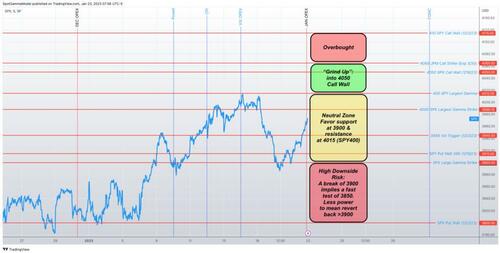

The S&P extended above its 200DMA…

…testing its medium-term down-trend…

Source: Bloomberg

Some key S&P levels:

-

4065 – JPM Collar Call Strike

-

4050 – Call Wall

-

4000 – Largest Gamma Strike

-

3990 – Jan 2022 downtrend resistance

-

3967 – 200DMA

-

3965 – CTA Pivot

We also note that today’s run in the S&P stalled perfectly at the pre-CPI-spike levels from December…

Interesting decoupling between VIX and stocks as we passed through Friday’s

Source: Bloomberg

And also we note that the Skew is surging recent as VIX treads water. The surge in skew suggests downside protection demand is alive and well…

Source: Bloomberg

Growth stocks have dramatically outperformed Value stocks since the start of the year as the Value/Growth ratio topped out perfectly at the cliff before the COVID-lockdown-driven easing-fest…

Source: Bloomberg

Treasuries extended their losses today with the short-end underperforming (2Y +6bps, 30Y +3bps) but year-to-date, yields all remain lower (led by the belly)…

Source: Bloomberg

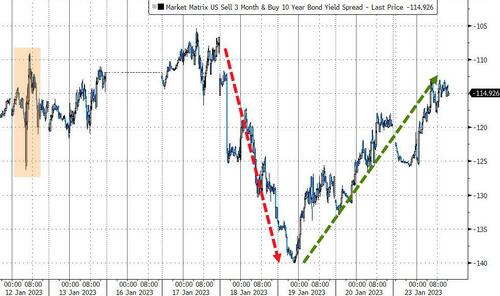

Yield curve steepened back to pre-CPI levels (but remains very deeply inverted)…

Source: Bloomberg

The Dollar ended the day unchanged, rallying back during the European session after some overnight weakness…

Source: Bloomberg

Bitcoin trod water for the last 48 hours after surging up to $23,000 on Friday/Saturday…

Source: Bloomberg

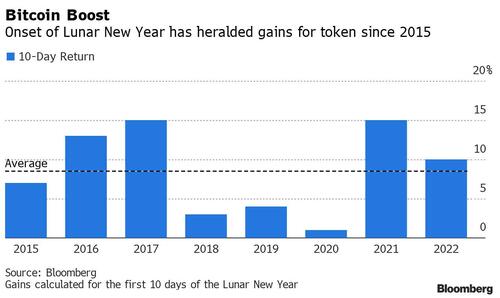

Additionally, as Bloomberg notes, the start of the Lunar New Year offers an additional tailwind to the 36% jump in Bitcoin so far in 2023, if history is any guide.

Every year since 2015, the price of the biggest cryptocurrency was higher 10 days after the festival’s onset – a 100% win rate – with investors who purchased and sold at those points in time seeing an average gain of 9%. The token’s rise was typically fastest in the first week after the holiday’s kickoff, Markus Thielen, head of research & strategy at Matrixport in Singapore, said in a note.

Gold dumped and pumped to end the day unchanged around $1925 despite USD strength…

Oil also ended unchanged (despite stronger dollar and ugly economic data), with WTI hovering around $81.50…

Finally, Bloomberg’s Financial Conditions Index is at its “loosest” since before The Fed started hiking rates in March 2022…

Source: Bloomberg

We simply cannot believe that after all the jawboning in the last two weeks as well as the explicit acknowledgement in FOMC Minutes, that Powell will not have to aggressively push back against this “unwarranted” easing…

Tyler Durden

Mon, 01/23/2023 – 16:01

via ZeroHedge News https://ift.tt/jZCuNYR Tyler Durden